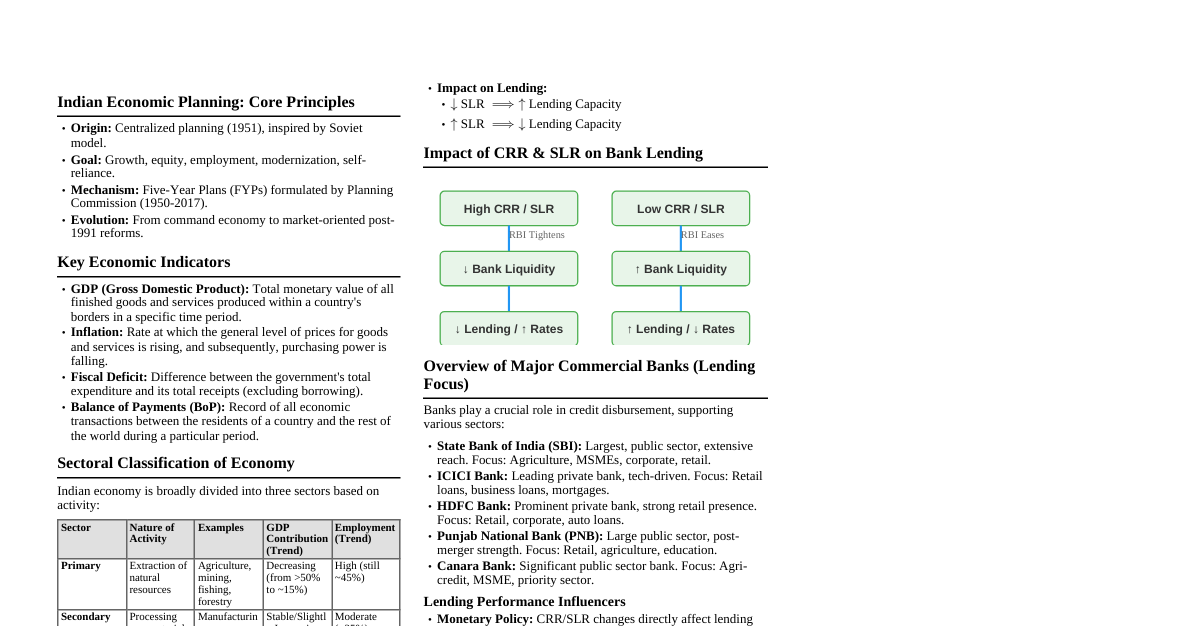

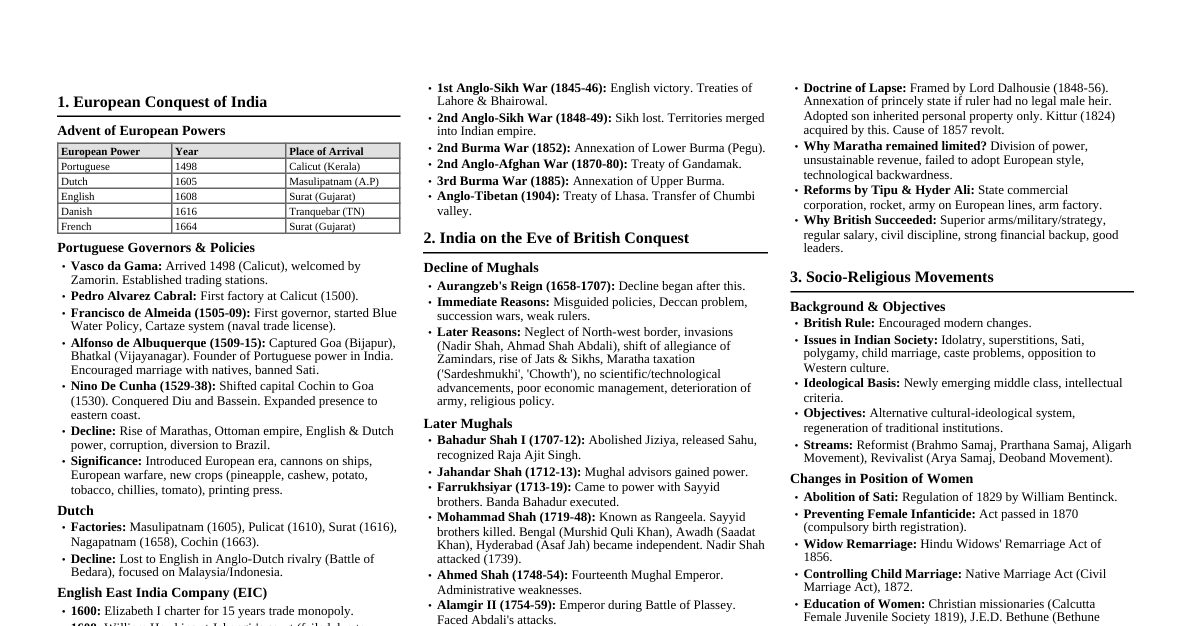

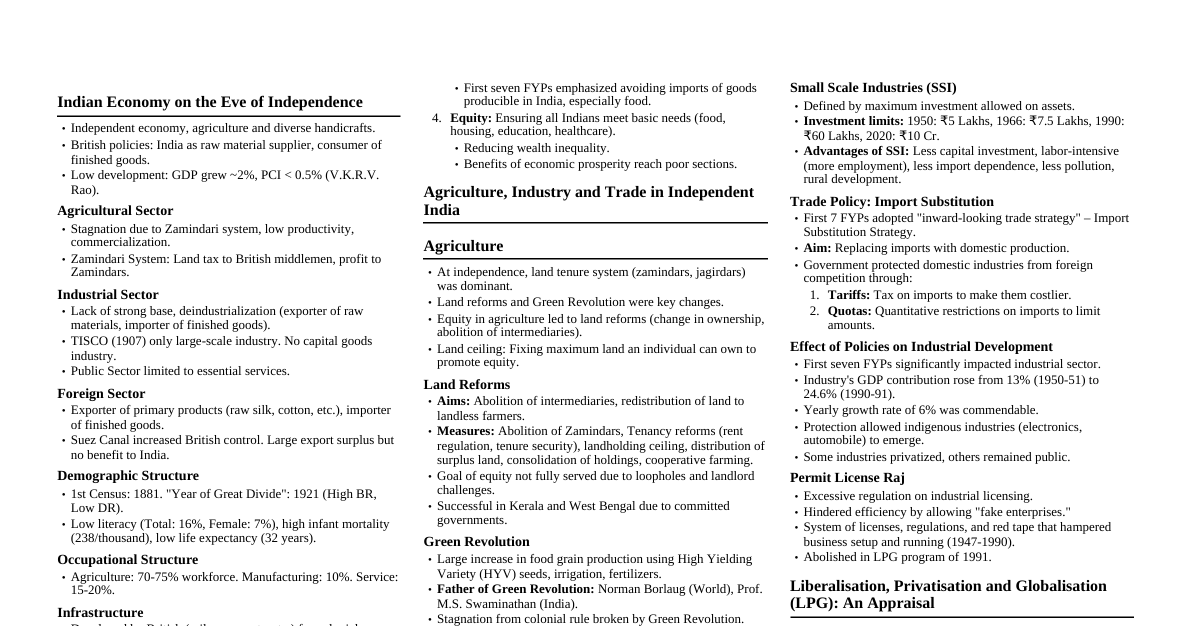

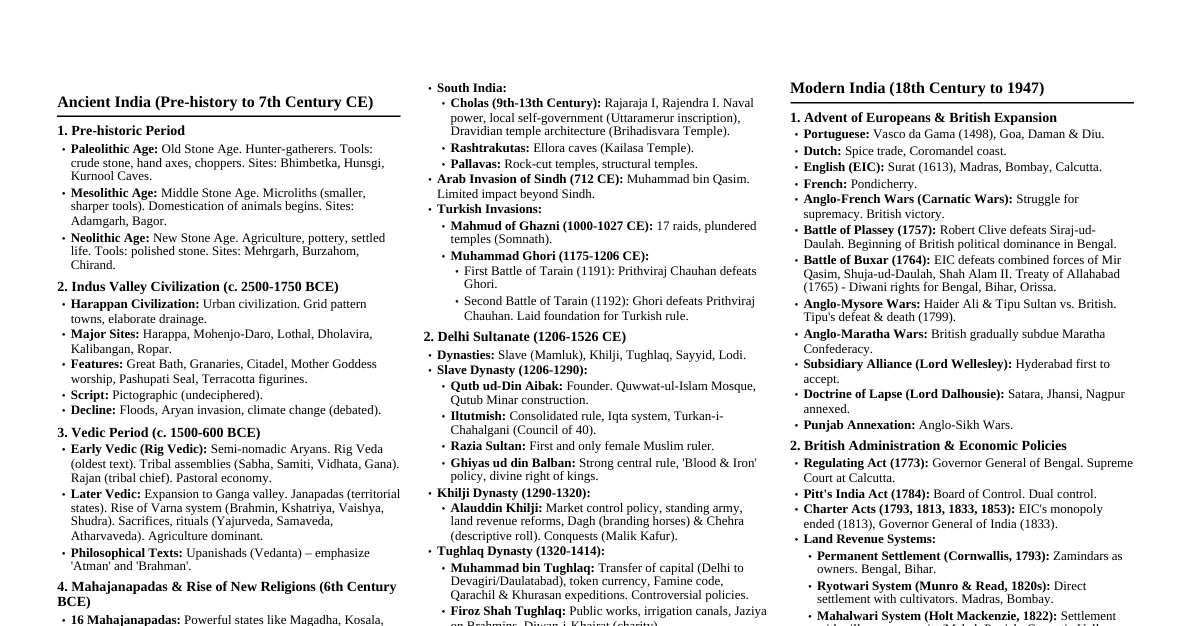

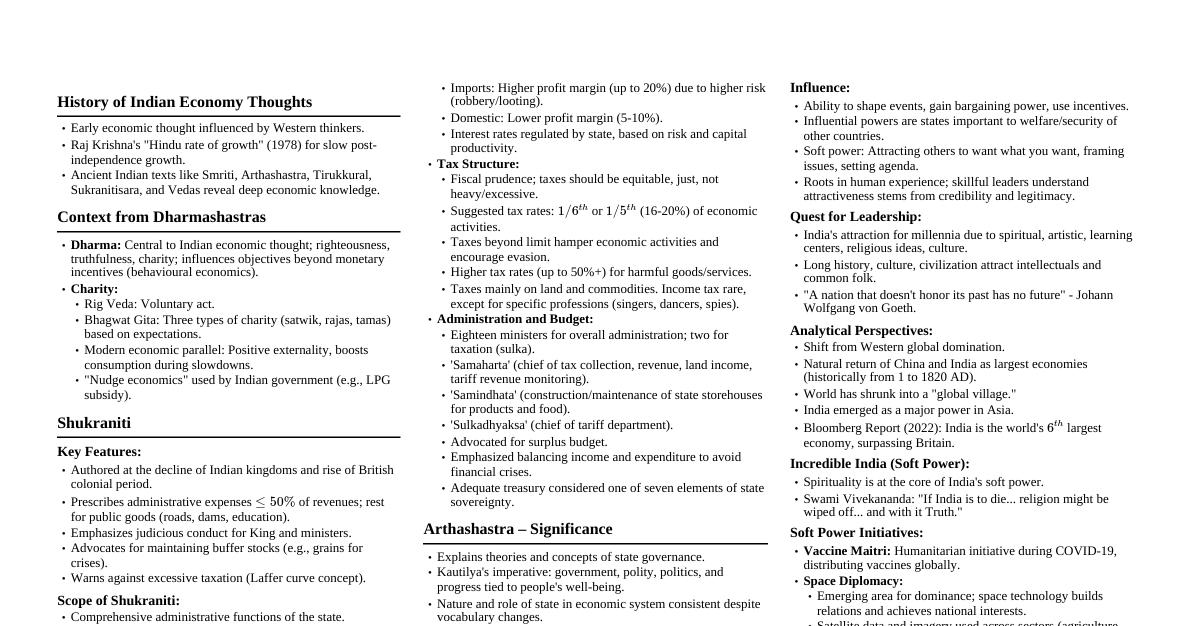

Indian Economic Planning: 1951-2017 India adopted centralized economic planning in 1951, inspired by the Soviet model, to achieve growth, equity, employment, and modernization. The Planning Commission (established 1950) formulated Five-Year Plans (FYPs). Evolution of Sectoral Contribution to GDP Initial State (1947): Agrarian economy, agriculture contributed >50% to GDP and employed >70% population. Low productivity, fragmented holdings, monsoon dependence. Early FYPs (1st & 2nd): Focused on agricultural development (1st FYP) and then heavy industrialization (2nd FYP, Mahalanobis model, PSEs). Shift in Emphasis: From 1980s, services sector gained prominence, especially post-1991 economic liberalization. Structural Transformation: Shift from primary sector dominated economy to secondary, and finally to tertiary sector led growth. End of Planning Period (2017): Tertiary sector contributed over 50% to India's GDP, marking a shift from agrarian to service-led economy. Objectives of Economic Planning Analyze changing contribution of agriculture, industry, services to GDP. Examine sector-wise focus of FYPs and their economic impact. Understand role of economic reforms (Green Revolution, Liberalization) in sectoral growth. Trace structural transformation from agrarian to service-dominated economy. Evaluate relationship between sectoral GDP contributions and employment generation. Sectoral Classification of Economy The economy is divided into three sectors based on the nature of economic activities: Primary Sector: Characteristics: Activities using natural resources (agriculture, fishing, forestry, mining, animal husbandry). Produces raw materials. Labor-intensive, traditional. Heavily reliant on natural resources/weather. Role in GDP: Contributed >50% at independence. Despite declining share, remains crucial for food security and employment. Government schemes (Green Revolution) boosted productivity. Secondary Sector: Characteristics: Activities transforming raw materials into finished goods (manufacturing, construction, electricity, gas). Relies on machinery, factories, modern techniques. Capital and technology intensive. Generates higher income/employment. Promotes urbanization/infrastructure. Role in GDP: Second FYP (1956-61) emphasized industrialization (steel, coal, heavy machinery). Public Sector Enterprises (PSEs) established. Helped diversify economy away from agriculture. Tertiary Sector (Services Sector): Characteristics: Provides services (transportation, health, communication, retail, education, tourism). Supports primary & secondary sectors. Relatively less employment initially but growing rapidly. Requires higher education and skilled labor. High growth potential in urban areas. Major source of foreign exchange. Role in GDP: Initially low share, but grew significantly post-1990s liberalization. Became largest contributor to GDP. Major boom in IT, telecom, banking, education. Urbanization and globalization accelerated its growth. By end of planning period, contributed over 50%. Highlights of Five-Year Planning in India Plan Period Focus Outcome 1st Plan (1951-56) Agriculture, irrigation, power Agriculture revived post-partition, 3.6% growth achieved 2nd Plan (1956-61) Industrialization (Nehru-Mahalanobis model) Focus on public sector industries 3rd Plan (1961-66) Self-sufficiency in food grains Impacted by wars (1962, 1965) & droughts, below target Plan Holiday (1966-69) Annual plans Reorientation & stabilization period 4th Plan (1969-74) Growth with stability & self-reliance Green Revolution introduced 5th Plan (1974-78) Poverty eradication, Minimum Needs Programme Discontinued by Janata government Rolling Plans (1978-80) Short-term goals Lacked continuity due to political instability 6th Plan (1980-85) Poverty alleviation, infrastructure Telecom & service sectors started expanding 7th Plan (1985-90) Modernization, self-reliance, productivity Rapid GDP growth, service sector & exports Annual Plans (1990-92) Crisis management due to BoP crisis Liberalization, Privatization, Globalization (LPG) reforms 8th Plan (1992-97) Social justice, inclusive growth, private sector Rapid GDP growth, service sector & exports 9th Plan (1997-2002) Inclusive growth, emphasis on education, health IT boom, telecom expansion 10th Plan (2002-07) Inclusive growth, sectoral expansion Rural development, education, empowerment 11th Plan (2007-12) Faster & more inclusive growth Poverty reduction despite global recession (2008) 12th Plan (2012-17) Sustainable, faster, and more inclusive growth Introduced environmental sustainability as core focus Sector-Wise GDP Contribution in India (1951-2017) Period Primary Sector (%) Secondary Sector (%) Tertiary Sector (%) 1951-56 (1st Plan) 51 16 33 1961-66 (2nd & 3rd Plans) 47 20 33 1970-85 (4th-6th Plans) 36 23 41 1985-90 (7th Plan) 30 26 44 1992-2002 (8th-9th Plans) 25-27 22-25 48-53 2007-17 (11th-12th Plans) 16-18 26-28 55-60 Analysis: Structural Shift & Policy Impacts Structural Shift: From agrarian to service-led economy. Employment Mismatch: Primary sector's GDP share declined, but it still employs a large population (disguised unemployment). Need to shift labor to industry and services. Policy Impacts: Green Revolution boosted agricultural output. Liberalization drove growth in telecom, finance, BPO sectors. "Make in India" aimed to boost manufacturing. Challenges: Regional biases in development. Conclusion on Indian Economic Planning India's economic planning from 1951 to 2017 successfully steered the nation from a predominantly agrarian economy to one where the services sector is the largest contributor to GDP. While early plans focused on building industrial capacity and ensuring food security, later plans emphasized inclusive growth, social justice, and leveraging the private sector. The structural transformation witnessed, though not always perfectly balanced in terms of employment generation across sectors, laid the foundation for modern India's economic trajectory. The shift from a centralized planning model to a more market-oriented approach, culminating in the dissolution of the Planning Commission, reflects the evolving economic philosophy and the dynamic nature of India's development journey. Monetary Policy Instruments: CRR & SLR The financial sector plays a crucial role in economic development, with banks mobilizing savings and channeling them into productive investments. The Reserve Bank of India (RBI) regulates bank lending through monetary policy instruments, primarily the Cash Reserve Ratio (CRR) and the Statutory Liquidity Ratio (SLR). Objectives of Studying CRR & SLR Understand their significance in Indian Banking System. Analyze historical trends and changes in CRR & SLR. Examine impact on bank lending capacity and credit availability. Compare lending patterns of banks during periods of high/low CRR/SLR. Evaluate relationship between CRR/SLR, bank profitability, liquidity, and credit risk. Cash Reserve Ratio (CRR) Meaning: Minimum percentage of a bank's total Net Demand and Time Liabilities (NDTL) that must be maintained as cash with the RBI. Key Terms: NDTL: Total deposits held by a bank (savings, current, fixed deposits). RBI: Central bank of India, regulates monetary policy and banking. Purpose: Control money supply in the economy. Manage liquidity and financial stability. Help RBI control inflation and stabilize the economy. How it Works: The cash kept with RBI earns no interest and cannot be used for lending or investment. Example: If CRR is 4.5% and a bank has NDTL of $100 crore, it must deposit $4.5 crore with RBI. This reduces the amount available for lending. Statutory Liquidity Ratio (SLR) Meaning: Minimum percentage of NDTL that a bank must maintain within itself, in the form of liquid assets. Liquid Assets: Cash, approved Government Securities (treasury bills, government bonds), gold. Purpose: Regulate credit flow. Ensure banks maintain sufficient liquid assets to meet sudden withdrawals. Channel bank funds towards government securities, helping government finance its expenditure. How it Works: Banks earn interest on these liquid assets. Example: If SLR is 18% and a bank has NDTL of $100 crore, it must set aside $18 crore in liquid assets (gold, government securities). This limits lending capacity but helps fund government and provides a safety net. Overview of Five Commercial Banks State Bank of India (SBI): Largest commercial bank, extensive rural/urban reach. Focus: agriculture, MSMEs, corporate loans. Punjab National Bank (PNB): Oldest and largest public sector bank with extensive rural/semi-urban reach. Focus: agriculture, MSMEs, education loans. ICICI Bank: Major private bank, known for innovation and technology-driven services. International presence. Focus: retail loans, business loans, educational loans. Bank of Baroda (BoB): Global public sector bank. Focus: export credit, MSMEs, housing loans, agriculture finance. Canara Bank: Large nationalized bank. Focus: agricultural credit, MSME financing, priority sector lending, infrastructure. Changes in CRR and SLR (2016-2023) As on CRR (%) SLR (%) 11-10-2016 4 21.25 01-07-2021 4 18 01-05-2022 4.5 18 01-04-2023 4.5 18 Advances Made by Commercial Banks (in ₹ Crore) Bank 2016-17 2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 State Bank of India 15,71,080 19,34,880 21,85,870 23,25,290 24,49,500 27,34,000 31,99,270 Punjab National Bank 4,19,490 4,33,735 4,58,250 4,71,830 6,74,230* 7,28,190 8,30,830 ICICI Bank 4,64,230 5,21,830 5,86,650 6,45,290 7,33,730 8,59,000 1,01,940 Bank of Baroda 3,66,480 4,27,430 4,68,820 6,90,120* 7,06,300 7,77,150 9,41,000 Canara Bank 3,42,000 3,81,700 4,27,730 4,32,180 6,39,000* 7,03,600 8,30,670 *Data after merger of banks. Analysis of Advances by Commercial Banks SBI: Consistently highest lending due to scale and reach. PNB: Major jump in 2020-21 due to merger with Oriental Bank of Commerce and United Bank of India. Credit expansion closely supported by RBI post-COVID. ICICI Bank: Consistent double-digit growth in advances. Benefited from SLR and CRR reduction during COVID years, boosting liquidity. Bank of Baroda: Major jump in 2019-20 due to merger with Dena Bank and Vijaya Bank. Post-merger, growth stabilized. Growth partly driven by CRR cuts and SLR relaxation. Canara Bank: Big jump in 2020-21 (41.85%) due to merger with Syndicate Bank. Growth started slightly slowing after that but supported by strong liquidity. Impact of CRR and SLR on Lending Patterns Impact of CRR on Lending: Lower CRR: More liquidity, increased lending capacity. Higher CRR: Less money available for loans, restricted lending. Impact of SLR on Lending: Lower SLR: More funds for banks to lend. Higher SLR: Limits portion of deposits available for lending, as funds are locked in securities. Reduced lending ability. Key Observations of Impact Monetary Control: CRR/SLR are central to controlling money supply, influencing bank lending. Support During Recession: During economic downturns (e.g., COVID-19), RBI reduced CRR/SLR to inject liquidity and stimulate lending. Pricing: Increase in CRR/SLR leads banks to raise interest rates, making borrowing more expensive. Public vs. Private Banks: Public banks may continue lending due to policy obligations, while private banks are more cautious under tighter CRR/SLR regimes. Liquidity Management: Higher CRR/SLR mandates enable banks to manage their cash reserves more effectively. Conclusion on CRR & SLR CRR and SLR are vital in influencing commercial banks' lending patterns. They allow the RBI to regulate the flow of funds, control money supply, and support economic growth. A reduction in CRR/SLR boosts banks' ability to extend loans, supporting growth in sectors like retail, MSMEs, and contributing to economic development and financial inclusion. Conversely, an increase restricts lending, leading to higher interest rates and slower credit expansion. Private sector banks are often more dynamic and responsive to changes in monetary policy, quickly adjusting their lending strategies. Public sector banks, though stable, tend to respond slower due to government directives and long-term priorities. Both instruments are essential for the RBI to balance financial stability with credit growth, shaping India's economic landscape.