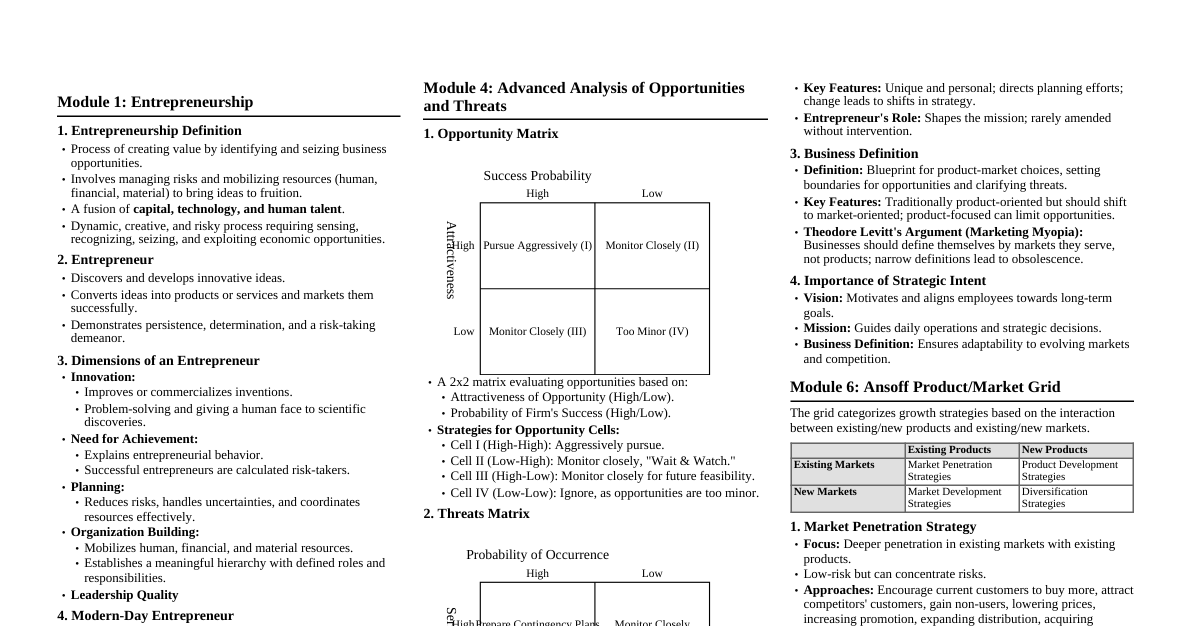

Entrepreneurship Fundamentals Definition: A process to create value through recognition of business opportunity, management of risk-taking, and mobilization of human, financial, and material resources needed to bring a project to fruition. Entrepreneur: One who discovers innovative ideas, develops these into products/services, markets them successfully, and nurtures the business persistently with untiring spirit. Concept of Entrepreneurship: Involves fusion of capital, technology, and human talent. It's a dynamic, risky, creative, and innovative process requiring a flair for sensing and exploiting economic opportunities. Dimensions of an Entrepreneur Innovation: Improvisation & improvement, distinct from invention (scientific discovery). Innovation gives a human face to invention, involving problem-solving and commercialization. Need for Achievement: A higher-level human need and a relevant factor for entrepreneurial behavior. People with a high need for achievement can succeed as entrepreneurs and are calculated risk-takers. Planning Capability: Necessary for mitigating risk, handling uncertainties, coordinating numerous resources, and forecasting beyond a certain point. Organization Building Ability: Mobilization of Human, Financial, and Material Resources; building formal hierarchical structures; defining roles and responsibilities; and clarifying relationships. Leadership Quality: The ability to lead and guide. Modern Day Entrepreneur Roles Visionary leader Organization Builder Excellent Manager Capable Administrator Manager vs. Business Leader Manager Business Leader Revenue Earner Earns Profits Enjoys formal authority Creator of wealth and assets Normally takes role for granted Leader of people Works with existing resources High Achiever Cannot make sweeping changes Great Motivator Roles are well defined with boundaries Role Model Exploring Marketing Opportunities Scanning the external environment. Business opportunities arise from changes in the external environment. Identify macro-environmental factors that affect business. Spot Marketing Opportunities by analyzing the dynamic nature of macro-environmental factors. Macro-Environmental Factors Demographic Factors: Age, age groups (pre-teens, teenagers, young adults), generations, gender, income & income distribution, family composition & size, occupation, education levels, population density, population distribution & migration. Economic Factors: Goal to create & manage demand, demand (needs/wants backed by purchasing power), purchasing power, personal disposable income, inflationary trends, employment indicators, market rate of interest, overall state of the economy. Technological Factors: Growth of technology, technology growth from advances in computing/internet/telecom, emergence of new & advanced technology, technology driving service sector growth, rate of adoption, thrust on R&D, rate of obsolescence, shrinking life spans of technologies/products, innovative approach. Political Factors: Political stability, government approach towards businesses, government infrastructure creation (roads, ports, power plants, etc.), government control of factors of production, clearances & licenses, aid to start-ups, regulatory mechanisms, subsidies, taxation policies. Legal Factors: Government laws, business laws (company & business practices), corporate laws, labor laws, laws to protect rights of consumers/companies/stakeholders. Social Factors: Social class segmentation (upper, middle, lower), differing purchasing power and preferences across classes. Cultural Factors: A mixed basket; unique combination of values & ethics, customs & traditions, rituals & festivals, history & heritage, language & literature. Dynamic nature, slow cultural shifts, core cultural values, globalization & localization. Environmental Scanning Macro-environmental factors: Political, Legal, Social, Cultural, Demographic, Economic, Technological. Micro-environmental factors: Customers, Competitors, Suppliers, Internal stakeholders, firm's internal environment. Environmental Scanning helps identify Opportunities & Threats. SWOT Analysis Strengths (S): Internal Analysis Weaknesses (W): Internal Analysis Opportunities (O): Environment Scanning Threats (T): Environment Scanning Internal Analysis Parameters Market share Customer satisfaction levels Product Quality Service Quality Price effectiveness Distribution effectiveness Promotion effectiveness Selling effectiveness Intensity of coverage of distribution Innovativeness Benchmarking Technique for Internal Analysis. Compares firm's business processes & performance metrics to industry best practices from competitors. Aims to understand the firm's standing relative to competitors on internal analysis parameters. Opportunity Matrix A $2 \times 2$ matrix using two dimensions: Attractiveness of Opportunity and Probability of the firm's success. Each dimension is sub-divided into High and Low, creating four scenarios (cells). Probability of Success $\downarrow$ Attractiveness of Opportunity $\downarrow$ High Probability of Success Low Probability of Success High in Attractiveness Pursue Aggressively (I) Monitor Closely (III) Low in Attractiveness Monitor Closely (II) Too Minor to Consider (IV) Strategies for Opportunity Matrix Cells: Cell I (High Attractiveness, High Success Probability): Firm should aggressively pursue these opportunities. Cell II (Low Attractiveness, High Success Probability): Firm should wait and watch, monitoring closely for improved attractiveness. Cell III (High Attractiveness, Low Success Probability): Firm should monitor closely to see if chances of success can be improved. Cell IV (Low Attractiveness, Low Success Probability): These opportunities may be ignored as too minor to consider. Examples of Opportunities New segments, new markets to serve Adoption of a new technology Product line extension possibilities Leveraging existing skills to enter new business/markets/segments Internet marketing possibilities Forward & backward integration Falling trade barriers in foreign markets Weak rivals Growing demand Acquisition of rival firms with attractive products/markets/technologies Alliances / Joint Ventures that expand market coverage or boost competitive capability Threats Matrix Similar to the Opportunity Matrix, but for threats, considering their seriousness and probability of occurrence. Probability of Occurrence $\downarrow$ Seriousness $\downarrow$ High Low High Prepare Contingency Plans (I) Monitor Closely (II) Low Monitor Closely (III) Ignore (IV) Strategies for Threats Matrix Cells: Cell I (High Seriousness, High Occurrence Probability): Prepare contingency plans. Cell II (High Seriousness, Low Occurrence Probability): Monitor closely. Cell III (Low Seriousness, High Occurrence Probability): Monitor closely. Cell IV (Low Seriousness, Low Occurrence Probability): Ignore (too minor). Examples of Threats Major breakthrough in technology that threatens the firm's business model. Adverse government legislation. Powerful competitor enters the industry. Discernible and abrupt shift in consumer tastes. Natural calamity with devastating impact on business. Substitute product or service appears on the market. Industry & Internal Analysis Internal Analysis identifies firm's own Strengths & Weaknesses. Industry Analysis understands firm's strengths & weaknesses relative to competitors. Local, Regional, National or International Benchmarking helps identify best practices. Benchmarking indicates areas of weaknesses. Examples of Strengths Low-cost manufacturing capabilities, technological know-how. Expertise in consistent customer service, unique advertisement/promotional talent. Proven record of defect-free manufacturing, state-of-the-art plant & equipment. Attractive real estate locations, strong distribution network. Access to valuable raw materials, up-to-date information systems, deep resources. Experienced, young & talented, motivated workforce. Intellectual capital, valuable team-spirit, vast collective knowledge. Proven Quality Control systems, patents, large base of loyal customers. Strong balance sheet, high credit rating, brand-name image. Company reputation/goodwill, committed/dedicated workforce. Expertise in new product development, vibrant & effective R&D team. Highly-trained customer service representatives, sound partnership with dealers & suppliers. Organizational agility in responding to changing market conditions, on-line business skills. Examples of Weaknesses No clear strategic direction, obsolete facilities. Too much debt, high unit cost, lack of necessary skills. Internal operating problems, narrow product line. Weak brand image, poor company reputation. Business Classification (Risks vs. Returns) Risks $\downarrow$ Returns $\downarrow$ High Low High Speculative Business Ideal Business Low Troubled Business Mature Business Strategic Intent An avenue from which the entrepreneur can seek to derive business growth and marketing opportunities. Components: Vision: The dream of the entrepreneur; an inspirational picture of the future. Offers clarity, hope, unity of purpose. A vivid description of what a company dreams to be. Values are essential ingredients. Timeless, unchanging core values define enduring character. Requires a quantum effort. Fundamental reason for existence beyond making money. Enables firm to stay focused. Must be shared, owned, and lived by every individual. Shared values unite different businesses. Mission: What the company is and why it exists. An expression of growth ambition. A proclamation to insiders & outsiders. Abstract, romantic, full of zeal. Not time-bound like a strategy. Unique & personal. Directs entire planning endeavor. A change in mission leads to a change in direction, plans & strategies. Entrepreneur plays a major role in shaping it. Can be called creed, policy, company purpose. Should be revised if relevance is lost over time. Business Definition: Provides the blueprint for the firm's product-market choice. Clarifies opportunities and threats. Traditionally product-oriented, but market definitions are superior (Theodore Levitt's "Marketing Myopia"). Product-oriented definitions foreclose wider search for opportunities and hide latent competition. Exploring Growth Options: Ansoff Product/Market Grid Developed by H. Igor Ansoff, published in Harvard Business Review in 1957. Markets $\downarrow$ / Products $\rightarrow$ Existing Products New Products Existing Markets Market Penetration Strategies Product Development Strategies New Markets Market Development Strategies Diversification Strategies Intensive Growth Strategies Market Penetration Strategy: Achieve growth through deeper penetration in existing markets with existing products. Low-risk strategy, firms do what they do best. Concentrates risks. Encourage current customers to buy more, attract competitors' customers, encourage non-users, decrease prices, increase promotion/distribution, acquire competitors. Appropriate if: industry resistant to major technological advancements, demand stable, target markets not saturated, strong entry barriers. Market Development Strategy: Grow by finding new uses & new users, hence new markets for existing products. Tap new distribution channels, bring cosmetic changes to products. Approaches: Add new segments/customer groups, seek additional distribution channels, seek different geographical markets, enter new domestic/foreign markets. Appropriate if: firm owns proprietary technology, potential consumers are profitable, consumer behavior does not deviate too far. Product Development Strategy: Achieve growth in existing markets through new products. New products are intrinsically new or improved versions/substitutes. Usually carried out through: Quality improvement (stronger, bigger, better), Feature improvement (safety, convenience, weight, material), Style improvement (new models). Implemented by: Investing in R&D, acquiring competitors' products, strategic partnerships. Diversification Strategies Firm enters a new market with a new product. Most risky among growth strategies. Requires both market development and product development. Risk can be mitigated through related diversification. Offers greatest potential for increased revenues by opening new revenue streams. Market Survey Techniques Types of Interviews: Structured & Direct Interviews: Most common, formal questionnaire, open/closed-ended questions, dichotomous/multiple choice, scales for responses, pretested, simple/unambiguous words. Field interviewers recruited & trained, appropriate for large samples, no high-skilled interviewers needed, no interviewer freedom to deviate. Interviewer records responses, followed by data tabulation, compilation, analysis, and report writing. Unstructured & Direct Interviews: Mostly used in Exploratory Research (little understanding of problem). General instructions given to interviewer, plenty of interviewer freedom. Respondent can be an expert, open-ended questions. Interviews may be recorded with permission. Skilled interviewers needed, in-depth probing ("Depth Interviews"). Interview lasts long, high cost per interview, not many can be conducted, not suited for large samples. Findings are indicative & qualitative. Indirect Interviews (Projective Techniques): Partially structured & unstructured format. Employed when direct questioning won't reveal hidden/subconscious motives. Employ principle of "Projection." Respondent describes ambiguous situations (picture, incomplete sentence) in their own way. Respondent interprets situation in terms of needs, emotions, attitudes, motives & values. Specialist interviewers & analysts needed, time-consuming and costly. Findings are qualitative & indicative. Interviewing Media: Personal Interview: Conducted at respondent's home/office/store. Opportunity for more & better information (face-to-face). Low non-response but high response bias. Better samples. More expensive. Telephone Interview: Useful for limited information, quick & inexpensive. Not used for indirect interviews. Easier to get cooperation. Impersonation risk. Body language missed, but voice intonations observed. Short duration, inexpensive, wide reach. Mail Interviews: Use postal mail or email. Respondent can answer at leisure. Quality of responses improve. Respondent can remain anonymous, revealing confidential information. High non-response rate. Requires long time. Bias introduced if only strongly-feeling respondents reply. Focus Group Conducted by trained moderator with 8-12 recruited participants with common background. Fosters interaction leading to spontaneous disclosure of attitudes, opinions, emotions & buying behavior. Lasts 2 hours with video-recording. Used to define problems, provide background, generate ideas (not solutions). Qualitative research technique, findings indicative. Costly, time-consuming, needs expert moderator & analyst. Applications: examining new concepts, improving products, finding unmet needs, creative inputs for advertising, profiling "opinion leaders." Can include specialist participants. Panels Sample of individuals/households/outlets/firms scattered geographically. Set up by MR agencies. Members give repetitive information on purchases of products/services. Can be: Consumer Purchase Panels, Advertising Audience Panels, Dealer Panels. Consumer Panels record purchase data in "diaries." Ad audience panels record viewership/listenership/readership data. TRP measures use panels with people-meter. Dealer Panels provide retail audit data (inventory, sales, prices). Form of syndicated research, sponsored by multiple clients. Provide longitudinal data. Repeated collection permits deeper analysis & tracking of market trends. Permits before-and-after analysis of intervening events (ad campaigns, promotions). Provides insight into brand-switching behavior. Can "condition" buying behavior. Attrition is a common problem. Project Formulation Systematic development of a Project Idea for the eventual objective of arriving at an Investment Decision. Stages of Project Formulation: Feasibility Analysis Techno – Economic Analysis Project Design and Network Analysis Input Analysis Financial Analysis Social Cost Benefit Analysis Pre Investment Analysis Feasibility Analysis An analysis that takes all of a project's relevant factors into account (economic, technical, legal, scheduling) to ascertain the likelihood of completing the project successfully. Techno Economic Analysis Analysis of choice of Optimal technology, Plan Design, and Projection of demand. Project Design and Network Analysis Projects are broken down into simple activities, arranged in logical sequence. Network Analysis is a system that plans both large and small projects and analyzes project activities. Network is a diagram depicting all activities (arrows) and milestones (nodes) from start to completion. Activities can be undertaken concurrently and sequentially. Each activity consumes time and resources. Network diagram connects all activities logically. Network Planning Objective: Find the shortest duration path through the network to complete all project activities. Some critical activities cannot be delayed without delaying project completion. Techniques: CPM (Critical Path Method): Activity durations are deterministic. PERT (Program Evaluation & Review Technique): Activity durations are probabilistic. For PERT, 3 time duration estimates are considered for each activity: Pessimistic time duration ($t_p$) Optimistic time duration ($t_o$) Most likely time duration ($t_m$) The Expected duration ($t_e$) is calculated as follows: $t_e = (t_o + 4t_m + t_p) / 6$ Analysis of Inputs Identification of the nature of resources involved. Estimation of the quantum of those resources required at different stages. Evaluation of the possibility of continued supply of such resources at affordable prices. Financial Analysis Outflow of cost and inflow of revenues. Involves estimation of project costs, operating costs, and fund requirements. Helps compare various project proposals on a common scale. Social Cost Benefit Analysis Broader outlook beyond profitability and cost benefits. Should generate employment, infrastructure & civic amenities for local people. Examines benefits accruing to society at large, directly or indirectly. Pre – Feasibility Analysis Lays stress on assessing Market Potential, Magnitude of Investment, Technical Feasibility, Financial Analysis, and Risk Analysis. Helps project sponsoring body, implementing body, and consulting agencies accept the proposal. Detailed Feasibility Study Goals Understand thoroughly all aspects of a project, concept, or plan. Become aware of potential problems. Determine if the project is viable (worth undertaking). Areas of Detailed Feasibility Study: Technical Feasibility Managerial Feasibility Economic Feasibility Financial Feasibility Cultural Feasibility Political Feasibility Environmental Feasibility Project Report Comprises 2 parts: Feasibility Report and Detailed Project Report. Important features of Feasibility Report: Introduction, Criteria/constraints, Methods. Overview of Alternative Options, Evaluation, Conclusions, Recommendations. Detailed Project Report (DPR): Emphasizes techno-economic aspects like: Location of plant, infrastructure, Volume of project, Capacity installed. Availability of resources, Details of product(s), sizes and capacity. Organisation, Technical knowhow. Project at a glance, Market Report, Technical Details (processes, plant layout). Plant & Machinery and Other Equipment, Project Schedule, Organisation. Project Appraisal Assesses how soon the entrepreneur can recover investment. Approving authorities (Govt. Agencies, Financial Institutions) assess desirability/viability. A project is appraised to minimize risk and uncertainty. Project decisions made amid uncertainty and turbulence in external environment. Macro-environmental factors (economic, demographic, social, cultural, technological, political, legal) are ever-changing. Micro-environmental factors (customer preferences, competitor moves, supplier services, internal environment) keep changing. Uncertainty and risk inject into investment decision. Essential to identify risk-prone events, probabilities of occurrence, and provision in prediction model. Project Appraisal Methods Conservative Methods: Shorter Payback Period: Selects project with shorter payback period to recover investment quickly. Risk Adjusted Discount Rate: Entrepreneur adds premium for risk over acceptable return. Modern Quantitative Techniques: Marketing Research: Primary: Collect data from end consumers (focus groups, one-to-one interviews). Secondary: Collect data from internet, government agencies, media, chambers of commerce (public, commercial sources, educational institutions). Operations Research (Decision Science): Applying mathematics to business questions for optimal solutions. Algorithms and Statistics Optimization Simulation Network Analysis: Setting up a network diagram depicting interrelationships between activities. PERT (Program Evaluation and Review Technique) CPM (Critical Path Method) Ratio Analysis: Quantitative method to gain insight into liquidity, operational efficiency, profitability by studying financial statements (balance sheet, income statement). Liquidity Ratios, Solvency Ratios, Profitability Ratios, Efficiency Ratios, Market Prospect Ratios. Other Risk Analysis Techniques: Sensitivity analysis Probability analysis Decision tree Factors Adding to Risk: Process or product becoming obsolete. Declining demand. Change in government policy. Price fluctuations. Foreign exchange restrictions. Inflationary tendencies. Net Present Value Method (NPV) Value of all future cash flows (positive and negative). Surplus of present value of future cash inflows over present and future cash outflows. Takes into account revenues, expenses, capital costs (Free Cash Flow - FCF). Advantages: Accounts for time value of money, comprehensive tool for evaluating future revenue/cash outlays, gives realistic picture, powerful for decision-making. Disadvantages: No set guidelines for Required Rate of Return, difficult to compare projects of different sizes, hidden costs, no method for selecting discounting rate. For conventional project (one-time investment at base period): $$ NPV = \sum_{t=1}^{n} \frac{P_t}{(1+r)^t} - C_0 $$ where $P_t$ are revenue inflows in period $t$, $r$ is rate of return, $C_0$ is cash outflow in period 0. For non-conventional investment: $$ NPV = \sum \frac{P_t}{(1+r)^t} - \sum \frac{C_t}{(1+r)^t} $$ where $P_t$ are revenue inflows, $C_t$ are cash outflows over $t$ periods, $r$ is rate of return, $n$ is life of project. Internal Rate of Return (IRR) Rate of return which, when used for discounting, reduces the net present value of an investment to zero. Equates aggregate discounted benefits with aggregate discounted costs. Metric used to estimate profitability of potential investments. Formula: $$ 0 = P_0 + \frac{P_1}{(1+IRR)} + \frac{P_2}{(1+IRR)^2} + \dots + \frac{P_n}{(1+IRR)^n} $$ where $P_0$ is initial investment (negative), $P_t$ are cash flows, $IRR$ is internal rate of return, $n$ is holding period. NPV = 0. IRR for Conventional Investment: $ \sum P_t/(1+r)^t - C_0 = 0 \implies \sum P_t/(1+r)^t = C_0 $ ($r$ is IRR). IRR for Non-conventional Investment: $ \sum P_t/(1+r)^t - \sum C_t/(1+r)^t = 0 \implies \sum P_t/(1+r)^t = \sum C_t/(1+r)^t $ ($r$ is IRR). IRR & RRR (Required Rate of Return): If $IRR > RRR$, entrepreneur can invest. If $IRR Financial Analysis of a Project (Estimates) Projected Capital Cost Estimates: Advance Expenditure, Plant and Machinery Cost, Cost of Spares, Freight and Insurance, Taxes and Duties, Installation Charges, Other Overhead Expenses, Cost of Land, Cost of Buildings and Civil Works, Cost of Premises. Projected Operating Cost Estimates: Cost of Raw Materials, Cost of Labour, Energy Cost, Plant Maintenance, Cost of Supervision, Administrative and Management Cost, Depreciation Charges, Interest on Borrowings. Operating Revenue Estimates: Gross Revenues, Net Revenues, Gross Margin, Operating Profit Before Interest and Tax (EBIT), Profits before Tax (PBT), Profit After Tax (PAT), Retained Earnings. Gross Revenue Total amount of sales recognized for a reporting period, prior to any deductions. Revenue Forecasting accuracy depends on assessment of demand potential and anticipated sale price. Requires market research. Net Revenue Net Revenues = Gross Revenues – (Sales Returns + Allowances + Discounts). Deductions from gross revenue include sales discounts, sales returns & allowances. Indicates ability to sell goods and services, not ability to generate profit. Cost of Goods Sold (COGS) Raw Material Cost, Labour Cost, Energy Cost, Supervision Cost. Repair and Maintenance Cost, Royalty and Knowhow Cost. Depreciation, Incidental Expenditure. Gross Margin & EBIT Gross Margin = Net Revenues - Cost of Goods Sold. Operating Profit Before Interest and Tax (EBIT) = Gross Margin - (Total Selling + General Expenses). PBT, PAT & Retained Earnings Profits Before Tax (PBT) = EBIT - Interest. Profits After Tax (PAT) = PBT – Income Tax. Retained Earnings = PAT - Dividends. Retained earnings (RE) is net income left over after paying dividends. Positive profits give room to utilize surplus money. Money not paid to shareholders counts as retained earnings. Proforma Balance Sheet A Projected Balance Sheet based on Proforma Operating Cost Estimates, Proforma Operating Revenue Estimates, and Proforma Profit and Loss Statement. Assets: Something that can generate economic value and/or future benefit. Generates cash flows (machinery, financial security, patent). Personal assets: house, car, investments, artwork, home goods. Types: Current assets (short-term, easily convertible to cash), Fixed assets (long-term), Tangible assets, Intangible assets, Operating assets, Non-operating assets. Fixed Assets: Land, Buildings, Plant and Machinery, Furniture and Fittings. Current Assets: Cash, Bank Balances, Marketable Securities, Sundry Debtors, Inventories (raw materials, WIP, finished goods), Prepaid Expenses. Total Assets = Fixed Assets + Current Assets. Liabilities: All types of account payables. Financial obligations to be met in short/long run. Play significant role in financing expansion/smooth operations. Current Liabilities: Sundry Creditors, Taxes Payable, Bills Payable, Proposed Dividends. Capital Stock: Common Stock, Preferred Stock. Total Debts: Secured Loans, Unsecured Loans. Reserves & Surpluses: Retained Earnings. Total Liabilities = Current Liabilities + Capital Stock + Total debts + Reserves & Surpluses. Balance Sheet shows Assets & Liabilities. Total Assets should equal Total Liabilities. Proforma Balance Sheet forecasts projected financial health of the venture. Project Finance 2 Vital Issues: Capital Required or Fixed Assets Capitalization. Composition of Capital or Capital Structure. Capital Structure Objectives: Minimizing the Cost of Capital. Maximizing the returns to owners or shareholders. Project Funds Fixed Financing (Fixed Capital). Working Financing (Working Capital). Fixed Capital Funds needed for purchasing Fixed Assets (e.g., Plant and Machinery, Furniture & Fixtures, Building). Need for Fixed Capital depends on: Nature of Business, Size of Business, Leasing Arrangement, Presence of Ancillary Units, Technology, Provision of Sub Contract, Trends in the Economy, International Business Condition. Sources of Finance for Fixed Assets Borrowing from Public, Financial Institutions. Lease Financing, Retained Earnings, Issue of Equity Shares. Issue of Preference Shares, Issue of Debentures, Term Loans. Deferred Credit, Development Loans or Capital Subsidies. Unsecured Loans and Deposits. Term Loans: Normally for 10-25 years. Repayment possible in installments (even before due date). Fixed rate of interest. Risk shared by financial institution and promoter. Recruitment of Nominee Director on firm's Board. Working Capital Capital required for running day-to-day operations. Components: Cash and bank balance, Accounts Receivable, Inventory, Advances Paid. Net Working Capital = Current Assets - Current Liabilities. Inventory (Components) Stock of raw materials. Stock of Finished Goods. Stock of In-Process Goods. Stores and Spares. Current Assets & Current Liabilities Current Assets: Items easily convertible into liquid cash within one accounting year (cash & bank balance, bills receivable, inventory). Current Liabilities: Items which the firm owes to others that are to be paid within one year (creditors, bills payable). Debt Equity Ratio Financial structure composed of Equity and Debt. Calculated by dividing a company's total liabilities by its shareholder equity. Figures available on the Balance Sheet. Working Capital Management Estimation of Requirement of Working Capital. Procurement of Funds for meeting Working Capital needs. Factors Determining Working Capital Requirement Operating Cycle, Sales Volume, Seasonality, Cyclical Factors, Nature of business. Terms of credit, Inventory Turnover, Technology, Contingency Plans. Operating Cycle: Time period during which Cash gets reconverted back to Cash through a number of processes. Long Operating Cycle Results in More Working Capital Requirement. Short Operating Cycle Results in Less Working Capital Requirement. Impact of Seasonality: During Peak Seasons, demand is high; during off Seasons, demand is low. Peak Season results in Shorter Cash-To-Cash Cycle $\implies$ less Working Capital. Off Season results in longer Cash-To-Cash Cycle $\implies$ more Working Capital. Factors in Estimating Working Capital: Cost of buying Raw Material (bulk buying reduces need). Average Time taken for Raw Materials to get into the process. Length of Production Cycle (direct impact on operating cycle). Credit extended to Buyers. Credit enjoyed from Suppliers. Delayed Wage Payment. Sources of Funds for Working Capital Borrowings from banks and other financial institutions (Bank credit). Short term finance sources like enjoying more credit period from suppliers. Unsecured non-bank short term sources (Unsecured public deposits, Inter-company deposits, Insurance companies like LIC). Pledging. Factoring. Factoring: Process where invoices representing 'commercial accounts receivables' are sold to another buyer ("Factor") at a discount to get instant cash. Inter – Company Deposits: A deposit made by one company with another, normally for up to 6 months. Short term deposits.