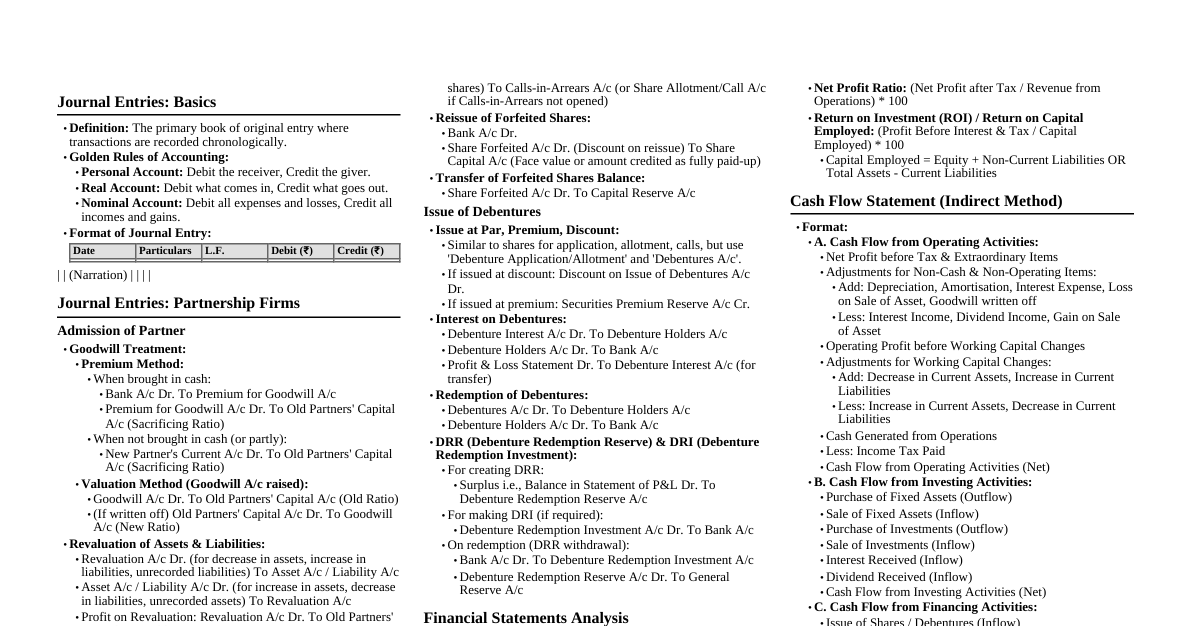

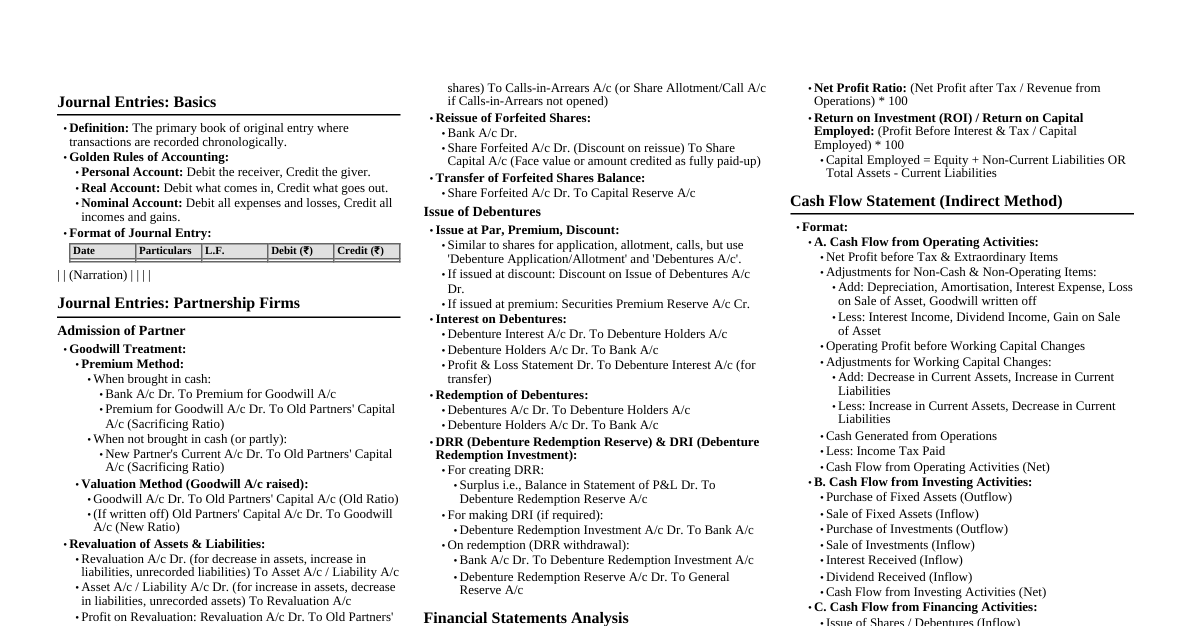

1. Basic Accounting Concepts Accounting: Art of recording, classifying, and summarizing in a significant manner and in terms of money, transactions and events which are, in part at least, of a financial character, and interpreting the results thereof. Objectives: Systematic recording of transactions. Ascertaining profit or loss. Ascertaining financial position. Providing information to users. Branches: Financial Accounting, Cost Accounting, Management Accounting. Users: Internal (Management, Employees), External (Investors, Creditors, Government, Public). 2. Accounting Principles (GAAP) Business Entity Concept: Business is separate from its owner. Money Measurement Concept: Only monetary transactions are recorded. Going Concern Concept: Business will continue indefinitely. Accounting Period Concept: Life of business divided into accounting periods (usually 1 year). Cost Concept: Assets recorded at their acquisition cost. Dual Aspect Concept: Every transaction has two effects (Debit & Credit). $Assets = Liabilities + Capital$ Revenue Recognition Concept: Revenue recognized when earned, not when cash received. Matching Concept: Expenses incurred to earn revenue should be matched against that revenue. Accrual Concept: Revenue and expenses recorded when they occur, regardless of cash flow. Full Disclosure Concept: All material information must be disclosed. Consistency Concept: Accounting methods should be consistent from period to period. Conservatism (Prudence) Concept: Anticipate no profits, but provide for all possible losses. Materiality Concept: Only material items are recorded with strict adherence to principles. 3. Accounting Equation $Assets = Liabilities + Capital$ Every transaction affects at least two accounts and keeps the equation balanced. 4. Journal Entry Rules (Golden Rules of Accounting) 4.1. Type of Accounts Personal Accounts: Individuals, firms, companies. Debit the receiver, Credit the giver. Real Accounts: Assets (tangible & intangible). Debit what comes in, Credit what goes out. Nominal Accounts: Expenses, incomes, gains, losses. Debit all expenses and losses, Credit all incomes and gains. 5. Ledger Posting Transferring entries from Journal to respective Ledger Accounts. Each account maintains a 'T' format: Debit side (left), Credit side (right). Balancing: Difference between total debits and total credits. 6. Trial Balance List of all ledger balances (Debit or Credit) at a specific date. Purpose: To check arithmetical accuracy of ledger accounts. Total Debits must equal Total Credits. Errors not disclosed by Trial Balance: Errors of Omission (transaction not recorded at all). Errors of Commission (wrong amount, but double entry correct). Compensating Errors. Errors of Principle. Posting to wrong account on correct side. 7. Cash Book Book of original entry and a ledger account. Types: Single Column: Only cash transactions. Double Column: Cash & Bank (or Cash & Discount, Bank & Discount). Triple Column: Cash, Bank, Discount. Petty Cash Book: For small expenses. Cash column always shows a debit balance or nil; Bank column can show debit or credit balance (overdraft). 8. Subsidiary Books Used for transactions of similar nature. Purchases Book: Credit purchases of goods. Sales Book: Credit sales of goods. Purchases Return Book: Goods returned to suppliers. Sales Return Book: Goods returned by customers. Bills Receivable Book: Bills accepted by debtors. Bills Payable Book: Bills accepted by us. Journal Proper: For transactions not recorded in other subsidiary books (e.g., opening entries, rectification entries, asset sales). 9. Bank Reconciliation Statement (BRS) Statement prepared to reconcile the difference between the bank balance as per cash book and the bank balance as per pass book. Common Causes of Difference: Cheques issued but not yet presented for payment. Cheques deposited but not yet cleared by bank. Direct deposits by customers into bank. Bank charges. Interest allowed by bank. Direct payments made by bank (e.g., insurance premium). Dishonor of cheques/bills. Errors in Cash Book or Pass Book. 10. Depreciation Systematic allocation of the depreciable amount of an asset over its useful life. Causes: Wear and tear, obsolescence, effluxion of time, depletion. Methods: Straight Line Method (SLM): $Depreciation = \frac{(Cost - Salvage Value)}{Useful Life}$ Depreciation amount is constant each year. Written Down Value Method (WDV/Diminishing Balance): $Depreciation = WDV \times Rate\%$ Depreciation amount decreases each year. 11. Inventory Valuation (Stock) Valued at Cost or Net Realizable Value (NRV), whichever is lower (Prudence Concept). Cost includes: Purchase price, duties, freight, other directly attributable costs. NRV: Estimated selling price less estimated costs of completion and selling expenses. Methods for Cost Determination: FIFO (First-In, First-Out): Assumes oldest goods are sold first. LIFO (Last-In, First-Out): Assumes newest goods are sold first (not allowed under Ind AS/IFRS). Weighted Average Method: Average cost of goods available for sale. 12. Accounting for Bills of Exchange Bill of Exchange: An unconditional order in writing, signed by the maker, directing a person to pay a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument. Parties: Drawer (maker), Drawee (acceptor), Payee. Key Scenarios: Bill retained till maturity. Bill discounted with bank. Bill endorsed to a creditor. Bill sent for collection. Dishonor of bill. 13. Final Accounts (Sole Proprietorship) 13.1. Trading Account Purpose: To ascertain Gross Profit or Gross Loss. Format: Debit Side: Opening Stock, Purchases, Direct Expenses (Wages, Carriage Inwards, Manufacturing Expenses). Credit Side: Sales, Closing Stock. $Gross Profit = (Sales + Closing Stock) - (Opening Stock + Purchases + Direct Expenses)$ 13.2. Profit & Loss Account Purpose: To ascertain Net Profit or Net Loss. Format: Debit Side: Gross Loss (if any), Indirect Expenses (Salaries, Rent, Advertising, Depreciation, Interest, Bad Debts). Credit Side: Gross Profit (if any), Indirect Incomes (Rent Received, Interest Received, Commission Received, Discount Received). $Net Profit = (Gross Profit + Other Incomes) - (Indirect Expenses)$ 13.3. Balance Sheet Purpose: To show the financial position of the business at a specific date. Format: Liabilities Side: Capital, Reserves, Long-term Liabilities (Loans), Current Liabilities (Creditors, Bills Payable, Outstanding Expenses, Bank Overdraft). Assets Side: Fixed Assets (Land, Building, Plant, Machinery, Furniture), Investments, Current Assets (Stock, Debtors, Bills Receivable, Cash, Bank, Prepaid Expenses, Accrued Income). $Assets = Liabilities + Capital$ (must balance). 13.4. Adjustments in Final Accounts Closing Stock: Trading A/c (Cr), Balance Sheet (Asset). Outstanding Expenses: P&L A/c (Dr - add to expense), Balance Sheet (Liability). Prepaid Expenses: P&L A/c (Dr - subtract from expense), Balance Sheet (Asset). Accrued Income: P&L A/c (Cr - add to income), Balance Sheet (Asset). Unearned Income: P&L A/c (Cr - subtract from income), Balance Sheet (Liability). Depreciation: P&L A/c (Dr), Balance Sheet (Asset - subtract from asset). Bad Debts: P&L A/c (Dr). Provision for Bad & Doubtful Debts: P&L A/c (Dr - new provision + old bad debts - old provision), Balance Sheet (Asset - subtract from Debtors). Interest on Capital: P&L A/c (Dr), Balance Sheet (add to Capital). Interest on Drawings: P&L A/c (Cr), Balance Sheet (subtract from Capital). Goods taken by Owner for Personal Use (Drawings): Trading A/c (Cr - subtract from purchases), Balance Sheet (subtract from Capital). Goods Distributed as Free Samples/Advertisement: Trading A/c (Cr - subtract from purchases), P&L A/c (Dr - as advertisement). 14. Rectification of Errors Correcting errors discovered before or after preparing Trial Balance. Errors not affecting Trial Balance: (Two-sided errors) Error of omission. Error of commission (wrong amount, correct sides). Compensating errors. Error of principle. Posting to wrong account but on correct side. Errors affecting Trial Balance: (One-sided errors) Posting to wrong side. Partial omission of posting. Wrong balancing of an account. Error in casting (totaling) subsidiary books. Error in carrying forward. Suspense Account: Used to temporarily balance the Trial Balance when one-sided errors are found. Once errors are rectified, Suspense Account should show zero balance. 15. Partnership Accounts 15.1. Partnership Deed Written agreement among partners. If absent, provisions of Indian Partnership Act, 1932 apply: Profit/Loss sharing: Equal. Interest on Capital: Not allowed. Interest on Drawings: Not charged. Salary/Commission to Partner: Not allowed. Interest on Loan by Partner: 6% p.a. allowed. 15.2. Capital Accounts Fixed Capital Method: Capital Accounts remain fixed. Current Accounts record all adjustments (interest on capital/drawings, salary, share of profit/loss). Fluctuating Capital Method: Only Capital Accounts are maintained. All adjustments directly affect Capital Accounts. 15.3. P&L Appropriation Account Extension of P&L Account, prepared after P&L Account. Purpose: To show distribution of Net Profit among partners. Debit Side: Net Profit (if loss, credit side), Interest on Capital, Partner's Salary/Commission, Reserves. Credit Side: Net Loss (if profit, debit side), Interest on Drawings. Balance is distributed among partners in their profit-sharing ratio. 15.4. Goodwill Reputation of a business in terms of monetary value. Methods of Valuation: Average Profit Method: Goodwill = Average Profit $\times$ No. of Years' Purchase. Super Profit Method: Super Profit = Actual Average Profit - Normal Profit. Normal Profit = Capital Employed $\times$ Normal Rate of Return. Goodwill = Super Profit $\times$ No. of Years' Purchase. Capitalization Method: Goodwill = Capitalized Value of Business - Net Assets. Capitalized Value = $\frac{Average Profit}{Normal Rate of Return} \times 100$. Or Goodwill = $\frac{Super Profit}{Normal Rate of Return} \times 100$. 15.5. Admission of a Partner New partner brings capital and share of goodwill (premium). Sacrificing Ratio: Ratio in which old partners sacrifice their share of profit for new partner. Goodwill Treatment: Premium brought in cash and retained: Dr Cash, Cr Goodwill Premium. Dr Goodwill Premium, Cr Sacrificing Partners' Capital. Premium brought in cash and withdrawn: Same as above, plus Dr Sacrificing Partners' Capital, Cr Cash. Goodwill not brought in cash: Dr New Partner's Current A/c, Cr Sacrificing Partners' Capital. Revaluation Account: Prepared to revalue assets and liabilities. Profit/Loss distributed among old partners in old ratio. 15.6. Retirement/Death of a Partner Outgoing partner's share of accumulated profits, reserves, and goodwill is given. Gaining Ratio: Ratio in which remaining partners acquire the outgoing partner's share. Goodwill Treatment: Remaining Partners' Capital A/c (Dr in gaining ratio) to Retiring Partner's Capital A/c (Cr). Revaluation Account prepared similar to admission. Amount due to retiring partner transferred to Loan Account or paid off. 16. Company Accounts 16.1. Share Capital Authorized Capital: Maximum capital a company can issue. Issued Capital: Part of authorized capital offered to public. Subscribed Capital: Part of issued capital subscribed by public. Called-up Capital: Part of subscribed capital demanded by company. Paid-up Capital: Part of called-up capital paid by shareholders. Reserve Capital: Part of uncalled capital, called only on winding up. Capital Reserve: Not available for dividend distribution (e.g., profit on sale of fixed assets). 16.2. Issue of Shares Shares can be issued at par, premium, or discount (discount only in specific cases like sweat equity shares). Application Money: Received with application. Allotment Money: Due on allotment. Call Money: Due on first/final call. Share Premium: Credited to Securities Premium Account, cannot be used for dividend distribution. Calls-in-Arrears: Money not paid by shareholders on calls. Calls-in-Advance: Money paid by shareholders before it's due. 16.3. Forfeiture of Shares Cancellation of shares for non-payment of call money. Journal Entry: Dr Share Capital A/c (with called-up amount on forfeited shares). Dr Securities Premium A/c (if premium not received). Cr Share Forfeiture A/c (with amount received on forfeited shares). Cr Calls-in-Arrears A/c (with amount not received). 16.4. Re-issue of Forfeited Shares Can be re-issued at par, premium, or discount. Discount on Re-issue: Cannot exceed the amount forfeited on those shares. Journal Entry: Dr Bank A/c (with re-issue price). Dr Share Forfeiture A/c (with discount allowed). Cr Share Capital A/c (with paid-up value of re-issued shares). Balance in Share Forfeiture A/c (relating to re-issued shares) transferred to Capital Reserve A/c. 16.5. Issue of Debentures Loan raised by company, bearing a fixed rate of interest. Can be issued at par, premium, or discount. Types: Secured/Unsecured, Registered/Bearer, Convertible/Non-convertible, Redeemable/Irredeemable. Loss on Issue of Debentures: Written off over the life of debentures from Securities Premium, Capital Reserve, or P&L A/c. 17. Financial Statements of Not-for-Profit Organisations (NPO) Receipts and Payments Account: Summary of Cash Book. Records all cash receipts and payments (revenue & capital, current & previous/next year). Starts with opening cash/bank balance, ends with closing cash/bank balance. Nature: Real Account. Income and Expenditure Account: Similar to P&L Account. Records only revenue items (current year only), on accrual basis. Purpose: To ascertain Surplus (income > expenditure) or Deficit (expenditure > income). Nature: Nominal Account. Balance Sheet: Shows financial position at year-end. Capital Fund (Accumulated Fund): Equivalent to Capital in profit-making concerns. Adjusted with Surplus/Deficit. Specific Funds: Funds for specific purposes (e.g., Building Fund, Prize Fund). Incomes from these funds are added to them; expenses are deducted. Not shown in I&E A/c. 18. Introduction to Company Final Accounts Prepared as per Schedule III of Companies Act, 2013. Key Statements: Balance Sheet (Statement of Financial Position). Statement of Profit and Loss. Cash Flow Statement (not covered in CA Foundation). Statement of Changes in Equity (not covered in CA Foundation). Balance Sheet Format: Equity and Liabilities, Assets. Statement of P&L Format: Revenue from Operations, Other Income, Total Revenue, Expenses, Profit before Tax, Tax Expense, Profit after Tax. Detailed notes to accounts are integral part of financial statements.