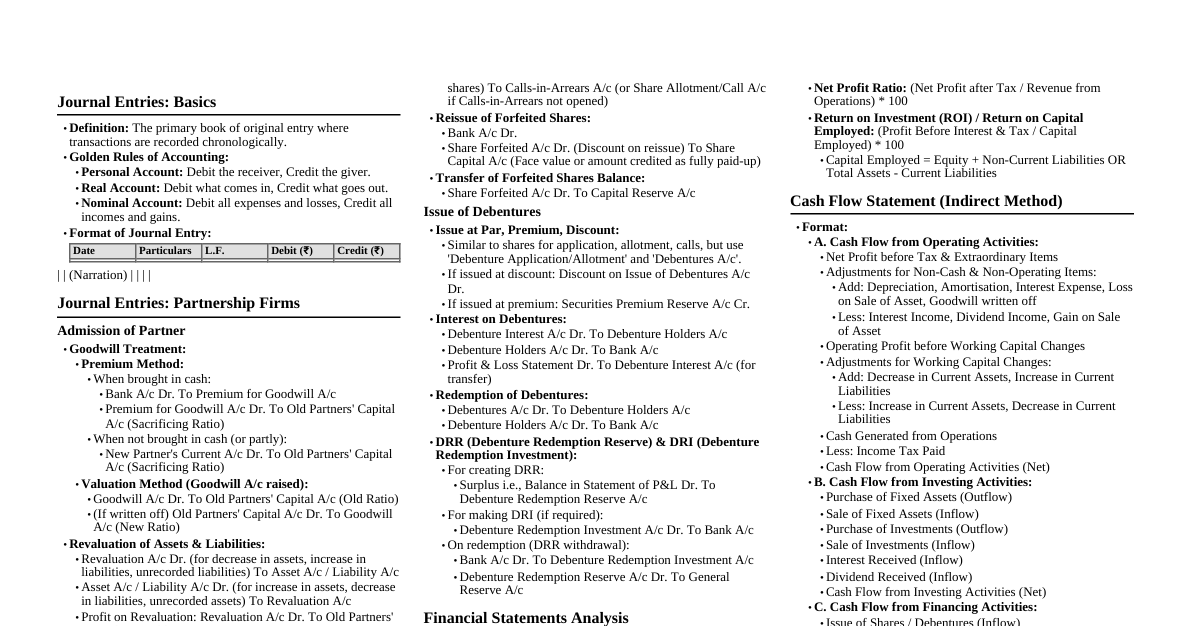

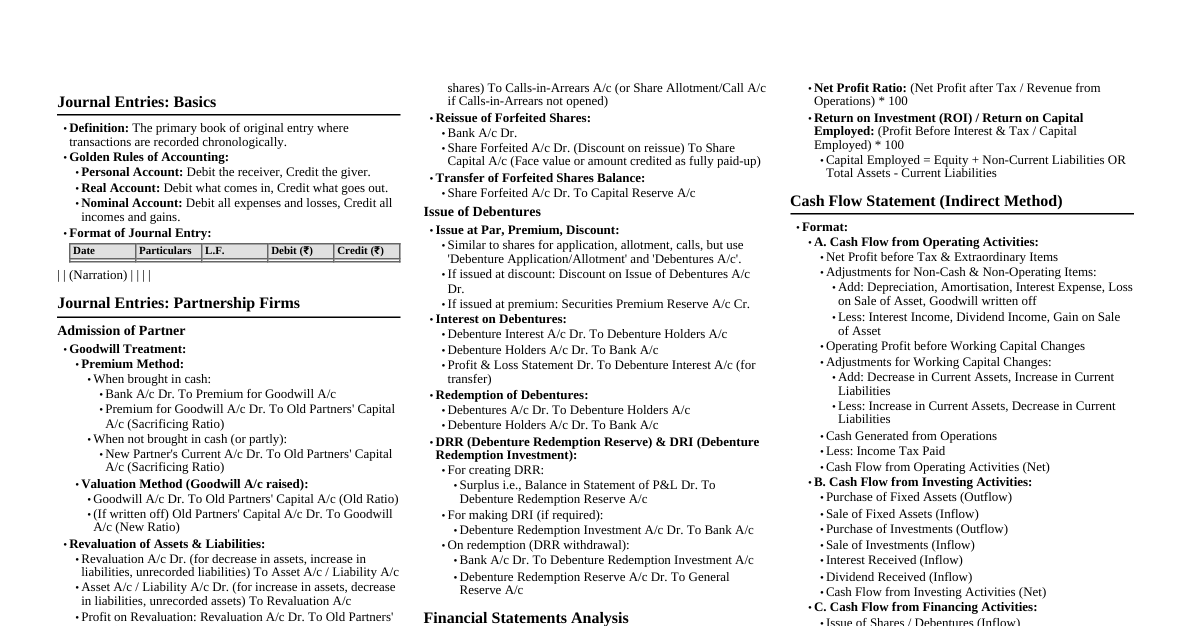

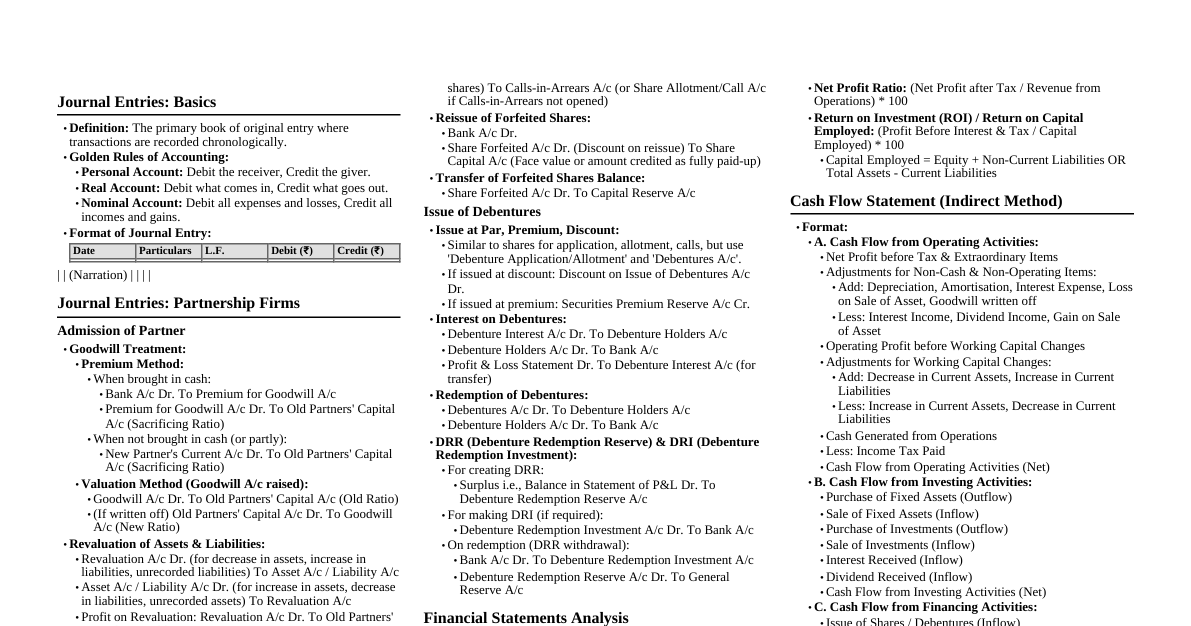

### Debentures: Basics - **Definition:** Long-term debt instrument issued by a company, acknowledging debt. - **Debenture Holders:** Creditors (not owners). Receive interest (fixed rate), not dividends. - **Interest:** A "charge against profits" (paid regardless of profit/loss). - **Types (Key):** - **Secured:** Backed by company assets. - **Unsecured:** No specific asset backing (rare in India). - **Convertible:** Can be converted into shares. - **Non-Convertible:** Cannot be converted into shares. - **Redeemable:** Repayable after a fixed period. - **Irredeemable:** Not repayable during company's life (rare). ### Issue of Debentures Debentures can be issued at Par, Premium, or Discount. #### 1. Issue for Cash - **At Par:** `Bank A/c Dr. To % Debentures A/c` (if full amount on application) - **At Premium:** ``` Bank A/c Dr. To % Debentures A/c To Securities Premium Reserve A/c ``` - **At Discount:** ``` Bank A/c Dr. Discount on Issue of Debentures A/c Dr. To % Debentures A/c ``` #### 2. Issue for Consideration Other Than Cash - For purchasing assets/business from a vendor. - **Entry:** `Vendor A/c Dr. To % Debentures A/c` (adjust for premium/discount) - **Number of Debentures:** `(Net Purchase Consideration) / (Issue Price per Debenture)` #### 3. Issue as Collateral Security - Debentures pledged as secondary security for a loan. - **Method 1:** No journal entry, just a note in Balance Sheet. - **Method 2:** ``` Debenture Suspense A/c Dr. To % Debentures A/c ``` (Debenture Suspense shown as an asset, Debentures as liability; net effect zero). ### Terms of Issue & Redemption - Debentures can be **redeemable at Par** or **at Premium**. - **Crucial:** If debentures are **redeemable at Premium**, any `Loss on Issue` must be recorded at the time of issue. - This `Loss on Issue` includes both `Discount on Issue` (if any) and `Premium on Redemption`. - **Journal Entry (for Loss on Issue):** ``` Loss on Issue of Debentures A/c Dr. To Premium on Redemption of Debentures A/c ``` (This entry is in addition to the normal issue entry and applies when redemption is at premium). - `Premium on Redemption` is a liability shown under `Long-term Borrowings`. ### Interest & Writing Off Loss #### Interest on Debentures - **Entry:** ``` Debenture Interest A/c Dr. To Debenture Holders A/c To TDS Payable A/c (if applicable) ``` - **Transfer:** `Statement of Profit & Loss A/c Dr. To Debenture Interest A/c` #### Writing Off Discount/Loss on Issue - `Discount on Issue` and `Loss on Issue` are capital losses. - **Written off over the life of debentures from:** 1. Securities Premium Reserve (first preference) 2. Statement of Profit & Loss (if SPR insufficient) - **Entry:** ``` Securities Premium Reserve A/c Dr. Statement of Profit & Loss A/c Dr. To Discount/Loss on Issue of Debentures A/c ``` ### Balance Sheet Presentation - **Debentures:** Shown under `Non-Current Liabilities` -> `Long-term Borrowings`. - **Securities Premium Reserve:** Under `Shareholders' Funds` -> `Reserves and Surplus`. - **Unwritten off Discount/Loss on Issue:** Shown as `Other Non-Current Assets`. - **Premium on Redemption:** Included in `Long-term Borrowings`.