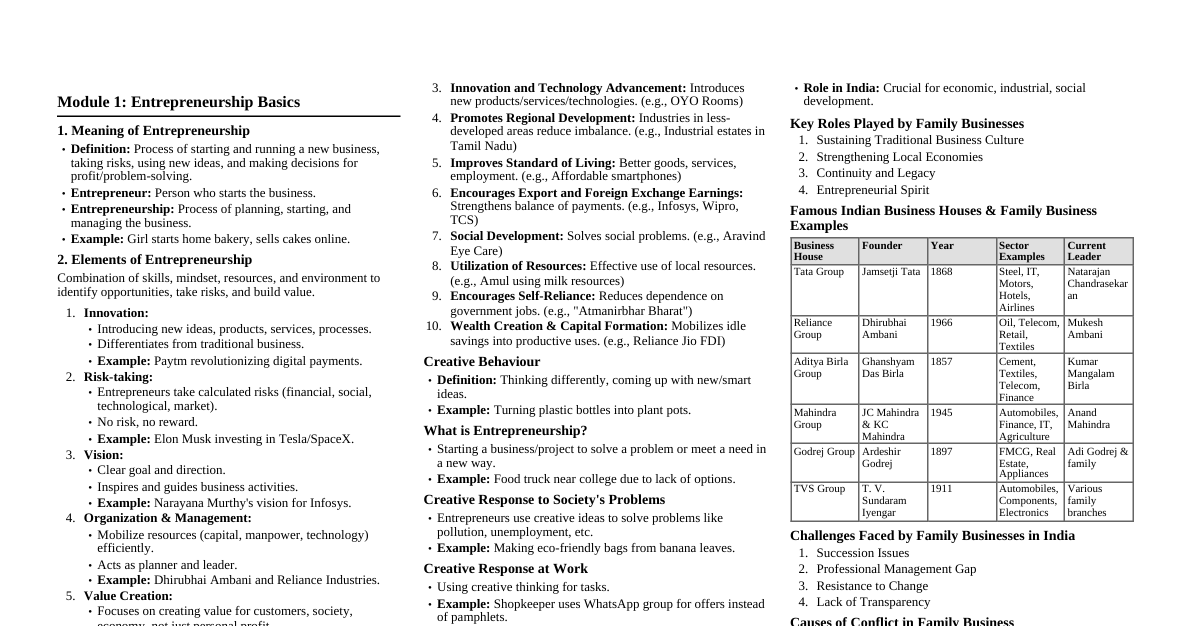

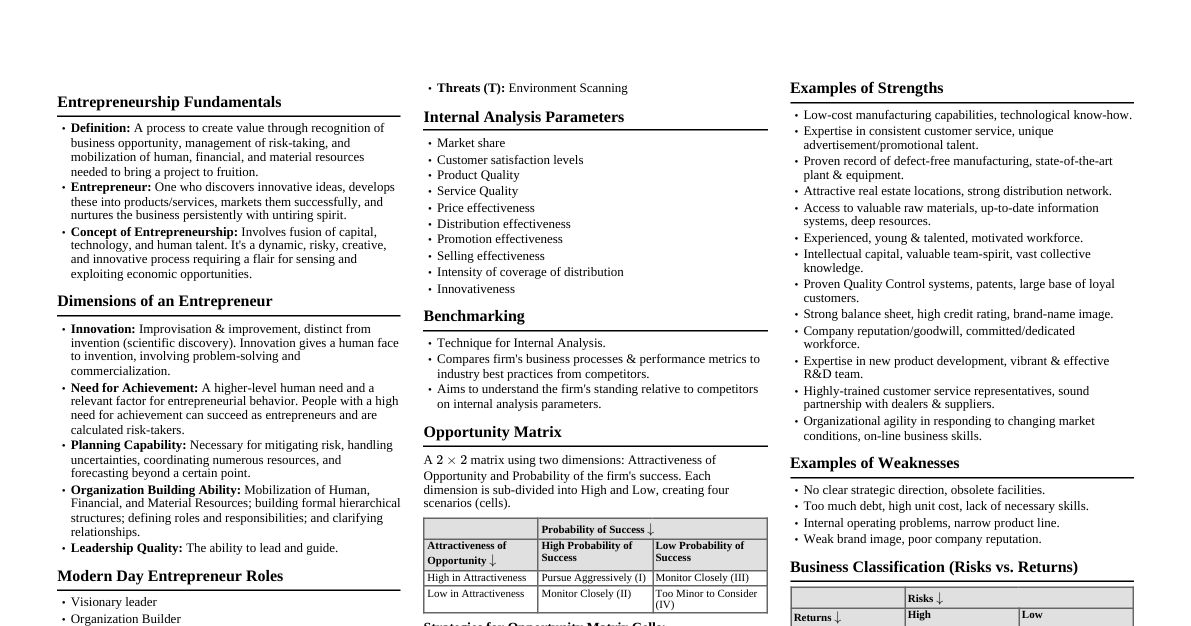

Module 1: Entrepreneurship 1. Entrepreneurship Definition Process of creating value by identifying and seizing business opportunities. Involves managing risks and mobilizing resources (human, financial, material) to bring ideas to fruition. A fusion of capital, technology, and human talent . Dynamic, creative, and risky process requiring sensing, recognizing, seizing, and exploiting economic opportunities. 2. Entrepreneur Discovers and develops innovative ideas. Converts ideas into products or services and markets them successfully. Demonstrates persistence, determination, and a risk-taking demeanor. 3. Dimensions of an Entrepreneur Innovation: Improves or commercializes inventions. Problem-solving and giving a human face to scientific discoveries. Need for Achievement: Explains entrepreneurial behavior. Successful entrepreneurs are calculated risk-takers. Planning: Reduces risks, handles uncertainties, and coordinates resources effectively. Organization Building: Mobilizes human, financial, and material resources. Establishes a meaningful hierarchy with defined roles and responsibilities. Leadership Quality 4. Modern-Day Entrepreneur Visionary leader, capable administrator, and excellent manager. 5. Manager vs. Business Leader Manager Business Leader Focuses on managing existing resources & earning revenue. Motivates, creates wealth, achieves high goals, acts as role model. Enjoys formal authority. Enjoys informal power. Roles are well-defined. High achiever, great motivator. Module 2: Entrepreneurship Management 1. Exploring Marketing Opportunities Entrepreneurs scan the external environment to identify business opportunities. Macro-environmental factors drive business changes and influence marketing opportunities. 2. Macro-Environmental Factors Demographic Factors: Age, gender, income, occupation, education, family size, population trends, urbanization, migration. Economic Factors: Purchasing power, inflation, disposable income, employment rates, interest rates, economic conditions. Technological Factors: Rapid advancements, short product lifecycles, need for innovation, R&D. Political Factors: Stability, government infrastructure, taxation, subsidies, policies toward startups. Legal Factors: Business, corporate, and labor laws protecting stakeholders. Social Factors: Social class segmentation affecting purchasing behaviors. Cultural Factors: Values, traditions, festivals, history shaping consumer behavior; globalization and localization coexist. Module 3: Analyzing Marketing Opportunities (Micro-Environmental Factors) 1. Micro-Environmental Factors Internal or immediate external factors influencing operations: Demand-related Factors: Nature, trends, seasonality, consumption patterns. Customers: Purchasing power, motives, habits, brand loyalty, switching behavior. Suppliers: Continuity, quality, dependability, pricing, credit terms. Employees: Talent and efficiency. Industry & Competition: Performance relative to industry players. Firm's Internal Environment: Operational and strategic efficiency. 2. SWOT Analysis Strengths & Weaknesses: Internal analysis (market share, customer satisfaction, product quality). Opportunities & Threats: External environment scanning (growth or risks). 3. Internal Analysis Parameters Market share, product/service quality, pricing, distribution, promotion, innovation effectiveness. Benchmarking: Comparing firm's metrics with industry best practices. Module 4: Advanced Analysis of Opportunities and Threats 1. Opportunity Matrix Success Probability High Low Attractiveness High Low Pursue Aggressively (I) Monitor Closely (II) Monitor Closely (III) Too Minor (IV) A 2x2 matrix evaluating opportunities based on: Attractiveness of Opportunity (High/Low). Probability of Firm's Success (High/Low). Strategies for Opportunity Cells: Cell I (High-High): Aggressively pursue. Cell II (Low-High): Monitor closely, "Wait & Watch." Cell III (High-Low): Monitor closely for future feasibility. Cell IV (Low-Low): Ignore, as opportunities are too minor. 2. Threats Matrix Probability of Occurrence High Low Seriousness High Low Prepare Contingency Plans Monitor Closely Monitor Closely Ignore Evaluates threats based on Seriousness and Probability of Occurrence . Strategies for Threat Cells: Cell I (High-High): Prepare contingency plans. Cell II (Low-High): Monitor closely. Cell III (High-Low): Monitor closely. Cell IV (Low-Low): Ignore. 3. SWOT Analysis (Combined) Strengths (Internal): Attributes providing competitive advantage. Weaknesses (Internal): Limitations hindering performance. Opportunities (External): Favorable external conditions for growth. Threats (External): Potential external risks. 4. Environmental Scanning Macro-Environmental Factors: Political, legal, social, cultural, demographic, economic, technological trends. Micro-Environmental Factors: Internal stakeholders, customers, competitors, suppliers, firm-specific conditions. 5. Business Classification by Risks and Returns Risks High Low Returns High Low Speculative Business Ideal Business Troubled Business Mature Business High Risk, High Return: Speculative businesses. High Risk, Low Return: Troubled businesses. Low Risk, High Return: Ideal businesses. Low Risk, Low Return: Mature businesses. Module 5: Strategic Intent and Its Components Strategic Intent is an approach entrepreneurs use to derive business growth and marketing opportunities by defining their long-term vision, mission, and business scope. 1. Vision Definition: The dream of the entrepreneur, providing a vivid and inspirational description of what the company aspires to become. Key Features: Abstract, romantic, full of zeal; offers clarity, hope, unity of purpose; built upon core, timeless values; drives firm's focus; must be shared, owned, and lived by everyone. 2. Mission Definition: Defines what the company is and why it exists; practical expression of growth ambition. Key Features: Unique and personal; directs planning efforts; change leads to shifts in strategy. Entrepreneur's Role: Shapes the mission; rarely amended without intervention. 3. Business Definition Definition: Blueprint for product-market choices, setting boundaries for opportunities and clarifying threats. Key Features: Traditionally product-oriented but should shift to market-oriented; product-focused can limit opportunities. Theodore Levitt's Argument (Marketing Myopia): Businesses should define themselves by markets they serve, not products; narrow definitions lead to obsolescence. 4. Importance of Strategic Intent Vision: Motivates and aligns employees towards long-term goals. Mission: Guides daily operations and strategic decisions. Business Definition: Ensures adaptability to evolving markets and competition. Module 6: Ansoff Product/Market Grid The grid categorizes growth strategies based on the interaction between existing/new products and existing/new markets. Existing Products New Products Existing Markets Market Penetration Strategies Product Development Strategies New Markets Market Development Strategies Diversification Strategies 1. Market Penetration Strategy Focus: Deeper penetration in existing markets with existing products. Low-risk but can concentrate risks. Approaches: Encourage current customers to buy more, attract competitors' customers, gain non-users, lowering prices, increasing promotion, expanding distribution, acquiring competitors. Appropriate When: Industry is stable, demand is stable, markets not saturated, strong entry barriers. 2. Market Development Strategy Focus: New markets for existing products by finding new uses or users. Approaches: Add new customer segments, explore additional distribution channels, enter new geographic/domestic regions, expand into foreign markets. Appropriate When: Proprietary technology can be leveraged, new markets are profitable, consumer behavior aligns. 3. Product Development Strategy Focus: New products for existing markets (improved versions). Approaches: Quality improvement, feature improvement, style improvement, invest in R&D, acquire competitors' products, form strategic partnerships. 4. Diversification Strategies Focus: Entering a new market with a new product. Highest risk among growth strategies. Can be mitigated with related diversification. Benefits: Unlocks new revenue streams, expands business scope. 5. Comparison of Strategies Strategy Focus Risk Level Examples Market Penetration Existing market, existing product Low Offering discounts, expanding distribution. Market Development New market, existing product Moderate Expanding internationally, new user segments. Product Development Existing market, new product Moderate Launching improved versions of current products. Diversification New market, new product High Entering a completely new industry. Module 7: Market Survey Techniques Market survey techniques are essential tools for collecting data, analyzing markets, and understanding consumer behavior. Types of Interviews Structured & Direct Interviews Description: Formal questionnaire with open/closed-ended questions. Characteristics: Pretested questionnaires, simple language, strict interviewer guidelines, used for large-scale surveys. Process: Field interviews $\to$ data tabulation $\to$ compilation $\to$ analysis $\to$ report. Unstructured & Direct Interviews Description: Used in exploratory research with general instructions but no strict guidelines. Characteristics: Open-ended questions with in-depth probing (Depth Interviews), skilled interviewers required, higher costs, qualitative findings. Structured & Indirect Interviews Description: Partially structured, uses projection techniques to uncover subconscious motives. Characteristics: Situations/stimuli presented to respondents, skilled interviewers/analysts, qualitative findings. Unstructured & Indirect Interviews Description: Blend of unstructured interviews with projective techniques to explore hidden feelings. Characteristics: Respondents freely interpret ambiguous scenarios, expensive, time-consuming, useful for deeper emotions. Interviewing Media Personal Interviews Conducted face-to-face. Advantages: Rich interaction, low non-response rates. Disadvantages: Expensive, response bias. Telephone Interviews Useful for quick and limited data collection. Advantages: Cost-effective, faster cooperation. Disadvantages: No body language, impersonation risks. Mail Interviews Conducted via postal or email. Advantages: Respondents can answer at convenience, anonymity. Disadvantages: High non-response rates, slower process. Focus Groups Description: Interactive discussions with 8-12 participants, moderated by an expert. Applications: Generating ideas, understanding consumer behavior, examining new concepts. Characteristics: Qualitative, indicative findings, requires recording/analysis, expensive. Panels Definition: Long-term studies involving a sample of individuals, households, or businesses. Types of Panels: Consumer Purchase Panels: Record product/brand purchase data. Advertising Audience Panels: Track media consumption. Dealer Panels: Audit inventory, sales, price data. Characteristics: Provide longitudinal data, analyze market trends, syndicated research, challenges like attrition. Comparison of Techniques Technique Best Use Advantages Disadvantages Structured Interviews Large-scale surveys Consistent, reliable data Limited flexibility. Unstructured Interviews Exploratory research In-depth insights High cost and time-consuming. Personal Interviews Detailed individual responses Rich data Expensive, potential bias. Telephone Interviews Quick, broad reach Cost-effective Misses body language. Mail Interviews Sensitive topics requiring anonymity Convenience and confidentiality High non-response rates. Focus Groups Idea generation and problem definition Interaction fosters spontaneous ideas Costly and labor-intensive. Panels Tracking trends over time Deep analysis and longitudinal data Risk of attrition and conditioning. Module 8: Project Formulation Project formulation is the systematic development of a project idea to arrive at an informed investment decision. Feasibility Analysis Definition: Evaluates all relevant factors of a project, including: Economic: Cost-benefit analysis, profitability. Technical: Assessment of technology, design, processes. Legal: Regulatory compliance. Scheduling: Timelines and resource availability. Objective: To ascertain the likelihood of successfully completing the project. Techno-Economic Analysis Focus Areas: Selection of optimal technology, planning and designing project layout, demand projection and forecasting. Project Design and Network Analysis Key Concepts: Projects divided into smaller activities, arranged in logical sequence. Network Analysis: Structured approach to planning and analyzing project activities. Network Analysis Definition: Visual representation (diagram) of project activities and milestones. Activities: Represented as arrows; consume time and resources. Milestones: Represented as nodes; denote significant points. Objectives: Logical connection of all activities, identification of critical and non-critical activities. Network Planning Techniques CPM (Critical Path Method): Deterministic activity durations. Focuses on identifying the critical path where delays affect project completion. PERT (Program Evaluation and Review Technique): Probabilistic activity durations. Considers three time estimates: Optimistic ($t_o$), Pessimistic ($t_p$), Most Likely ($t_m$). Expected Duration ($t_e$): $t_e = \frac{t_o + 4t_m + t_p}{6}$ Analysis of Inputs Steps: Identify required resources, estimate quantities, ensure availability at affordable prices. Financial Analysis Components: Estimation of project/operating costs, forecasting fund requirements, comparison of project proposals. Social Cost-Benefit Analysis Evaluates broader societal impacts: employment generation, industrialization benefits, contribution to overall societal well-being. Pre-Feasibility Analysis Focus Areas: Market potential, investment magnitude, technical/financial feasibility, risk analysis. Purpose: Helps stakeholders decide whether to proceed with a detailed feasibility study. Detailed Feasibility Study Goals: Comprehensive understanding, identification of challenges, project viability. Areas of Study: Technical, Managerial, Economic, Financial, Cultural, Political, Environmental Feasibility. Module 9: Stages of Project Formulation Feasibility Analysis: Evaluates economic, technical, legal, scheduling; assesses successful completion likelihood. Techno-Economic Analysis: Determines optimal technology, develops plans/designs, projects market demand. Project Design and Network Analysis: Breaks project into activities, arranges logically; uses CPM/PERT. Input Analysis: Identifies resource types, estimates quantities, evaluates availability/affordability. Financial Analysis: Estimates costs, assesses fund requirements, compares proposals. Social Cost-Benefit Analysis: Broadens focus to social benefits (employment, infrastructure); examines direct/indirect societal benefits. Pre-Investment Analysis: Assists stakeholders in deciding on project proposal. Project Report A project report is the final deliverable at the formulation stage and consists of two parts: Feasibility Report: Contents: Introduction, criteria/constraints, methodology, alternatives overview, evaluation/conclusions/recommendations. Detailed Project Report (DPR): Emphasis: Techno-economic aspects. Key Elements: Location/infrastructure, project volume/capacity, resource availability, product details, organization structure, technical know-how. Sections: Project at a glance, market report, technical details, plant/machinery, project schedule, organizational setup. Project Appraisal Purpose: Assess the project's desirability and viability. Stakeholders: Entrepreneurs (investment recovery), approving authorities (feasibility). Methods of Project Appraisal Payback Period: Time taken to recover initial investment. Simple but ignores time value of money. Average Rate of Return Method (ARR): Average annual profit as % of initial investment. Net Present Value (NPV): Calculates difference between present value of cash inflows and outflows. Considers time value of money. Benefit-Cost Ratio: Ratio of PV of benefits to PV of costs. Ratio greater than 1 indicates profitable project. Internal Rate of Return (IRR): Discount rate at which NPV is zero. Higher IRR indicates more attractive investment. Module 10: Project Appraisal (Detailed) Project appraisal evaluates a project's financial and economic prospects, ensuring informed decision-making. Key Concepts of Project Appraisal Discounted Cash Flow (DCF) Techniques: Purpose: Assess expected returns by considering time value of money. Types: Net Present Value (NPV), Internal Rate of Return (IRR). Net Present Value (NPV) Definition: Surplus of the present value of future cash inflows (revenues) over the present and future cash outflows (expenses and costs). Formula: $NPV = \sum \frac{P_t}{(1+r)^t} - \sum \frac{C_t}{(1+r)^t}$ $P_t$: Revenue inflows at time $t$. $C_t$: Cash outflows at time $t$. $r$: Discount rate (rate of return). $t$: Time period (1 to n, project lifespan). Key Features: Incorporates time value of money; comprehensive evaluation; positive NPV indicates profitable investment. Difficulties: Determining appropriate discount rate, limited comparability between projects of different sizes, potential hidden costs. Internal Rate of Return (IRR) Definition: Rate of return that discounts all cash flows of a project to a Net Present Value of zero. Formula: $0 = \sum \frac{P_t}{(1+IRR)^t} - \sum \frac{C_t}{(1+IRR)^t}$ $IRR$: Internal rate of return. $P_t$: Revenue inflows at time $t$. $C_t$: Cash outflows at time $t$. Decision Criteria: If $IRR > RRR$ (Required Rate of Return), proceed; if $IRR Key Features: Determines project's break-even rate, used to estimate profitability. Cash Flow Patterns Conventional Investment: One-time initial outflow followed by positive inflows. Non-Conventional Investment: Cash outflows occur at different times, redemption terms may vary. Comparison of NPV and IRR Feature NPV IRR Concept Surplus value of future inflows minus outflows. Rate at which NPV becomes zero. Decision Basis Positive NPV indicates viability. Compare IRR with RRR. Complexity Requires discount rate assumption. Requires solving nonlinear equations. Preferred When Comparing projects with different sizes. Evaluating profitability in percentage terms. Module 11: Project Appraisal (Risk and Uncertainty) Project appraisal minimizes risks and uncertainties associated with investment decisions in dynamic environments. Importance of Project Appraisal Macro-environmental factors: Economic, demographic, social, cultural, technological, political, legal conditions. Micro-environmental factors: Customer preferences, competitor activities, supplier services, internal environment. Uncertainty management: Identifying risk-prone events, calculating probabilities, incorporating into predictive models. Project Appraisal Methods Conservative Methods Shorter Payback Period: Prefers projects with shorter payback period; ensures quicker recovery. Risk-Adjusted Discount Rate: Adds risk premium to standard discount rate; accounts for project risks. Modern Quantitative Techniques Marketing Research: Primary Research: Data collected directly from consumers (focus groups, one-on-one interviews). Secondary Research: Data sourced from public sources, commercial databases, educational institutions. Operations Research: Also known as Decision Science. Uses mathematical methods to solve business problems. Involves: algorithms and statistics, optimization, simulation. Network Analysis: Depicts interrelationships among project activities. Aids in monitoring and timely project completion. Methods: PERT (probabilistic time estimates), CPM (deterministic time estimates). Ratio Analysis: Evaluates financial health and performance. Examples: Liquidity, Solvency, Profitability, Efficiency, Market Prospect Ratios. Other Techniques for Risk Analysis Sensitivity Analysis: Studies impact of variable changes on project outcomes. Probability Analysis: Calculates likelihood of various outcomes. Decision Tree: Visualizes decision paths, risks, and outcomes for complex problems. Key Risk Factors in Project Appraisal Obsolescence: Product/process may become outdated. Demand Decline: Reduced customer interest or market contraction. Policy Changes: Government regulations affecting operations. Price Fluctuations: Variations in input or output prices. Foreign Exchange Restrictions: Barriers to international financial transactions. Inflationary Pressures: Erosion of purchasing power. Module 12: Financial Analysis of a Project Financial analysis evaluates projected costs, revenues, and overall financial health. Key Elements of Financial Analysis Projected Capital Cost Estimates: Advance expenditure, plant/machinery, spares, freight/insurance, taxes/duties, installation charges, other overheads, land/buildings, premises. Projected Operating Cost Estimates: Raw material, labor, energy, plant maintenance, supervision/administrative, depreciation, interest on borrowings. Projected Revenue Estimates: Gross Revenue: Total sales before deductions. Net Revenue: Gross revenue minus sales returns, allowances, discounts. Gross Margin: Net revenue minus Cost of Goods Sold (COGS). EBIT (Earnings Before Interest and Tax): Gross margin minus operating expenses. Profit Before Tax (PBT): EBIT minus interest. Profit After Tax (PAT): PBT minus taxes. Retained Earnings: PAT minus dividends. Key Financial Metrics Gross Revenue: Total sales, influenced by projected demand, sale price, market research. Net Revenue: Formula: $Net Revenue = Gross Revenue - (Sales Returns + Allowances + Discounts)$ Cost of Goods Sold (COGS): Includes: Raw materials, labor, energy, supervision, depreciation. Gross Margin & EBIT: Gross Margin Formula: $Gross Margin = Net Revenue - COGS$ EBIT Formula: $EBIT = Gross Margin - (Selling Expenses + General Expenses)$ Profit and Retained Earnings: PBT Formula: $PBT = EBIT - Interest$ PAT Formula: $PAT = PBT - Income Tax$ Retained Earnings Formula: $Retained Earnings = PAT - Dividends$ Proforma Balance Sheet Forecasts financial health based on projected estimates. Key Components: Assets: Current Assets: Cash, bank balances, inventories, prepaid expenses. Fixed Assets: Land, buildings, plant, machinery. Formula: $Total Assets = Fixed Assets + Current Assets$ Liabilities: Current Liabilities: Sundry creditors, taxes payable, proposed dividends. Long-term Liabilities: Loans and retained earnings. Formula: $Total Liabilities = Current Liabilities + Capital Stock + Total Debts + Reserves$ Balance Sheet Equation: $Total Assets = Total Liabilities$ Module 13: Project Finance Project finance involves determining capital required and sources of funding. Key Issues in Project Finance Capital Required (Fixed Assets Capitalization): Funding for purchasing and maintaining fixed assets. Capital Structure (Composition of Capital): Balancing debt and equity to minimize cost of capital and maximize owner returns. Project Funds Fixed Capital: Funds for purchasing fixed assets (plant/machinery, buildings, fixtures/furniture). Working Capital: Funds for day-to-day operations (cash, bank balances, accounts receivable, inventory, advances to suppliers). Factors Influencing Fixed Capital Needs Nature and size of business, availability of leasing arrangements, ancillary units, technology level, provision of subcontracts, economic/international business conditions. Sources of Finance for Fixed Assets Equity and Preference Shares: Ownership funding. Borrowing: From public, debentures. Loans: Term loans (10-25 years), development loans, capital subsidies. Retained Earnings: Profits reinvested. Lease Financing: Renting assets. Deferred Credit: Payment for assets deferred. Unsecured Loans and Deposits: Funding without collateral. Working Capital Definition: Capital needed for day-to-day operations. Formula: $Net Working Capital = Current Assets - Current Liabilities$ Components: Cash and bank balances, accounts receivable, inventory, advances paid to suppliers. Current Assets: Items convertible to liquid cash within a year (cash, inventory). Debt-Equity Ratio Definition: Measure of company's financial leverage. Formula: $Debt-to-Equity Ratio = \frac{Total Liabilities}{Shareholders' Equity}$ Purpose: Assesses balance between debt and equity, reflects ability to meet obligations. Term Loans for Fixed Capital Repayment period: 10-25 years. Features: Fixed interest rates, shared risk, possible nominee director. Module 14: Working Capital Working capital is the difference between current assets and current liabilities, measuring short-term financial health. Formula: $Working Capital = Current Assets - Current Liabilities$ Components: Current Assets: Cash & Bank Balances, Bills Receivable, Inventory (raw materials, work in progress, finished goods). Current Liabilities: Creditors, Bills Payable. Working Capital Management Estimating Working Capital Requirements: Determining capital needed for operations. Procuring Funds: Ensuring availability of adequate funds. Factors Determining Working Capital Requirements Operating Cycle: Time for cash to convert back to cash. Long cycle $\to$ more working capital. Sales Volume: Higher sales $\to$ more working capital. Seasonality: Peak season $\to$ shorter cash-to-cash cycle, less working capital. Off season $\to$ longer cycle, more working capital. Cyclical Factors: Economic cycles impact working capital. Nature of Business: Manufacturing businesses often require more working capital. Credit Terms: Flexible credit to customers increases working capital; credit from suppliers reduces it. Inventory Turnover: Faster turnover reduces working capital. Technology: Advanced technology can streamline operations, reducing production time. Contingency Plans: Provisions for emergencies impact estimations. Factors Involved in Estimating Working Capital Cost of buying raw materials. Average time to process raw materials. Length of production cycle. Credit extended to buyers and enjoyed from suppliers. Wage payment schedules. Impact of Bulk Raw Material Purchases Buying in bulk with discounts reduces working capital. Restricting raw material budgets can strain operations. Sources of Funds for Working Capital Borrowings: From banks and financial institutions (bank credit, short-term loans). Supplier Credit: Extended credit periods reduce immediate working capital needs. Unsecured Non-Bank Sources: Private loans, interest-free advances. Factoring: Selling accounts receivables to a "factor" at a discount for instant cash. Inter-Company Deposits: Short-term deposits made by one company into another. Insurance Companies: Short-term loans. Factoring Definition: Process where accounts receivables are sold to a third party (factor) at a discount. Purpose: Provides immediate cash flow. Module 15: Human Resource Management HRM is critical in understanding and managing human behavior within organizations. Variables of Human Behaviour Biographical Characteristics: Attributes such as age, gender. Ability Criteria: Capabilities required for a job (intelligence, aptitude). Job Performance Parameters Employee Productivity: Efficiency in achieving targets. Absenteeism: Unauthorized absence from work (avoidable, unavoidable). Employee Turnover: Rate at which employees leave. Employee Loyalty: Commitment toward organization. Job Satisfaction: Employee contentment. Age and Job Performance Factors in Favor of Age: Experience, higher commitment, better judgment, ethical approach, less supervision, good trainer. Factors Against Age: More risk aversion, less flexibility, resistance to new technology. Impact of Age on Performance: Productivity: No proven correlation. Absenteeism: Avoidable (inverse relation), Unavoidable (direct relation). Turnover: Inversely related to age. Gender and Job Performance Gender vs Absenteeism: Women often exhibit higher absenteeism (domestic responsibilities). Gender vs Employee Turnover: In India, women more likely to leave jobs for family roles. Module 16: Human Resource Management II This module delves into human abilities and their critical role in organizational success. Human Ability Definition: Capacity of an individual to perform a given task. Significance: Key variable influencing human behavior and job performance. Relevance for Entrepreneurs: Ensures hiring the right people with abilities suited for specific roles. Types of Abilities Intellectual Ability: Necessary for mental tasks (thinking, reasoning, problem-solving). Physical Ability: Attributes required for physical tasks (strength, coordination, stamina). Intellectual Abilities (7 Dimensions) Numerical Ability: Capacity to work with numbers. Verbal Comprehension: Understanding spoken messages. Perceptual Speed: Quickly and accurately recognizing similarities and differences. Inductive Reasoning: Predicting future outcomes based on past trends. Deductive Reasoning: Logical thinking to uncover underlying reasons. Spatial Visualization: Imagining and manipulating objects in 3D. Memory: Retaining and recalling knowledge. Intelligence Quotient (IQ) Definition: Measure of relative intelligence in performing intellectual tasks. Formula: $IQ = \frac{Mental Age}{Chronological Age} \times 100$ Significance: High IQ necessary for intellectually demanding jobs, but not all roles require it. Types of Intelligence Cognitive Intelligence: Mental abilities like problem-solving, analytical reasoning, decision-making. Social Intelligence: Ability to interact effectively and work collaboratively. Emotional Intelligence (EI): Understanding and managing emotions (measured as EQ). Cultural Intelligence: Awareness of cultural differences and effective functioning in cross-cultural situations. Importance of Intelligence for Entrepreneurs Task Alignment: Matches individuals with right jobs. Efficiency: Ensures effective task performance and adaptability. Team Dynamics: Supports cohesive, collaborative, innovative teams. Cross-Cultural Success: Navigates diverse and global work environments. Module 17: Leadership Leadership is critical for managing human resources. Leadership and its Importance Definition of a Leader: Someone who "knows the way, shows the way, goes the way." Key Insights: Entrepreneurs must act as first leaders; leadership essential for navigating challenges. Leader vs. Manager Leader Manager Evolves naturally. Appointed formally. Has followers. Has subordinates. Followers choose their leader. Subordinates do not choose their manager. Operates based on a vision. Operates with targets. Enjoys informal power. Enjoys formal authority. Functions in unstructured environments. Works in structured environments. Found in all spheres of life. Primarily found in organizations. Personality and Leadership Personality: Derived from "Persona" (mask); represents unique traits. Leadership Traits: Ambition/Energy, Desire to Lead, Honesty/Integrity, Self-Confidence, Intelligence, High Self-Monitoring, Job-Relevant Knowledge. The Big Five Model of Personality Traits Extraversion: Ability to communicate effectively, skills in interactions, inspires through public speaking. Agreeableness: Warm, friendly, cooperative nature; builds trust. Conscientiousness: Responsible, organized, hardworking, adheres to norms, goal-oriented. Emotional Stability: Maintains composure, exhibits self-confidence, manages mental turbulence. Openness to Experience: Creativity, innovation, willingness to experiment, open to learning, sensitive/adaptable. Module 18: Leadership II This module covers leadership theories. 1. Trait Theories Focus on identifying inherent traits distinguishing effective leaders. 2. Behavioural Theories Emphasize specific behaviors that can be observed/learned. Behavioural Theories of Leadership Ohio State University Studies: Used Leader Behaviour Description Questionnaire (LBDQ). Identified two dimensions: Initiating Structure (task orientation), Consideration (people orientation). Michigan State University Studies: Findings aligned with Ohio State. Identified two dimensions: Production Orientation (task focus), Employee Orientation (employee needs focus). Managerial Grid (Blake & Mouton): Concern for Results HIGH Concern for People HIGH LOW Country Club Management (1,9) Team Management (9,9) Impoverished Management (1,1) Authority-Compliance Management (9,1) Middle of the Road Management (5,5) Managerial Grid by Blake and Mouton (1964) Evaluates leadership styles based on concern for people (Y-axis) and concern for production (X-axis). Fiedler's Contingency Model of Leadership Emphasizes that effective leadership depends on a match between leader's style and situational demands. Assumptions: Leadership style is fixed; situational favorableness determines leader influence. LPC Questionnaire Least Preferred Co-worker (LPC) Questionnaire: Tool to identify leader's style (relationship-oriented vs. task-oriented). High LPC score: Relationship-oriented leader. Low LPC score: Task-oriented leader. Description of Fiedler's Contingency Model Three situational factors determine leader's control: Leader-Member Relations: Level of trust, respect, confidence between leader and team. Task Structure: Extent to which task is clearly defined. Position Power: Authority granted to the leader. Findings of Fiedler's Contingency Model Task-oriented leaders (Low LPC) perform best in highly favorable or highly unfavorable situations. Relationship-oriented leaders (High LPC) perform best in moderately favorable situations. Representation of Fiedler's Contingency Model (Tabular) Situation Characteristics Leader-Member Relations Task Structure Position Power Favorableness of the Situation Effective Leadership Style 1. Very Favorable Good High Strong Highly Favorable Task-Oriented (Low LPC) 2. Moderately Favorable (High Control) Good High Weak Moderately Favorable Relationship-Oriented (High LPC) 3. Moderately Favorable (Low Control) Good Low Strong Moderately Favorable Relationship-Oriented (High LPC) 4. Very Unfavorable Poor Low Weak Highly Unfavorable Task-Oriented (Low LPC) Key Insights Favorable situations: Task-oriented leaders excel due to focus on goals, strong support, structured tasks. Moderately favorable situations: Relationship-oriented leaders excel by building trust, cohesion. Unfavorable situations: Task-oriented leaders are effective due to emphasis on direction, task completion. Module 19: Leadership Models Hersey & Blanchard Situational Leadership Model Leadership effectiveness depends on adapting style to follower maturity. Key Components: Leadership Styles: Telling (High Task, Low Relationship), Selling (High Task, High Relationship), Participating (Low Task, High Relationship), Delegating (Low Task, Low Relationship). Follower Maturity: Defined by ability and willingness to complete a task. Leader-Member Exchange (LMX) Model Emphasizes quality of leader-subordinate relationship; forms "in-groups" and "out-groups." Key Components: In-Group: Close, trusted relationship with leader; more responsibility, autonomy, resources. Out-Group: Formal, distant relationship; routine tasks, limited decision power. Stages of Relationship Development: Role-Taking, Role-Making, Routinization. Path-Goal Theory Focuses on how leaders motivate followers by clarifying path, removing obstacles, providing support. Key Components: Leadership Styles: Directive, Supportive, Participative, Achievement-Oriented. Follower and Task Characteristics: Leaders adapt based on follower ability/experience and task structure. Motivational Mechanisms: Leaders motivate by clarifying path, reducing roadblocks, offering aligned rewards. Comparison of the Models Aspect Hersey & Blanchard LMX Model Path-Goal Theory Focus Leader adapts to follower maturity Quality of leader-subordinate relationship Leader's role in motivating followers Core Idea Leadership style depends on follower readiness In-groups and out-groups affect dynamics Leadership style influences motivation Key Strength Flexibility and adaptability Emphasizes fairness and relationships Focus on motivation and goal clarity Leadership Styles Telling, Selling, Participating, Delegating Not defined; relationship-based Directive, Supportive, Participative, Achievement-Oriented Module 20: Statutory Provisions I (Factories Act, 1948) Objectives Consolidate and amend law regulating workers in factories. Regulate working conditions. Ensure basic health, safety, welfare requirements are provided. Important Definitions Factory: Premises where manufacturing process is carried on with/without power, employing 10/20+ workers. Adult: Completed 18 years of age. Adolescent: Completed 15 but not 18 years of age. Child: Not completed 15 years of age. Calendar Year: 12 months starting Jan 1. Worker: Person employed in manufacturing process, cleaning, or related work. Chief Inspector of Factories Government functionary empowered to visit factories, enforce provisions, impose penalties. Health & Hygiene of Factory Workers (Sections 11-20) Cleanliness (S11): Clean, free from effluents, no dust, floors cleaned weekly, walls repainted every 3 years. Disposal of wastes and effluents (S12): State governments to make rules for effective disposal, pollution control boards ensure treatment. Ventilation and temperature (S13): Adequate fresh air, comfortable room temperature. Dust and fumes (S14): Exhaust appliances near origin, exhaust fans to prevent discomfort. Artificial humidification (S15): Humidity artificially controlled, state governments set standards. Overcrowding (S16): No overcrowded rooms, $\ge 9.9 m^3$ per worker (old factories), $\ge 14.2 m^3$ per worker (new factories). Lighting (S17): Sufficient natural/artificial lighting, state governments set standards. Drinking water (S18): Sufficient supply of purified water, marked points 6m from washing places, cold water for 250+ workers. Latrines and urinals (S19): Separate, enclosed, well-lit, ventilated, sanitary facilities for male/female workers; prescribed standards for 250+ workers. Spittoons (S20): Sufficient number, maintained clean; spitting outside designated areas punishable. Module 21: Statutory Provisions II (Factories Act, 1948) Safety Provisions (Sections 21-41) Fencing of machinery - S21 Employment of young persons on dangerous machines - S23 Striking gear and devices for cutting off power - S24 Self-acting machines - S25 Casing of new machinery - S26 Prohibition of employment of women and children near cotton openers - S27 Hoists and lifts - S28 Lifting machines, chains, ropes, and lifting tackles - S29 Revolving machinery - S30 Pressure plant - S31 Floors, stairs, and means of access - S32 Pits, sumps, and openings in the floor - S33 Excessive weights - S34 Protection of eyes - S35 Precautions against dangerous fumes, gases, etc. - S36 Use of portable electric light - S36A Explosive or inflammable dust, gas, etc. - S37 Precautions in case of fire - S38 Power to require specifications of defective parts or tests of stability - S39 Safety of buildings and machinery - S40 Maintenance of buildings - S40A Safety officer - S40B Important Provisions of Safety Employment of young persons on dangerous machines (S23): Young persons must be fully instructed on risks before working. Prohibition of employment of women and children near cotton openers (S27): Not to be employed in areas where cotton openers are in operation. Safety Officers (S40B): Factories with 1,000+ workers or risky operations must employ safety officers as prescribed by state government. Welfare Provisions (Sections 42-50) Washing facilities - S42 Facilities for storing and drying clothing - S43 Facilities for sitting - S44 First aid appliances - S45 Canteens - S46 Shelters, restrooms, and lunchrooms - S47 Crèches - S48 Welfare officers - S49 Important Provisions of Welfare Canteens (S46): Factories with 250+ workers must provide a canteen; state government prescribes standards. Crèches (S48): Factories employing 30+ women must provide suitable rooms for children under 6; state government sets standards. Welfare Officers (S49): Factories with 500+ workers must employ welfare officers; duties, qualifications, conditions determined by state government.