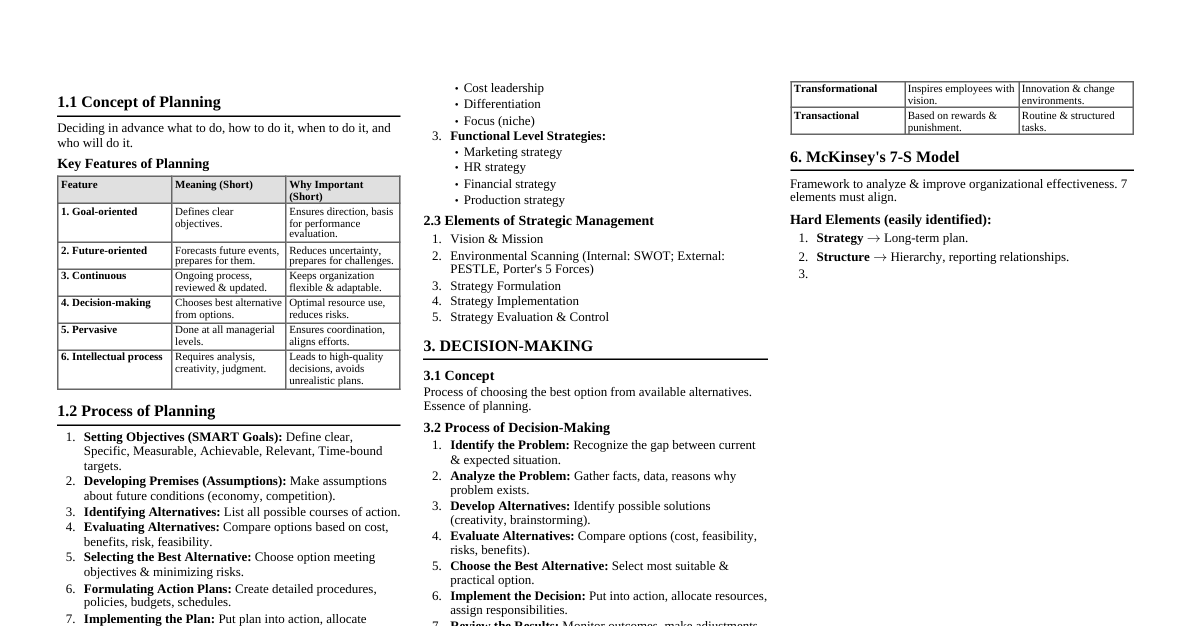

Situations of Decision Making Decision making is a critical management function, often fraught with uncertainty. The context in which decisions are made significantly impacts the process and potential outcomes. Certainty: In this ideal scenario, decision-makers have complete and accurate information about all alternatives and their outcomes. The future state is known, and the consequences of each choice are predictable. Example: A company decides to deposit surplus cash in a savings account with a guaranteed interest rate. The return is known with certainty. Risk: Under risk, decision-makers can identify all possible outcomes for each alternative and can assign probabilities to their occurrence. While the future is not fully known, its likelihood can be quantified. Statistical methods and probability theory are often used here. Example: An investment firm deciding between several stocks, each with a historical performance that allows for estimating the probability of certain returns or losses. Actuarial science in insurance is another good example. Uncertainty: This is the most challenging situation. Decision-makers know the possible alternatives but cannot estimate the probabilities of their outcomes. The future is highly unpredictable, and there is a lack of reliable data or past experience. Judgment, intuition, and creative thinking become crucial. Example: A startup launching a completely new product into an uncharted market. The success or failure cannot be predicted with any statistical confidence. Strategic decisions during major economic crises also fall into this category. Decision Making Process A systematic approach to decision making helps in navigating complex situations and improving the quality of choices. 1. Identify a Problem or Opportunity The process begins with recognizing a discrepancy between the current state and a desired state, or identifying a potential advantage. William Pound's guidelines are useful: Deviation from Past Experience: When actual performance falls short of historical performance (e.g., sales decline unexpectedly). Deviation from the Set Plan: When current results do not align with strategic goals or budgeted figures (e.g., project milestones are missed). Competitor Actions: When rivals introduce innovative products, gain market share, or employ new strategies that threaten one's position. External Input: Problems brought to attention by customers, employees, or other stakeholders. Clearly defining the problem is paramount, as a well-defined problem is half-solved. Avoid addressing symptoms rather than root causes. 2. Gather Information Once the problem or opportunity is identified, comprehensive and relevant information must be collected. This step involves: Data Collection: Acquiring factual data, statistics, and reports. Stakeholder Input: Consulting individuals or groups affected by the decision or possessing relevant knowledge. Research: Conducting market research, competitive analysis, or technical studies. The quality and completeness of information directly impact the quality of the decision. Insufficient or biased information can lead to flawed alternatives and poor outcomes. 3. Analyze the Situation & Develop Alternatives This stage involves understanding the problem in depth and generating a range of possible solutions. It requires creativity and critical thinking. Brainstorming: Generating a large number of ideas without immediate judgment to foster creativity. Personal Search: Drawing on one's own experience, knowledge, and intuition. Consulting Experts: Seeking advice from specialists, consultants, or mentors who have experience with similar problems. Subordinate Involvement: Engaging team members in the idea generation process, which can lead to diverse perspectives and increased ownership. Benchmarking/Best Practices: Studying how similar problems have been solved by other organizations or in different contexts. It's important to develop a diverse set of alternatives, rather than settling for the first obvious solution. 4. Evaluate Alternatives Each generated alternative must be critically assessed against a set of criteria. This step often involves a systematic comparison. SWOT Analysis: For each alternative, identify its internal Strengths and Weaknesses , and external Opportunities and Threats . Feasibility: Can the alternative be implemented with available resources (time, money, personnel, technology)? Acceptability: Is the alternative consistent with organizational values, policies, and ethical standards? Will stakeholders accept it? Desirability: Does the alternative align with the overall strategic goals and objectives of the organization? What are the potential benefits and drawbacks? Cost-Benefit Analysis: Quantifying the financial and non-financial costs and benefits of each option. Risk Assessment: Analyzing the potential negative consequences and their likelihood for each alternative. This evaluation helps narrow down the options to the most viable and effective ones. 5. Select a Preferred Alternative Based on the evaluation, the decision-maker chooses the alternative that best meets the objectives, minimizes risks, and maximizes benefits. This choice often involves trade-offs and careful consideration of various factors: Potential Problems: Anticipating what could go wrong with the chosen alternative and developing contingency plans. Precautionary Steps: Implementing measures to mitigate identified risks. Risk Tolerance: The organization's or individual's willingness to accept certain levels of risk. Resource Allocation: Ensuring that the necessary resources are committed to the chosen solution for successful implementation. Impact on Stakeholders: Considering how the decision will affect employees, customers, suppliers, and the community. This final choice is a commitment to a course of action. 6. Implement the Decision Once a decision is made, it must be put into action. This involves communicating the decision to relevant parties, allocating resources, and assigning responsibilities. Developing an action plan with specific steps, timelines, and responsible parties. Ensuring that all necessary resources (financial, human, technological) are available. Communicating the decision clearly and persuasively to gain buy-in and cooperation. 7. Monitor and Evaluate The decision-making process doesn't end with implementation. It's crucial to monitor the progress and evaluate the effectiveness of the chosen solution. Performance Measurement: Tracking key metrics to see if the decision is achieving its intended outcomes. Feedback Collection: Gathering input from those affected by the decision. Corrective Action: If the decision is not yielding the desired results, adjustments or a new decision-making cycle may be necessary. This step provides valuable learning for future decisions. Classification of Decision Making Decisions can also be categorized based on their routine nature and the structuredness of the problem. Programmed Decisions These are routine, repetitive decisions for which established procedures or rules exist. They are typically made in response to well-defined problems and require minimal judgment or thought. They allow managers to delegate authority and save time for more complex issues. Characteristics: Repetitive, routine, clearly defined problems, reliance on policies/rules/procedures, lower-level management. Examples: Processing customer orders or handling standard customer complaints. Inventory reordering when stock levels hit a predetermined minimum. Employee attendance policies or standard hiring procedures for entry-level positions. Determining eligibility for a standard bank loan based on credit scores. Non-Programmed Decisions These are unique, non-recurring decisions that require a custom-made solution. They typically involve unstructured problems, and there are no established procedures to follow. They often involve higher uncertainty and are usually made by upper management. Characteristics: Novel, unstructured problems, high uncertainty, reliance on judgment and creativity, higher-level management. Examples: Developing a new product line or entering a new market segment. Deciding on a major organizational restructuring or merger/acquisition. Responding to a significant public relations crisis or a natural disaster. Investing in a new, unproven technology. Formulating a new corporate strategy in response to disruptive innovation.