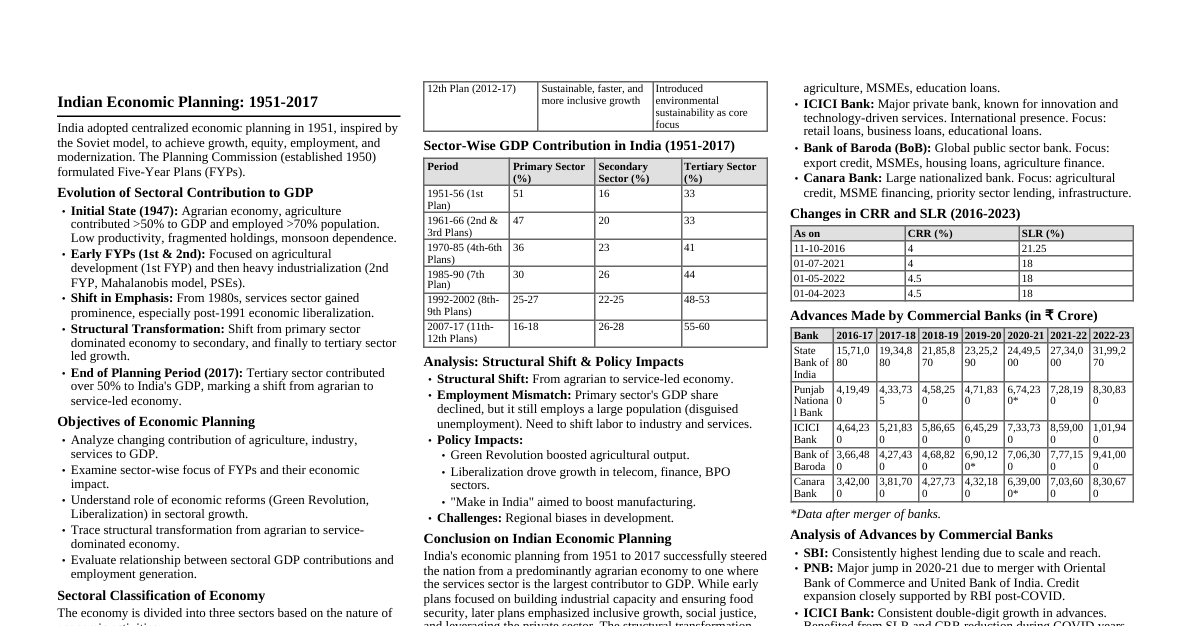

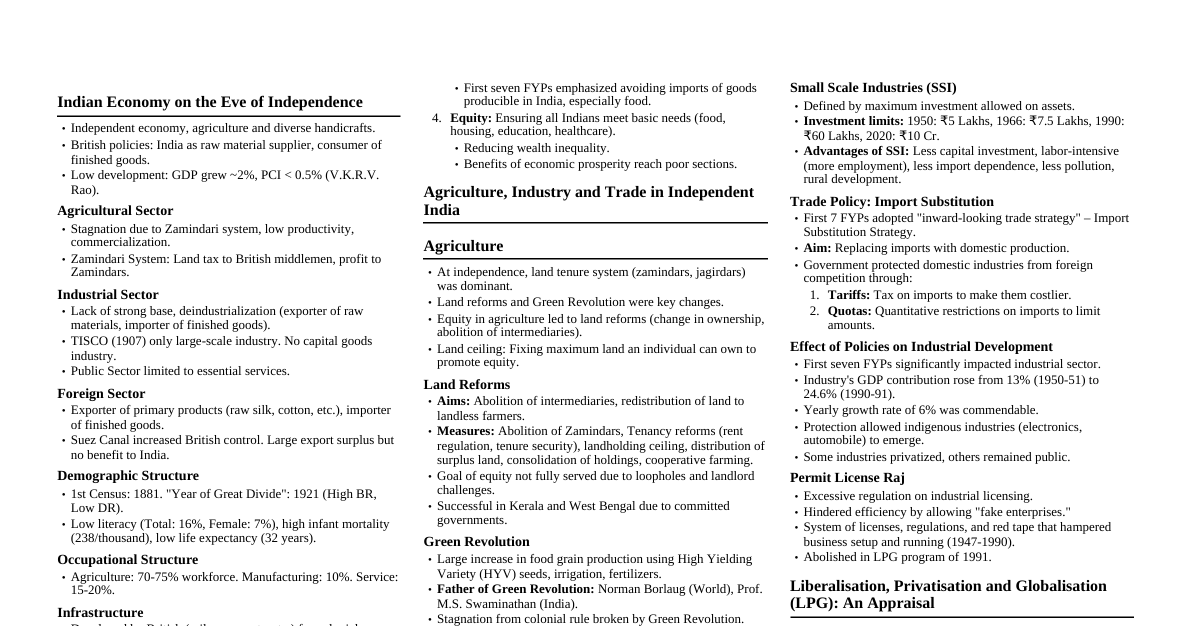

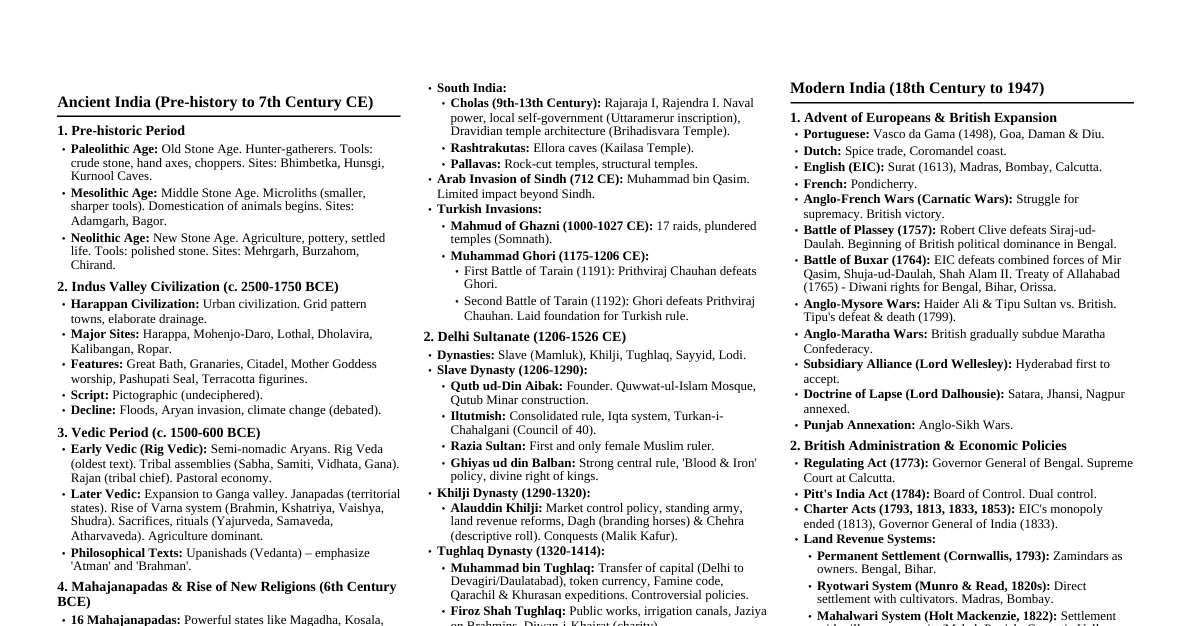

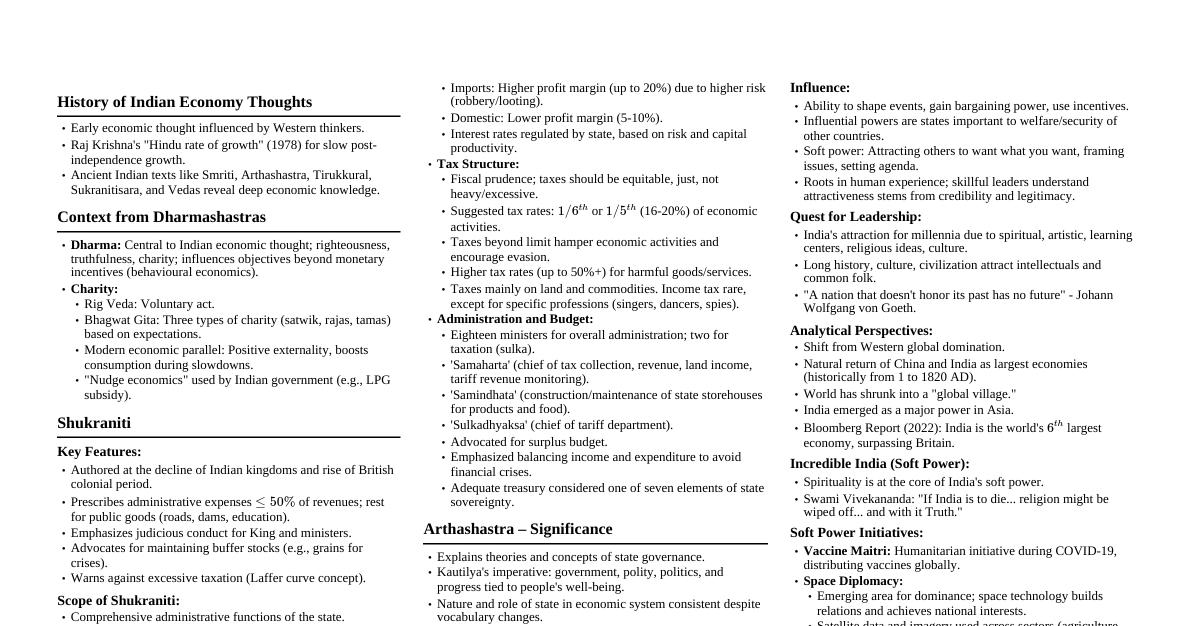

Indian Economic Planning: Core Principles Origin: Centralized planning (1951), inspired by Soviet model. Goal: Growth, equity, employment, modernization, self-reliance. Mechanism: Five-Year Plans (FYPs) formulated by Planning Commission (1950-2017). Evolution: From command economy to market-oriented post-1991 reforms. Key Economic Indicators GDP (Gross Domestic Product): Total monetary value of all finished goods and services produced within a country's borders in a specific time period. Inflation: Rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Fiscal Deficit: Difference between the government's total expenditure and its total receipts (excluding borrowing). Balance of Payments (BoP): Record of all economic transactions between the residents of a country and the rest of the world during a particular period. Sectoral Classification of Economy Indian economy is broadly divided into three sectors based on activity: Sector Nature of Activity Examples GDP Contribution (Trend) Employment (Trend) Primary Extraction of natural resources Agriculture, mining, fishing, forestry Decreasing (from >50% to ~15%) High (still ~45%) Secondary Processing raw materials Manufacturing, construction, utilities Stable/Slightly Increasing (~25%) Moderate (~25%) Tertiary (Service) Provides services IT, finance, transport, education, health Increasing (from ~30% to >55%) Increasing (~30%) Sectoral Transformation Highlights Economy shifted from primary-dominated to a service-led one. Key Drivers: Industrialization, economic liberalization (1991), globalization, urbanization. Challenge: Large portion of population still dependent on primary sector despite its declining GDP share (disguised unemployment). Evolution of Five-Year Plans (FYPs) in India A brief overview of the thematic focus and outcomes of India's planning era: Plan Period Primary Focus Key Outcomes / Events 1st (1951-56) Agriculture & Irrigation Initiated community development; laid foundation. 2nd (1956-61) Heavy Industrialization Mahalanobis Model; rapid industrial growth. 3rd (1961-66) Self-reliance & Food Grains Impacted by wars (1962, 1965) & droughts. Annual (1966-69) "Plan Holiday" Due to economic crisis; Green Revolution launched. 5th (1974-78) Poverty Eradication (Garibi Hatao) Minimum Needs Programme. 8th (1992-97) LPG Reforms & Human Dev. Post-liberalization growth, private sector focus. 11th (2007-12) Faster & Inclusive Growth Focus on rural dev, education, health. 12th (2012-17) Sustainable & Equitable Growth Last FYP; focus on environmental sustainability. NITI Aayog (2015): Replaced Planning Commission, focusing on cooperative federalism and long-term strategy. Financial Sector & Monetary Policy Regulator: Reserve Bank of India (RBI) controls money supply and interest rates. Key Tools: CRR (Cash Reserve Ratio) and SLR (Statutory Liquidity Ratio). Cash Reserve Ratio (CRR) Definition: % of bank's Net Demand and Time Liabilities (NDTL) kept as cash with RBI. Purpose: Controls money supply & inflation. Ensures financial stability. Impact on Lending: $\downarrow$ CRR $\implies \uparrow$ Liquidity $\implies \uparrow$ Lending $\uparrow$ CRR $\implies \downarrow$ Liquidity $\implies \downarrow$ Lending Statutory Liquidity Ratio (SLR) Definition: % of NDTL maintained by bank itself in liquid assets (cash, gold, approved securities). Purpose: Regulates credit flow. Ensures bank solvency. Facilitates government borrowing. Impact on Lending: $\downarrow$ SLR $\implies \uparrow$ Lending Capacity $\uparrow$ SLR $\implies \downarrow$ Lending Capacity Impact of CRR & SLR on Bank Lending High CRR / SLR RBI Tightens ↓ Bank Liquidity ↓ Lending / ↑ Rates Low CRR / SLR RBI Eases ↑ Bank Liquidity ↑ Lending / ↓ Rates Overview of Major Commercial Banks (Lending Focus) Banks play a crucial role in credit disbursement, supporting various sectors: State Bank of India (SBI): Largest, public sector, extensive reach. Focus: Agriculture, MSMEs, corporate, retail. ICICI Bank: Leading private bank, tech-driven. Focus: Retail loans, business loans, mortgages. HDFC Bank: Prominent private bank, strong retail presence. Focus: Retail, corporate, auto loans. Punjab National Bank (PNB): Large public sector, post-merger strength. Focus: Retail, agriculture, education. Canara Bank: Significant public sector bank. Focus: Agri-credit, MSME, priority sector. Lending Performance Influencers Monetary Policy: CRR/SLR changes directly affect lending capacity. Economic Cycles: Recessions lead to cautious lending, booms encourage credit growth. Bank Mergers: Can significantly boost balance sheets and lending figures (e.g., PNB, BoB, Canara Bank post-merger). Regulatory Environment: RBI's prudential norms and sector-specific guidelines. Major Economic Reforms in India Green Revolution (1960s): Introduction of high-yielding varieties, fertilizers, irrigation. Led to food self-sufficiency. Bank Nationalization (1969 & 1980): Increased access to credit for agriculture and small industries, expanded banking network. Economic Liberalization (1991): Shift from 'License Raj' to market economy. Reduced tariffs, opened up sectors, led to rapid growth, especially in services. Goods and Services Tax (GST, 2017): Unified indirect tax system, aimed at simplifying taxation and improving ease of doing business. Insolvency and Bankruptcy Code (IBC, 2016): Streamlined framework for resolving insolvency, improving credit culture. Conclusion India's economic journey has been marked by strategic planning and significant reforms. The financial sector, guided by the RBI's monetary policy tools like CRR and SLR, plays a pivotal role in channeling resources for growth. Understanding these mechanisms is crucial to comprehending the dynamics of the Indian economy and its trajectory towards becoming a major global economic power.