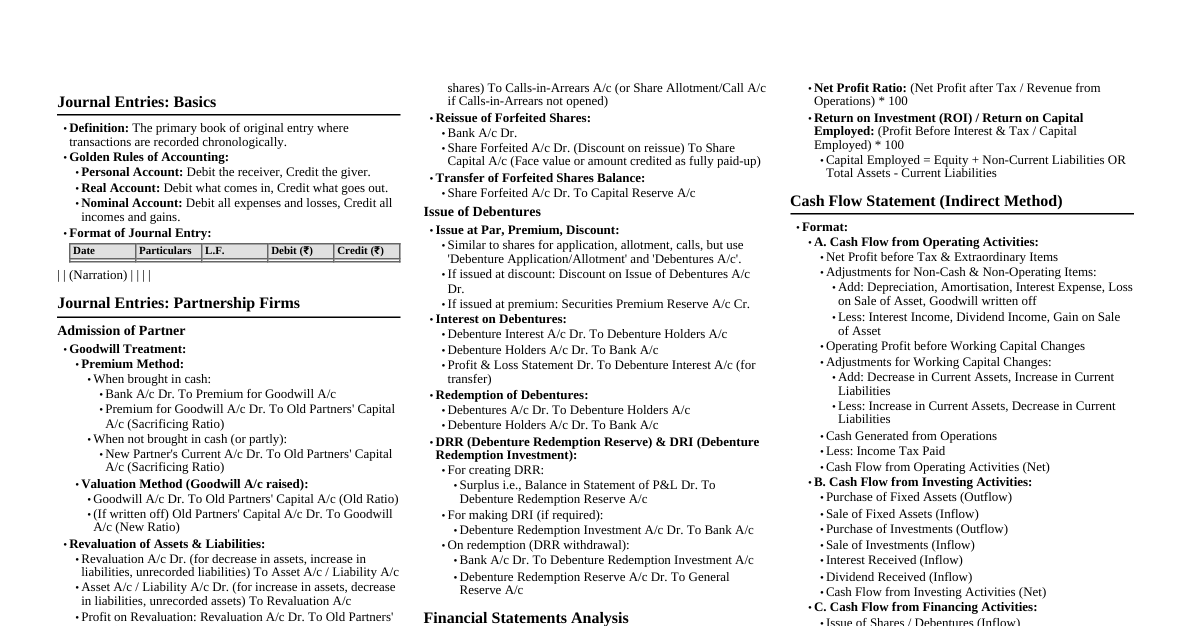

### Journal Entries: Basics - **Definition:** The primary book of original entry where transactions are recorded chronologically. - **Golden Rules of Accounting:** - **Personal Account:** Debit the receiver, Credit the giver. - **Real Account:** Debit what comes in, Credit what goes out. - **Nominal Account:** Debit all expenses and losses, Credit all incomes and gains. - **Format of Journal Entry:** | Date | Particulars | L.F. | Debit (₹) | Credit (₹) | |------|-------------|------|-----------|------------| | | | | | | | | (Narration) | | | | ### Journal Entries: Partnership Firms #### Admission of Partner - **Goodwill Treatment:** - **Premium Method:** - When brought in cash: - Bank A/c Dr. To Premium for Goodwill A/c - Premium for Goodwill A/c Dr. To Old Partners' Capital A/c (Sacrificing Ratio) - When not brought in cash (or partly): - New Partner's Current A/c Dr. To Old Partners' Capital A/c (Sacrificing Ratio) - **Valuation Method (Goodwill A/c raised):** - Goodwill A/c Dr. To Old Partners' Capital A/c (Old Ratio) - (If written off) Old Partners' Capital A/c Dr. To Goodwill A/c (New Ratio) - **Revaluation of Assets & Liabilities:** - Revaluation A/c Dr. (for decrease in assets, increase in liabilities, unrecorded liabilities) To Asset A/c / Liability A/c - Asset A/c / Liability A/c Dr. (for increase in assets, decrease in liabilities, unrecorded assets) To Revaluation A/c - Profit on Revaluation: Revaluation A/c Dr. To Old Partners' Capital A/c (Old Ratio) - Loss on Revaluation: Old Partners' Capital A/c Dr. To Revaluation A/c (Old Ratio) - **Accumulated Profits/Losses & Reserves:** - Reserves / P&L (Cr.) / Workmen Compensation Reserve / Investment Fluctuation Fund A/c Dr. To Old Partners' Capital A/c (Old Ratio) - P&L (Dr.) / Deferred Revenue Exp. A/c Dr. To Old Partners' Capital A/c (Old Ratio) #### Retirement/Death of Partner - **Goodwill Treatment:** - Remaining Partners' Capital A/c Dr. (Gaining Ratio) To Retiring/Deceased Partner's Capital A/c - **Revaluation:** Same as admission. - **Accumulated Profits/Losses & Reserves:** Same as admission. - **Payment to Retiring Partner:** - Retiring Partner's Capital A/c Dr. To Bank A/c (if paid in full) To Retiring Partner's Loan A/c (if not paid) #### Dissolution of Partnership Firm - **Realisation Account:** - For transferring assets (excluding cash/bank, fictitious assets): - Realisation A/c Dr. To Sundry Assets A/c (Individual assets at book value) - For transferring liabilities (excluding partner's loan, capital): - Sundry Liabilities A/c Dr. (Individual liabilities at book value) To Realisation A/c - For sale of assets: - Bank/Cash A/c Dr. To Realisation A/c - For assets taken over by partner: - Partner's Capital A/c Dr. To Realisation A/c - For payment of liabilities: - Realisation A/c Dr. To Bank/Cash A/c - For liabilities paid by partner: - Realisation A/c Dr. To Partner's Capital A/c - For realisation expenses: - Realisation A/c Dr. To Bank/Cash A/c - Profit on Realisation: Realisation A/c Dr. To Partners' Capital A/c (Profit Sharing Ratio) - Loss on Realisation: Partners' Capital A/c Dr. To Realisation A/c (Profit Sharing Ratio) - **Final Settlement:** - Partner's Capital A/c Dr. To Bank/Cash A/c (Final payment) - Bank/Cash A/c Dr. To Partner's Capital A/c (Deficiency brought in) ### Journal Entries: Company Accounts #### Issue of Shares - **Application Money Received:** - Bank A/c Dr. To Share Application A/c - **Allotment of Shares:** - Share Application A/c Dr. - Share Allotment A/c Dr. (if money due) To Share Capital A/c (Face Value) To Securities Premium Reserve A/c (Premium Amount) - **Call Money Due:** - Share First/Second/Final Call A/c Dr. To Share Capital A/c - **Call Money Received:** - Bank A/c Dr. To Share First/Second/Final Call A/c - **Calls-in-Arrears:** - Calls-in-Arrears A/c Dr. (if maintained) To Share First/Second/Final Call A/c - **Forfeiture of Shares:** - Share Capital A/c Dr. (Called-up amount) - Securities Premium Reserve A/c Dr. (if premium not received) To Share Forfeited A/c (Amount received on shares) To Calls-in-Arrears A/c (or Share Allotment/Call A/c if Calls-in-Arrears not opened) - **Reissue of Forfeited Shares:** - Bank A/c Dr. - Share Forfeited A/c Dr. (Discount on reissue) To Share Capital A/c (Face value or amount credited as fully paid-up) - **Transfer of Forfeited Shares Balance:** - Share Forfeited A/c Dr. To Capital Reserve A/c #### Issue of Debentures - **Issue at Par, Premium, Discount:** - Similar to shares for application, allotment, calls, but use 'Debenture Application/Allotment' and 'Debentures A/c'. - If issued at discount: Discount on Issue of Debentures A/c Dr. - If issued at premium: Securities Premium Reserve A/c Cr. - **Interest on Debentures:** - Debenture Interest A/c Dr. To Debenture Holders A/c - Debenture Holders A/c Dr. To Bank A/c - Profit & Loss Statement Dr. To Debenture Interest A/c (for transfer) - **Redemption of Debentures:** - Debentures A/c Dr. To Debenture Holders A/c - Debenture Holders A/c Dr. To Bank A/c - **DRR (Debenture Redemption Reserve) & DRI (Debenture Redemption Investment):** - For creating DRR: - Surplus i.e., Balance in Statement of P&L Dr. To Debenture Redemption Reserve A/c - For making DRI (if required): - Debenture Redemption Investment A/c Dr. To Bank A/c - On redemption (DRR withdrawal): - Bank A/c Dr. To Debenture Redemption Investment A/c - Debenture Redemption Reserve A/c Dr. To General Reserve A/c ### Financial Statements Analysis #### Comparative Statements - **Format:** | Particulars | Note No. | Previous Year (₹) | Current Year (₹) | Absolute Change (₹) | Percentage Change (%) | |---|---|---|---|---|---| | Revenue from Operations | | | | | | | Less: Expenses | | | | | | | Profit before Tax | | | | | | - **Calculation:** - Absolute Change = Current Year Amount - Previous Year Amount - Percentage Change = (Absolute Change / Previous Year Amount) * 100 #### Common Size Statements - **Format:** | Particulars | Note No. | Previous Year (₹) | Previous Year (% of total) | Current Year (₹) | Current Year (% of total) | |---|---|---|---|---|---| | **Balance Sheet:** | | | | | | | Equity & Liabilities | | | | | | | Assets | | | | | | | **Statement of P&L:** | | | | | | | Revenue from Operations | | | | | | | Less: Expenses | | | | | | | Profit before Tax | | | | | | - **Calculation:** - Each item as a percentage of Total Assets/Liabilities (for Balance Sheet) or Revenue from Operations (for Statement of P&L). - Percentage = (Individual Item Amount / Total Amount) * 100 #### Ratio Analysis - **Liquidity Ratios:** - **Current Ratio:** Current Assets / Current Liabilities - **Quick Ratio (Liquid Ratio/Acid Test Ratio):** (Current Assets - Inventory - Prepaid Expenses) / Current Liabilities - **Solvency Ratios:** - **Debt to Equity Ratio:** Debt / Equity - **Total Assets to Debt Ratio:** Total Assets / Debt - **Proprietary Ratio:** Shareholders' Funds / Total Assets - **Interest Coverage Ratio:** Profit Before Interest & Tax / Interest Expense - **Activity Ratios (Turnover Ratios):** - **Inventory Turnover Ratio:** Cost of Revenue from Operations / Average Inventory - **Trade Receivables Turnover Ratio:** Net Credit Revenue from Operations / Average Trade Receivables - **Trade Payables Turnover Ratio:** Net Credit Purchases / Average Trade Payables - **Working Capital Turnover Ratio:** Revenue from Operations / Working Capital - **Profitability Ratios:** - **Gross Profit Ratio:** (Gross Profit / Revenue from Operations) * 100 - **Operating Ratio:** (Cost of Revenue from Operations + Operating Expenses / Revenue from Operations) * 100 - **Operating Profit Ratio:** (Operating Profit / Revenue from Operations) * 100 OR (100 - Operating Ratio)% - **Net Profit Ratio:** (Net Profit after Tax / Revenue from Operations) * 100 - **Return on Investment (ROI) / Return on Capital Employed:** (Profit Before Interest & Tax / Capital Employed) * 100 - Capital Employed = Equity + Non-Current Liabilities OR Total Assets - Current Liabilities ### Cash Flow Statement (Indirect Method) - **Format:** - **A. Cash Flow from Operating Activities:** - Net Profit before Tax & Extraordinary Items - Adjustments for Non-Cash & Non-Operating Items: - Add: Depreciation, Amortisation, Interest Expense, Loss on Sale of Asset, Goodwill written off - Less: Interest Income, Dividend Income, Gain on Sale of Asset - Operating Profit before Working Capital Changes - Adjustments for Working Capital Changes: - Add: Decrease in Current Assets, Increase in Current Liabilities - Less: Increase in Current Assets, Decrease in Current Liabilities - Cash Generated from Operations - Less: Income Tax Paid - Cash Flow from Operating Activities (Net) - **B. Cash Flow from Investing Activities:** - Purchase of Fixed Assets (Outflow) - Sale of Fixed Assets (Inflow) - Purchase of Investments (Outflow) - Sale of Investments (Inflow) - Interest Received (Inflow) - Dividend Received (Inflow) - Cash Flow from Investing Activities (Net) - **C. Cash Flow from Financing Activities:** - Issue of Shares / Debentures (Inflow) - Buyback of Shares (Outflow) - Redemption of Debentures / Preference Shares (Outflow) - Long-term Loans raised (Inflow) - Repayment of Long-term Loans (Outflow) - Interest Paid (Outflow) - Dividend Paid (Outflow) - Cash Flow from Financing Activities (Net) - **Net Increase / Decrease in Cash & Cash Equivalents (A+B+C)** - **Add: Opening Balance of Cash & Cash Equivalents** - **Closing Balance of Cash & Cash Equivalents** - **Extraordinary Items:** Shown separately after cash flow from respective activity. - **Non-Cash Items:** Depreciation, Amortisation, Provision for doubtful debts. - **Non-Operating Items:** Interest paid/received, dividend paid/received, profit/loss on sale of assets/investments.