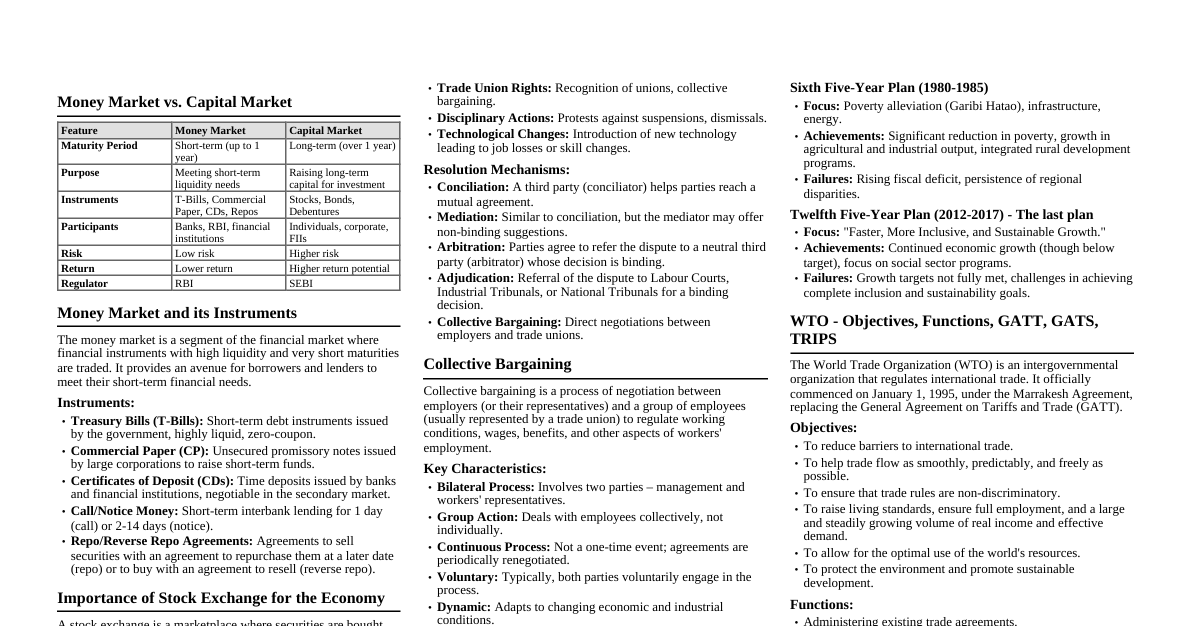

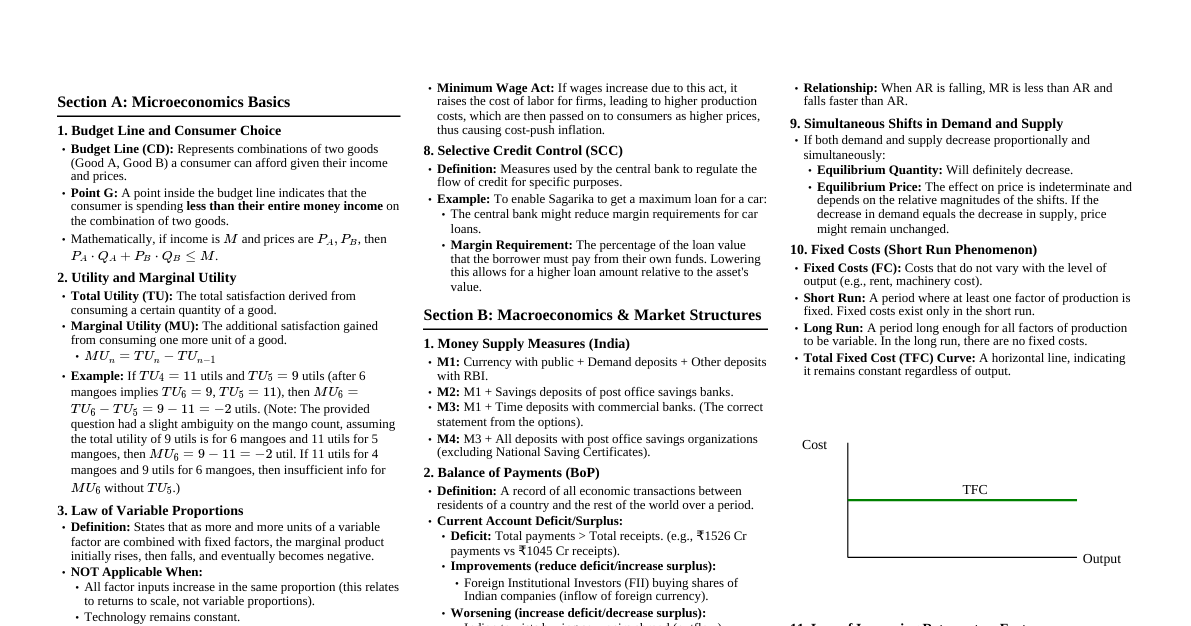

1. Introduction to Micro and Macro Economics Origin: Terms 'Micro' (Mikros - small) and 'Macro' (Makros - large) coined by Ragnar Frisch (1933). Microeconomics: Studies individual units (consumer, producer, firm, commodity price). Historical Review: Developed first, traditional approach, popularized by Alfred Marshall. Scope: Theory of Product Pricing (Demand/Supply Analysis), Theory of Factor Pricing (Rent, Wages, Interest, Profit), Theory of Economic Welfare. Features: Study of Individual Units, Price Theory, Partial Equilibrium, Based on Assumptions (Ceteris Paribus), Slicing Method, Use of Marginalism Principle, Analysis of Market Structure, Limited Scope. Importance: Price Determination, Free Market Economy, Foreign Trade, Economic Model Building, Business Decisions, Useful to Government, Basis of Welfare Economics. Macroeconomics: Studies the economy as a whole (total employment, national income, general price level). Historical Review: Existed before micro, mercantilists, physiocrats, classical theories. Modern macro popularized by J.M. Keynes (1936, "General Theory..."). Scope: Theory of Income and Employment (Consumption/Investment functions, Business Cycles), Theory of General Price Level and Inflation, Theory of Economic Growth and Development, Macro Theory of Distribution. Features: Study of Aggregates, Income Theory, General Equilibrium Analysis, Interdependence, Lumping Method, Growth Models, General Price Level, Policy-oriented. Importance: Functioning of an Economy, Economic Fluctuations, National Income, Economic Development, Performance of an Economy, Study of Macroeconomic Variables, Level of Employment. Key Differences (Micro vs. Macro): Basis Microeconomics Macroeconomics Meaning Individual unit behavior Aggregates behavior Tools Individual demand/supply Aggregate demand/supply Theory Price Theory Income & Employment Theory Method Slicing Method Lumping Method 2. Utility Analysis Utility: Want-satisfying power of a good. Features of Utility: Relative concept (time, place) Subjective concept (person to person) Ethically neutral concept Differs from usefulness Differs from pleasure Differs from satisfaction Measurement is hypothetical (abstract, cardinal/numerical not possible) Multi-purpose Depends on intensity of want Basis of demand Types of Utility: Form, Place, Service, Knowledge, Possession, Time. Concepts of Utility: Total Utility (TU): Aggregate utility from all units consumed. $TU = \sum MU$ Marginal Utility (MU): Additional utility from an additional unit. $MU_n = TU_n - TU_{(n-1)}$ Relationship between TU and MU: First unit: $TU = MU$. As consumption increases: TU increases at diminishing rate, MU diminishes. Point of Satiety: TU is maximum and constant, MU is zero. Beyond satiety: TU declines, MU becomes negative (disutility). Units of Commodity x Total and Marginal Utility TU Curve MU Curve Satiety Disutility Law of Diminishing Marginal Utility (DMU): Statement: "Other things remaining constant, the additional benefit which a person derives from a given increase in his stock of a thing, diminishes with every increase in the stock that he already has." (Alfred Marshall) Assumptions: Rationality, Cardinal measurement, Homogeneity, Continuity, Reasonability, Constancy (income, tastes, MU of money), Divisibility, Single want. Exceptions (Apparent): Hobbies, Miser, Addictions, Power, Money (often violate assumptions). Criticisms: Unrealistic assumptions, Cardinal measurement not possible, Indivisible goods, Constant MU of money, Single want. Significance: Usefulness to consumers (diversify consumption), Useful to government (tax, trade, pricing policy), Basis of paradox of values, Basis of law of demand. Relationship between MU and Price: Consumer equilibrium: $MU_x = P_x$ Intra-marginal units: $MU_x > P_x$ (willing to buy) Extra-marginal units: $MU_x 3. A Demand Analysis Demand: Desire backed by willingness and ability to pay. Demand = Desire + Willingness to purchase + Ability to pay. Features: Relative concept, expressed with reference to time and price. Demand Schedule: Tabular representation of price-quantity demanded relationship. Individual Demand: Quantity demanded by a single consumer. Market Demand: Total quantity demanded by all consumers (horizontal summation of individual demands). Demand Curve: Graphical representation of demand schedule. Slopes downward from left to right (inverse relationship between price and quantity demanded). Reasons for Downward Sloping Demand Curve: Law of DMU, Income effect, Substitution effect, Multi-purpose uses, New Consumers. Types of Demand: Direct demand (consumer goods) Indirect/Derived demand (producer goods, factors of production) Complementary/Joint demand (e.g., car and fuel) Composite demand (e.g., electricity) Competitive demand (substitutes, e.g., tea or coffee) Determinants of Demand: Price, Income, Prices of Substitute Goods, Price of Complementary Goods, Nature of product, Size of population, Expectations about future prices, Advertisement, Tastes, Habits and Fashions, Level of Taxation, Other factors (Climatic conditions, Technology, Government policy, Customs and traditions). Law of Demand: Statement: "Other things being equal, higher the price of a commodity, smaller is the quantity demanded and lower the price of a commodity, larger is the quantity demanded." (Alfred Marshall) Symbolically: $D_x = f(P_x)$ Assumptions (Ceteris Paribus): Constant level of income, No change in population size, Constant prices of substitutes/complements, No future price expectations, No change in tastes/habits/fashions, No change in taxation policy. Exceptions (Upward sloping demand curve): Giffen's paradox, Prestige goods, Speculation, Price illusion, Ignorance, Habitual goods. Variations in Demand (due to price change, other factors constant): Expansion of demand: Rise in quantity demanded due to fall in price (downward movement along the same demand curve). Contraction of demand: Fall in quantity demanded due to rise in price (upward movement along the same demand curve). Changes in Demand (due to changes in other factors, price constant): Increase in demand: Rise in quantity demanded due to favorable changes in other factors (demand curve shifts right). Decrease in demand: Fall in quantity demanded due to unfavorable changes in other factors (demand curve shifts left). 3. B Elasticity of Demand Elasticity of Demand: Degree of responsiveness of quantity demanded to a change in its price or any other factor. Types of Elasticity of Demand: Income elasticity ($E_y$): Responsiveness of demand to income change. $E_y = \frac{\%\Delta Q}{\%\Delta Y}$ Positive for normal goods, Negative for inferior goods, Zero for necessary goods. Cross elasticity ($E_c$): Responsiveness of demand for commodity A to price change of commodity B. $E_c = \frac{\%\Delta Q_A}{\%\Delta P_B}$ Positive for substitutes, Negative for complements, Zero for non-related goods. Price elasticity ($E_d$): Responsiveness of demand to price change. $E_d = \frac{\%\Delta Q}{\%\Delta P} = \frac{\Delta Q/Q}{\Delta P/P}$ Types of Price Elasticity: Perfectly Elastic ($E_d = \infty$): Infinite change in quantity for slight/zero price change (horizontal demand curve). Perfectly Inelastic ($E_d = 0$): No change in quantity for price change (vertical demand curve). Unitary Elastic ($E_d = 1$): Proportionate change in quantity for proportionate price change (rectangular hyperbola). Relatively Elastic ($E_d > 1$): More than proportionate change in quantity for price change (flatter demand curve). Relatively Inelastic ($E_d Methods of Measuring Price Elasticity of Demand: Ratio or Percentage Method: $E_d = \frac{\%\Delta Q}{\%\Delta P}$ Total Expenditure Method: Compares total expenditure before and after price change. $E_d > 1$: Total outlay increases with price fall. $E_d = 1$: Total outlay remains constant. $E_d Point Method or Geometric Method: Measures elasticity at a specific point on the demand curve. $E_d = \frac{\text{Lower segment}}{\text{Upper segment}}$ On a linear demand curve, elasticity varies from $\infty$ (Y-axis) to 0 (X-axis). Factors Influencing Elasticity of Demand: Nature of commodity, Availability of substitutes, Number of uses, Habits, Durability, Complementary goods, Income of the consumer, Urgency of needs, Time period, Proportion of expenditure. Importance of Elasticity of Demand: To a Producer, To Government (taxation), In Factor Pricing, In Foreign Trade, Public Utilities. 4. Supply Analysis Stock: Total quantity of commodity available for sale with a seller at a particular point of time. (Potential supply) Supply: Quantity of a commodity offered for sale by producers at a given price during a given period of time. (Flow concept) Supply Schedule: Tabular representation of price-quantity supplied relationship. Individual Supply: Quantity supplied by a single producer. Market Supply: Total quantity supplied by all producers. Supply Curve: Graphical representation of supply schedule. Slopes upwards from left to right (direct relationship between price and quantity supplied). Determinants of Supply: Price of commodity, State of technology, Cost of Production, Infrastructural facility, Government policy, Natural conditions, Future expectations about price, Other factors (nature of market, prices of other goods, exports/imports, industrial relations, availability of factors). Law of Supply: Statement: "Other things being constant, higher the price of a commodity, more is the quantity supplied and lower the price of a commodity less is the quantity supplied." (Alfred Marshall) Symbolically: $S_x = f(P_x)$ Assumptions: Constant cost of production, Constant technique of production, No change in weather conditions, No change in Government policy, No change in transport cost, Prices of other goods remain constant, No future expectations. Exceptions: Supply of labour (backward bending supply curve), Agricultural goods, Urgent need for cash, Perishable goods, Rare goods. Variations in Supply (due to price change, other factors constant): Expansion of supply: Rise in quantity supplied due to rise in price (upward movement along the same supply curve). Contraction of supply: Fall in quantity supplied due to fall in price (downward movement along the same supply curve). Changes in Supply (due to changes in other factors, price constant): Increase in supply: Rise in quantity supplied due to favorable changes in other factors (supply curve shifts right). Decrease in supply: Fall in quantity supplied due to unfavorable changes in other factors (supply curve shifts left). Concepts of Cost: Total Cost (TC): Total expenditure on factors of production. $TC = TFC + TVC$ (TFC=Total Fixed Cost, TVC=Total Variable Cost) Average Cost (AC): Cost per unit. $AC = \frac{TC}{TQ}$ (TQ=Total Quantity) Marginal Cost (MC): Addition to total cost by producing one more unit. $MC_n = TC_n - TC_{n-1}$ Concepts of Revenue: Total Revenue (TR): Total sales proceeds. $TR = Price \times Quantity$ Average Revenue (AR): Revenue per unit. $AR = \frac{TR}{TQ}$ Marginal Revenue (MR): Addition to total revenue by selling one more unit. $MR_n = TR_n - TR_{n-1}$ 5. Forms of Market Market: Arrangement for buyers and sellers to interact and exchange goods/services. (Augustin Cournot) Classification of Market: On the basis of Place: Local, National, International. On the basis of Time: Very short period, Short period, Long period, Very long period. On the basis of Competition: A) Perfect Competition: (Ideal/imaginary) Features: Large number of sellers & buyers, Homogeneous product, Free entry & exit, Single price, Perfect knowledge, Perfect mobility of factors, Absence of transport cost, No government intervention. Price Determination: Interaction of demand and supply (equilibrium price). B) Imperfect Competition: I) Monopoly: (Mono=single, poly=seller) One seller, no close substitutes. Features: Single seller, No close substitute, Barriers to entry, Complete control over supply, Price maker, Price discrimination, No distinction between firm and industry. Types: Private, Public, Legal, Natural, Simple, Discriminating, Voluntary. II) Oligopoly: (Oligo=few, poly=sellers) Few firms. Features: Few firms/sellers, Interdependence, Advertising, Entry barriers, Lack of uniformity, Uncertainty. III) Monopolistic Competition: (E.H. Chamberlin) Many sellers, differentiated products. Features: Fairly large number of sellers & buyers, Product differentiation, Free entry & exit, Selling cost, Close substitutes, Concept of group. 6. Index Numbers Index Number: Statistical device to measure changes in a variable or group of variables over time. (Spiegel, Croxton & Cowden) Features: Statistical devices, Specialized averages (percentages), Measure net change, Univariate or Composite, Current year/Base year, Base year index = 100, "Barometers of economic activity." Terminologies: Base Year ($p_0, q_0$), Current Year ($p_1, q_1$). Types of Index Numbers: Price Index, Quantity Index, Value Index, Special Purpose Index. Significance: Framing suitable policies, Studies trends and tendencies, Forecasting, Measurement of inflation, Useful to present financial data in real terms (deflating). Construction of Index Numbers (Steps): Purpose, Selection of base year, Selection of items, Selection of price quotations, Choice of suitable average, Assigning proper weights, Selection of appropriate formula. Methods of Constructing Index Numbers: A) Simple Index Number (equal importance): Price Index: $P_{01} = \frac{\sum p_1}{\sum p_0} \times 100$ Quantity Index: $Q_{01} = \frac{\sum q_1}{\sum q_0} \times 100$ Value Index: $V_{01} = \frac{\sum p_1 q_1}{\sum p_0 q_0} \times 100$ B) Weighted Index Number (assigns weights): Laspeyres' Price Index (Base year quantities as weights): $P_{01} = \frac{\sum p_1 q_0}{\sum p_0 q_0} \times 100$ Paasche's Price Index (Current year quantities as weights): $P_{01} = \frac{\sum p_1 q_1}{\sum p_0 q_1} \times 100$ Limitations: Based on samples, Bias in data, Misuse, Defects in formulae, Changes in economy, Qualitative changes, Arbitrary weights, Limited scope. 7. National Income National Income: Total income of the nation; flow of goods and services produced in an economy during a year. Definitions: NIC (volume of commodities/services without duplication), A.C. Pigou (part of objective income measured in money), Irving Fisher (services received by ultimate consumers). Features: Macro Economic concept, Value of only final goods and services, Net aggregate value, Net income from abroad, Financial year, Flow concept, Money value. Circular Flow of National Income: Process where money receipts and payments flow in a circular manner. Two-sector model (Households & Firms): Factor income from firms to households, consumption expenditure from households to firms. Three-sector model: Adds Government. Four-sector model: Adds Foreign sector. Concepts of National Income: Gross Domestic Product (GDP): Market value of final goods/services produced *within* domestic territory. $GDP = C + I + G + (X-M)$ Net Domestic Product (NDP): $NDP = GDP - Depreciation$ Gross National Product (GNP): Gross value of final goods/services produced by *residents* of a country. $GNP = C + I + G + (X-M) + (R-P)$ (R=receipts from abroad, P=payments abroad) Net National Product (NNP): $NNP = GNP - Depreciation$ Green GNP: Indicator of sustainable use of natural environment. $Green GNP = GNP - (\text{Net fall in stock of natural capital + pollution load})$ Methods of Measurement: 1) Output Method / Product Method (Value Added Method): Sum of market value of all final goods/services (Final Goods Approach) or sum of value added at each stage of production (Value Added Approach). Precautions: Avoid double counting, include self-consumption imputed value, deduct indirect taxes, add subsidies, consider price level changes, add exports, deduct imports, deduct depreciation, ignore second-hand goods. 2) Income Method / Factor Cost Method: Sum of income payments to factors of production. $NI = Rent + Wages + Interest + Profit + Mixed Income + Net export + Net receipts from abroad$ Precautions: Ignore transfer incomes, unpaid services, income from second-hand goods/shares/bonds, government direct taxes. Include undistributed profits, imputed value of self-consumption/owner-occupied houses. 3) Expenditure Method / Outlay Method: Sum of total expenditure by society. $NI = C + I + G + (X-M) + (R-P)$ (C=Private consumption, I=Gross Domestic Private Investment, G=Government expenditure) Precautions: Ignore intermediate goods, second-hand goods, transfer payments, financial assets. Deduct indirect taxes, add subsidies, include final goods/services. Difficulties in Measurement: Theoretical: Transfer payments, Illegal income, Unpaid services, Production for self-consumption, Income of foreign firms, Valuation of Government Services, Changing price level. Practical/Statistical: Double counting, Non-monetized sector, Inadequate/unreliable data, Depreciation, Capital gains/losses, Illiteracy/ignorance, Difficulties in classifying working population, Valuation of inventories. Importance: For the Economy (Social Accounts), National policies, Economic planning, Economic Research, Comparison of Standard of Living, Distribution of Income. 8. Public Finance in India Public Finance: Study of income and expenditure of the government (central, state, local). Government Functions: Obligatory: Protection from external attacks, maintaining law & order. Optional: Education, health, social security. Differences between Public Finance and Private Finance: Basis Public Finance Private Finance Objectives Maximum social advantage Private interests Expenditure Determines expenditure first Considers income first Credit status High degree of credit Limited credit Print currency Can print notes No such right Elasticity More elastic Less elastic Structure of Public Finance: Public Expenditure, Public Revenue, Public Debt, Fiscal Policy, Financial Administration. I) Public Expenditure: Incurred by public authority for protection, collective needs, welfare. Classification: Revenue Expenditure (day-to-day functions, e.g., salaries). Capital Expenditure (progress & development, e.g., investments). Developmental Expenditure (productive, e.g., health, education). Non-Developmental Expenditure (unproductive, e.g., war). Reasons for Growth: Increase in Government Activities, Rapid Increase in Population, Growing Urbanization, Increasing Defence Expenditure, Spread of Democracy, Inflation, Industrial Development, Disaster Management. II) Public Revenue: Aggregate income of the government. A) Taxes: Compulsory contribution without direct quid pro quo. Canons of Taxation (Adam Smith): Equity/Equality, Certainty, Convenience, Economy. Types: Direct Tax (burden on same person, e.g., income tax). Indirect Tax (burden can be shifted, e.g., GST). Direct Tax Categories: Proportionate, Progressive, Regressive. B) Non-Tax Revenue Sources: Fees (return for specific services). Prices of public goods and services (e.g., railway fares). Special Assessment (payment for special facilities). Fines and Penalties (discourage law violation). Gifts, Grants and Donations (from citizens, foreign governments). Special Levies (on harmful commodities). Borrowings (from people, foreign governments, institutions). Goods and Services Tax (GST): Introduced July 1, 2017. Replaced many indirect taxes. CGST (Central), SGST (State), IGST (Integrated). III) Public Debt: Loans raised by government. Internal Debt: Borrowed within the country. External Debt: Borrowed from foreign sources. IV) Fiscal Policy: Government adjusts spending and tax rates to influence economy. V) Financial Administration: Efficient implementation of revenue, expenditure, and debt policy. Government Budget: Financial statement of expected receipts and proposed expenditures for a financial year. Revenue Budget: Revenue receipts (tax/non-tax) and revenue expenditure. Capital Budget: Capital receipts (loans, disinvestment) and capital payments (development projects, investments). Types of Budget: Balanced Budget: Receipts = Expenditure (Classical view, neutral). Surplus Budget: Receipts > Expenditure (Useful during inflation). Deficit Budget: Receipts Importance of Budget: Affects taxes, disposable income, government expenditure, economic policies, production, income distribution, resource utilization. 9. Money Market and Capital Market in India Financial Market: Market for sale and purchase of financial assets (bonds, stocks, etc.). Comprises Money Market and Capital Market. A) Money Market in India: Meaning: Market for lending and borrowing short-term funds ( Structure (Dichotomous): Organized Sector: RBI, Commercial Banks, Co-operative Banks, Development Financial Institutions, Discount and Finance House of India (DFHI). Unorganized Sector: Indigenous Bankers, Money Lenders, Unregulated Non-Bank Financial Intermediaries (Chit funds, Nidhi, Loan companies). Reserve Bank of India (RBI): Central bank, apex of banking system (established 1935, nationalized 1949). Functions: Issue of Currency Notes, Banker to the Government, Banker's Bank, Custodian of Foreign Exchange Reserves, Controller of Credit (quantitative: bank rate, OMO, CRR, SLR; qualitative: margin requirements), Collection & Publication of Data, Promotional & Developmental Functions, Other Functions (clearing house, lender of last resort). Commercial Banks: Intermediaries, profit-seeking. Functions: Acceptance of deposits (Demand: current/savings; Time: recurring/fixed), Providing loans & advances, Ancillary functions (fund transfer, merchant banking, demat, internet banking), Credit Creation. Co-operative Banks: Supplement commercial banks, meet credit needs of local population (established 1904). Three-tier structure: State, District Central, Primary. Development Financial Institutions (DFIs): Provide medium/long-term finance (e.g., IFCI, NABARD). Discount and Finance House of India (DFHI): Set up 1988 to impart liquidity to money market instruments. Money Market Instruments: Call/Notice Money, Treasury Bills, Commercial Papers, Certificate of Deposits, Commercial Bills. Role of Money Market: Short-term requirements of borrowers, Liquidity Management, Portfolio Management, Equilibrating mechanism, Financial requirements of Government, Implementation of Monetary policy, Economizes use of cash, Growth of Commerce, Industry, Trade. Problems: Dual Structure (organized/unorganized), Lack of uniformity in interest rates, Shortage of funds, Seasonal fluctuations, Lack of financial inclusion, Delays in technological upgradation. Reforms: New instruments (CPs, CDs, MMMFs), RBI Repos/Reverse Repos, Market-determined interest rates, NEFT/RTGS, Electronic dealing system. B) Capital Market in India: Meaning: Market for long-term funds (equity and debt) raised domestically and internationally. Structure: Government Securities Market (Gilt-Edged): Deals in government/semi-government securities (fixed interest). Industrial Securities Market: Deals with shares/debentures. Primary Market (New Issues) Secondary Market (Old Issues - Stock Exchanges like BSE, NSE). Development Financial Institutions (DFIs): (e.g., IFCI, IIBI, EXIM Bank). Financial Intermediaries: Merchant banks, Mutual funds, Leasing companies, Venture capital companies. Role of Capital Market: Mobilizes long term savings, Provides equity capital, Operational efficiency, Quick valuation, Integration. Problems: Financial Scams, Insider trading & price manipulation, Inadequate debt instruments, Decline in volume of trade (regional exchanges), Lack of informational efficiency. Reforms: SEBI (1988/1992), NSE (1992), Computerized Screen Based Trading System (SBTS), Demat accounts, Increased access to global funds (ADRs, GDRs), Investor Education and Protection Fund (IEPF). 10. Foreign Trade of India Internal Trade: Buying and selling goods/services within national boundaries. Foreign Trade: Trade between different countries (International/External Trade). (Wasserman & Hultman) Types of Foreign Trade: Import Trade: Purchase of goods/services from another country (inflow). Export Trade: Sale of goods/services to another country (outflow). Entrepot Trade: Purchase from one country, process, and sell to another. Role of Foreign Trade: Earn foreign exchange, Encourages Investment, Division of labour and specialization, Optimum allocation and utilization of resources, Stability in price level, Availability of multiple choices, Brings reputation and helps earn goodwill. Composition and Direction of India's Foreign Trade (Changes since 1947): Composition: Increasing share of Gross National Income. Increase in volume and value of trade. Change in composition of exports (from primary products to manufactured items, gems, software). Change in composition of imports (from consumer goods to capital goods, chemicals, fertilizers, petroleum). Oceanic trade (around 68%). Development of new ports. Direction: Shift from Britain to USA, Germany, Japan, UK. Trends in India’s Foreign Trade since 2001: Recent Trends in Exports: Engineering goods, Petroleum products, Chemicals and chemical products, Gems and Jewellery, Textiles and readymade garments. Trends in Imports: Petroleum, Gold, Fertilizers, Iron and Steel. Concept of Balance of Payments (BoP): Systematic record of all international economic transactions of a country during a given period. (Ellsworth, Walter Krause) Balance of Trade (BoT): Difference between value of country's exports and imports of *physical goods* (visible trade). Trade Surplus: Export value > Import value. Trade Deficit: Import value > Export value.