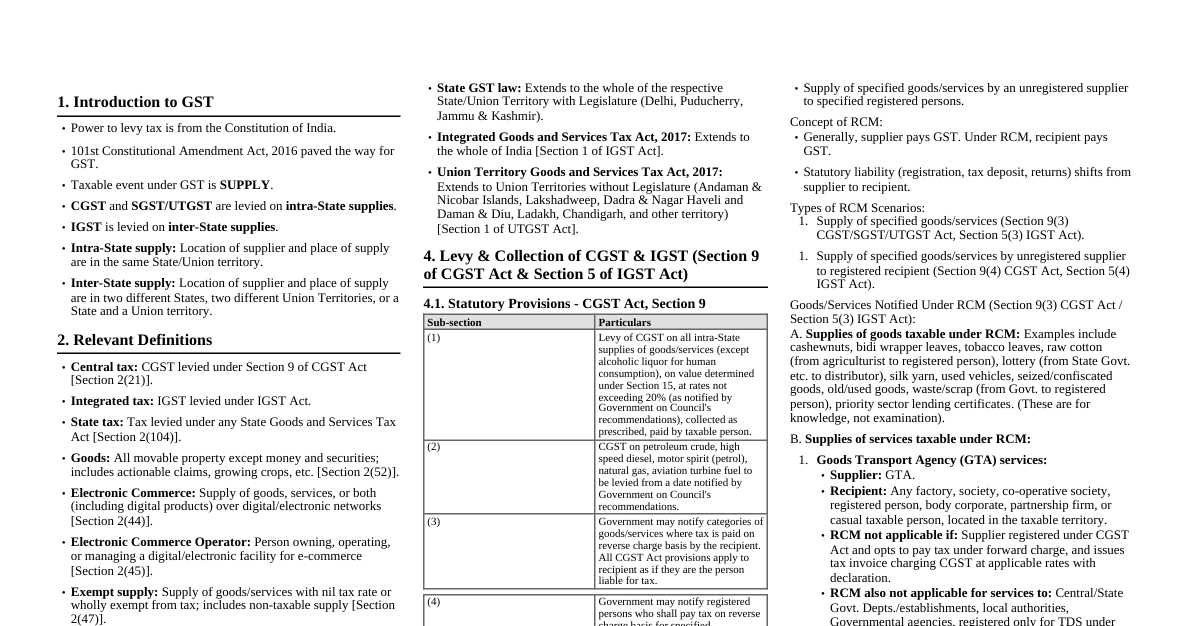

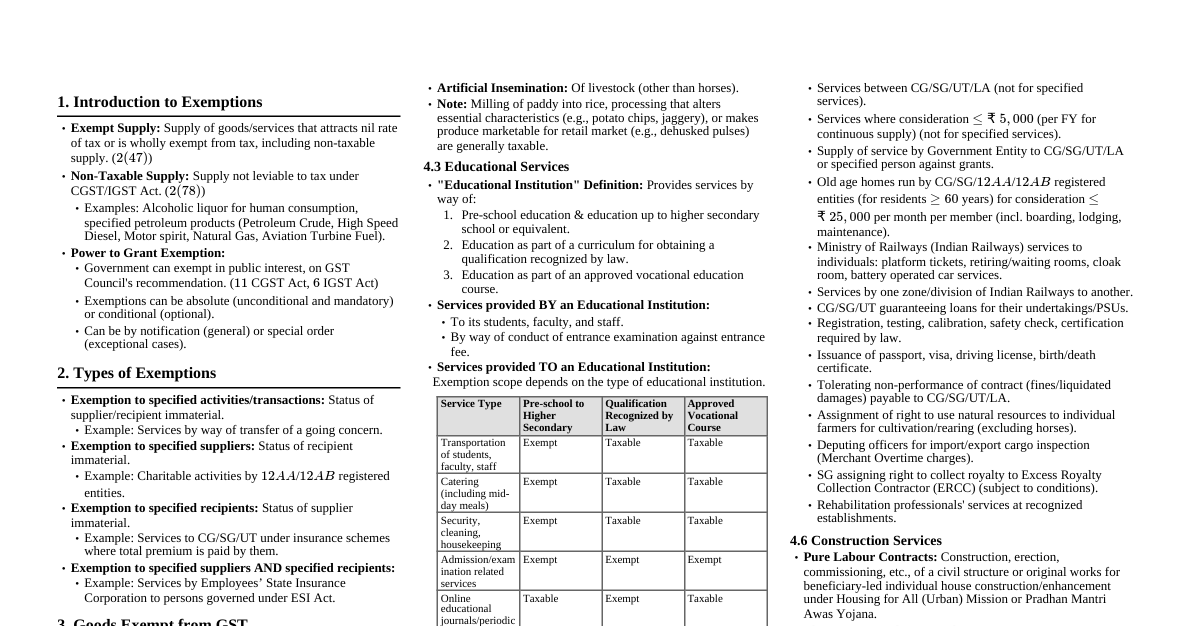

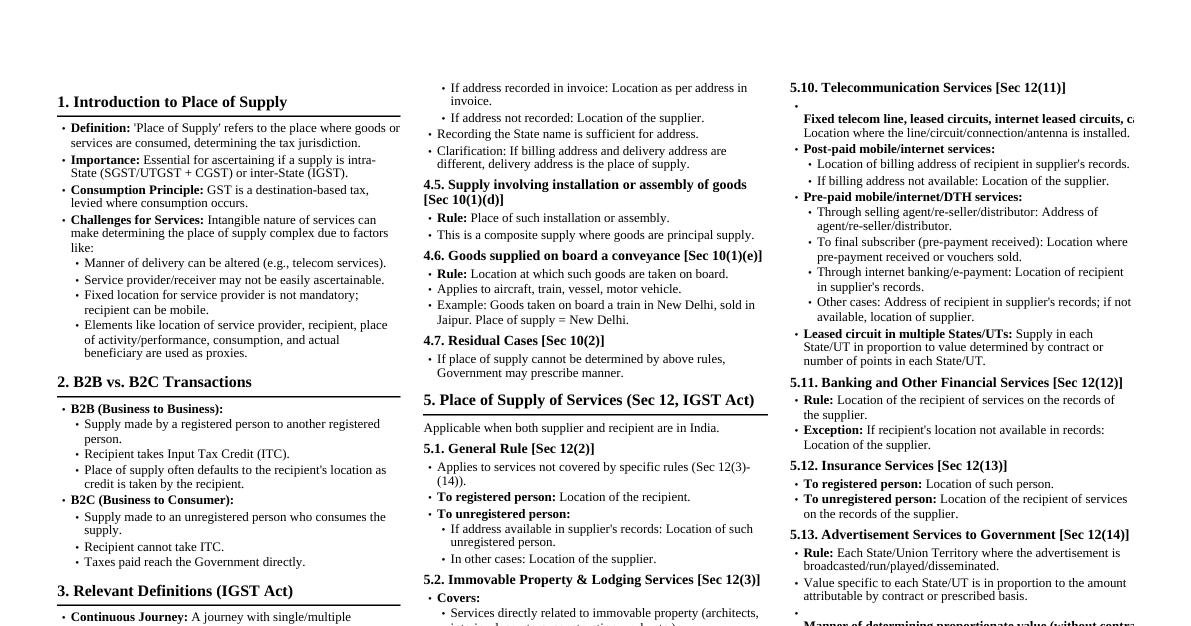

1. Introduction to Supply Under GST Taxable Event: Under GST, the single comprehensive taxable event is "Supply" of goods or services or both. Replaces previous taxable events like manufacture, sale, service rendering. 2. Relevant Definitions Goods: Movable property (other than money & securities), includes actionable claim, growing crops, grass, things attached to land agreed to be severed. [Section 2(52)] Services: Anything other than goods, money, and securities, including activities relating to money use/conversion for which consideration is charged. [Section 2(102)] Includes facilitating/arranging transactions in securities. Principal: Person on whose behalf an agent carries on business of supply/receipt of goods/services. [Section 2(88)] Family: Spouse & children; parents, grandparents, brothers, sisters if wholly/mainly dependent. [Section 2(49)] Consideration: Any payment (money or otherwise) for supply, by recipient or other person. Excludes government subsidies. Deposits are consideration only when applied by supplier for supply. [Section 2(31)] Actionable Claim: Claim to any unsecured debt or beneficial interest in movable property not in claimant's possession, recognized by civil courts. [Section 2(1) CGST Act read with Section 3 Transfer of Property Act, 1882] Manufacture: Processing raw material into a new product with distinct name, character, use. [Section 2(72)] Money: Indian legal tender or foreign currency, cheques, etc., recognized by RBI, when used to settle obligation/exchange. Excludes numismatic value currency. [Section 2(75)] Taxable Supply: Supply leviable to tax under the Act. [Section 2(108)] Taxable Territory: Territory to which Act applies. [Section 2(109)] Supplier: Person supplying goods/services, includes agent. For specified actionable claims, platform owner/operator is deemed supplier. [Section 2(105)] Recipient: For consideration: Person liable to pay consideration. No consideration (goods): Person to whom goods delivered/made available. No consideration (service): Person to whom service rendered. Includes agent acting for recipient. [Section 2(93)] Person: Includes Individual, HUF, Company, Firm, LLP, AOP/BOI, Corporation, Body Corporate (outside India), Co-operative Society, Local Authority, Central/State Government, Society, Trust, Artificial Juridical Person. [Section 2(84)] 3. Concept of Supply [Section 7 of CGST Act] 3.1 Meaning and Scope of Supply - Section 7(1) Supply includes: Section 7(1)(a): All forms of supply of goods or services or both (e.g., sale, transfer, barter, exchange, license, rental, lease, disposal) made or agreed to be made for a consideration by a person in the course or furtherance of business . Section 7(1)(aa): Activities/transactions by a person (other than an individual) to its members/constituents for cash, deferred payment, or other valuable consideration. Explanation: Person and its members/constituents are deemed two separate persons; inter se supply is deemed. Section 7(1)(b): Importation of services, for a consideration whether or not in the course or furtherance of business. Section 7(1)(c): Activities specified in Schedule I , made or agreed to be made without a consideration . 3.2 Activities or Transactions to be Treated as Supply of Goods or Services - Section 7(1A) Activities/transactions constituting a supply per Section 7(1) are treated as supply of goods or services as referred to in Schedule II . 3.3 Non-Supplies Under GST - Section 7(2) Notwithstanding Section 7(1), the following are treated neither as a supply of goods nor a supply of services: Section 7(2)(a): Activities or transactions specified in Schedule III . Section 7(2)(b): Such activities/transactions undertaken by Central Government, State Government, or any local authority as public authorities, as notified by the Government. 3.4 Power to Specify Supply Types - Section 7(3) Government may specify transactions to be treated as: A supply of goods and not services. A supply of services and not goods. 4. Parameters of Supply Supply should be of goods or services. Supply should be made for a consideration. Supply should be made in the course or furtherance of business. 5. Supply of Goods or Services for Consideration in Course or Furtherance of Business [Section 7(1)(a)] 5.1 Supply Should Be of Goods or Services or Both 'Supply includes' indicates an extensive meaning. Anything other than goods or services (e.g., money, securities) does not attract GST. Diagram: Goods: Every kind of movable property, excludes money & securities, includes actionable claims. Services: Anything other than goods, money & securities. Money / Securities: NOT Supply. 5.2 Supply Includes Specified Forms, for Consideration, in Course or Furtherance of Business Illustrative forms: Sale, transfer, barter, exchange, license, rental, lease, disposal. 5.3 Forms of Supply Sale & Transfer: Transfer of ownership/title for a price. Example: Shopkeeper selling a pen. Example: Company transferring goods to depot for sale. Barter & Exchange: Barter: Exchange goods/services for other goods/services without money. Exchange: May involve goods partly for goods and partly for money. Example: New car in exchange for old car + money. Example: Doctor-barber service exchange. License, Lease, Rental & Disposal: License: Permission to engage in activity. Rental/Lease: Agreement to use property/equipment for a period for money. Disposal: Sale, pledge, giving away, use, consumption. These are generally supply of service as no title transfer. 5.4 Consideration Payment (money or in kind) by recipient or third person. Excludes Central/State Government subsidies. Deposit is consideration only when applied by supplier for supply. Quid Pro Quo: "Something for something" is essential. Donations without quid pro quo: Not supply if purpose is philanthropic, no commercial gain, and no obligation on recipient. Art works to galleries: Not supply until sold, as no consideration from gallery to artist. 'No Claim Bonus' in insurance: Not consideration for supply by insured, as no contractual obligation to refrain from claiming. 5.5 In Course or Furtherance of Business GST applies to commercial transactions. Personal capacity supplies generally excluded unless falling under 'business' definition. Business Definition [Section 2(17)]: Includes any trade, commerce, manufacture, profession, vocation, etc., whether for monetary benefit or not. Any activity incidental/ancillary. Any activity of same nature, even if no volume/continuity. Supply/acquisition of goods (including capital goods) & services in connection with commencement/closure. Provision of facilities by club/association to members for consideration. Admission for consideration to any premises. Services as holder of office. Activities of a race club (totalisator, bookmaker). Activity by Government/local authority as public authorities. Example: Sale of personal car/jewellery by individual is generally not in course of business. Example: Artist selling paintings (vocation) is in course of business. Example: RWA collecting maintenance charges from members. Example: Admission to cinema halls. Example: Race club facilitating wagering transactions. 6. Importation of Services for Consideration [Section 7(1)(b)] Import of services for a consideration is a supply, whether or not in the course or furtherance of business. This is an exception to the 'in course or furtherance of business' rule. Example: Architect services for personal residence from foreign architect. 7. Activities Without Consideration - Deemed Supply [Section 7(1)(c) read with Schedule I] Activities treated as supply even if made without consideration: 7.1 Permanent Transfer/Disposal of Business Assets (Para 1) Conditions: Disposal/transfer of business assets. Transfer/disposal must be permanent. Input Tax Credit (ITC) must have been availed on such assets. Example: Free disposal of old laptops where ITC was availed. 7.2 Supply Between Related Persons or Distinct Persons (Para 2) Supply of goods or services or both between 'related persons' or 'distinct persons' (Section 25) for business furtherance, even without consideration. Related Persons (Explanation to Section 15): Officers/directors of one another's business. Legally recognized partners. Employer & employee. Third person controls/owns/holds $\geq 25\%$ voting stock/shares of both. One controls the other. Third person controls both. Together control a third person. Members of the same family. One is sole agent/distributor/concessionaire of the other. Distinct Persons (Section 25(4) & (5)): Separate registrations under same PAN in different States/UTs. Establishments in different States/UTs (even if one is unregistered). Stock/Branch Transfers: Transfers between different GST registrations of same legal entity are deemed supply. Not supply if under single GST registration in same State. Employer-Employee: Services by employee to employer in course of employment are outside GST (Schedule III). Gifts: Gifts up to ₹50,000 per financial year from employer to employee are NOT supply. Gifts > ₹50,000 are supply if for business furtherance. Perquisites: Perquisites provided by employer to employee as per contractual agreement are not subject to GST. 7.3 Principal – Agent (Para 3) Supply of goods by principal to agent (or vice versa) without consideration, where agent undertakes to supply/receive goods on principal's behalf. Only supply of goods (not services) is covered. Deciding factor: Whether agent issues invoice for further supply in his own name. If agent issues invoice in his name $\implies$ supply by principal to agent is covered. If agent issues invoice in principal's name $\implies$ not covered. Del-credere agent (DCA): Guarantees payment to supplier. If DCA issues invoice in principal's name: Not an agent under Para 3. Loan from DCA to buyer is independent supply; interest does not form part of goods value. If DCA issues invoice in his own name: Is an agent under Para 3. Loan from DCA to buyer is subsumed in goods supply by DCA; interest forms part of goods value (Section 15(2)(d)). 7.4 Importation of Services (Para 4) Import of services by a person from a related person or from his establishments outside India, without consideration, in the course or furtherance of business. Example: Legal consultancy from foreign head office to Indian branch (related persons, for business). Example: Architect services from related person for personal residence is NOT supply (not for business). 7.5 Sales Promotion Schemes Free Samples & Gifts: Generally not supply unless covered by Schedule I. Buy One Get One Free: Not individual free supply; treated as two goods for price of one. Taxability depends on composite vs. mixed supply. 8. Activities/Transactions Between a Person (Other Than Individual) and its Members/Constituents for Consideration [Section 7(1)(aa)] Covers supplies by associations, clubs, etc., to members for consideration. Explanation deems the person and its members as two separate persons, overriding the doctrine of mutuality. Example: RWA supplying air-conditioners at concessional price or collecting maintenance charges from members. 9. Activities/Transactions to Be Treated As Supply of Goods or Supply of Services [Section 7(1A) read with Schedule II] Classifies certain activities as either supply of goods or supply of services to avoid ambiguity: Para No. Activity/Transaction Nature of Supply 1. Transfer (of goods) Any transfer of title in goods. Supply of Goods Any transfer of right in goods/undivided share without title transfer. Supply of Services Transfer of title under agreement where property passes at future date upon full payment. Supply of Goods 2. Land and Building Any lease, tenancy, easement, licence to occupy land. Supply of Services Any lease/letting out of building (commercial, industrial, residential) for business/commerce. Supply of Services 3. Treatment or Process Any treatment or process applied to another person’s goods (job work). Supply of Services 4. Transfer of Business Assets Goods forming part of business assets transferred/disposed so as no longer to be part of assets. Supply of Goods Goods held/used for business put to private use or made available for non-business purpose. Supply of Services Goods forming part of assets of a person ceasing to be taxable person deemed supplied immediately before ceasing. (Exceptions: business transfer as going concern; business by personal representative). Supply of Goods 5. Other Supplies (a) Renting of immovable property. Supply of Services (b) Construction of complex, building, civil structure (for sale, where consideration received before completion certificate/first occupation). Supply of Services (c) Temporary transfer or permitting use/enjoyment of any intellectual property right. Supply of Services (d) Development, design, programming, customisation, adaptation, upgradation, enhancement, implementation of IT software. Supply of Services (e) Agreeing to obligation to refrain from an act, or to tolerate an act or situation, or to do an act. Supply of Services (f) Transfer of right to use any goods for any purpose (for consideration). Supply of Services 6. Composite Supplies Works contract. Supply of Services Supply of food/drink (other than alcoholic liquor) for human consumption, as part of service or otherwise. Supply of Services 9.1 Clarifications on Schedule II Tenancy Rights (Pagadi system): Transfer of tenancy right against consideration (tenancy premium) is supply of service. Agreeing to obligation to refrain/tolerate/do (Para 5(e)): Must be an express/implied agreement/contract. Consideration must flow in return for this contract. Example: Non-compete agreements, allowing hawker for payment. Food Supplied to Patients: Food to in-patients (as advised) is part of composite supply of healthcare (not separately taxable). Other food supplies are taxable. Bus Body Building: Composite supply; classification (goods/service) depends on principal supply. Retreading of Tyres: Process of retreading is principal supply (service). If old tyres belong to supplier, supply of retreaded tyres is supply of goods. Food & Beverages at Cinema Halls: If supplied independently: Taxable as 'restaurant service'. If bundled with cinema exhibition and qualifies as composite supply: Entire supply taxed at rate applicable to cinema exhibition (principal supply). 10. Non-Supplies Under GST [Section 7(2)(a) & (b) read with Schedule III] Activities/transactions treated neither as supply of goods nor services: 10.1 Non-Supplies Listed in Schedule III Para No. Activity/Transaction 1. Services by an employee to the employer in the course of or in relation to his employment. 2. Services by any court or Tribunal. 3. (a) Functions performed by MPs, MLAs, Panchayats, Municipalities, other local authorities. (b) Duties performed by any person holding post under Constitution. (c) Duties performed by Chairperson/Member/Director in government body (who is not deemed employee). 4. Services of funeral, burial, crematorium, mortuary (including transportation of deceased). 5. Sale of land and, subject to paragraph 5(b) of Schedule II, sale of building (i.e., entire consideration received after completion certificate/first occupation). 6. Actionable claims, other than specified actionable claims. Specified actionable claims: betting, casinos, gambling, horse racing, lottery, online money gaming. Online money gaming: players pay money/VDA with expectation of winning money/VDA. 10.2 Non-Supplies Notified Vide Notification [Section 7(2)(b)] Activities relating to Panchayat/Municipality functions (Article 243G/243W of Constitution). Grant of alcoholic liquor licence by State Governments. Note: Other government licenses/privileges for a fee are taxable (under reverse charge). 10.3 Non-Supplies Clarified by Way of Circular Inter-State movement of various modes of conveyance (trains, buses, trucks, etc.) between distinct persons for carrying goods/passengers or for repairs/maintenance (not for further supply of conveyance itself). Inter-State movement of rigs, tools, spares, and goods on wheels (like cranes) (not for further supply of goods). 11. Conditions for GST Leviability Supply must be made by a taxable person (registered or liable to be registered). Supply must be a taxable supply (leviable to tax under GST Law). Exempt supply: Nil rate of tax or wholly exempt; includes non-taxable supply. [Section 2(47)] 12. Composite and Mixed Supplies [Section 8] Determines tax liability when multiple supplies are bundled. 12.1 Composite Supplies Definition [Section 2(30)]: Two or more taxable supplies of goods or services or both, or any combination. Naturally bundled and supplied in conjunction with each other in ordinary course of business. One of which is a principal supply. Principal Supply [Section 2(90)]: Predominant element of a composite supply, to which other supplies are ancillary. Determining "Naturally Bundled": Consumer perception (expect as package). Majority of providers offer similar bundle. Nature of services (main service + incidental/ancillary). Indicators: Single price, advertised as package, elements not available separately, integral to overall supply. Tax Liability: Treated as supply of such principal supply. Entire value taxed at rate applicable to principal supply. Example: 5-star hotel conference package (convention service is principal supply). Example: Laptop with bag (laptop is principal supply). Example: Flight ticket with food, insurance, lounge access (transportation is principal supply). 12.2 Mixed Supplies Definition [Section 2(74)]: Two or more individual supplies of goods or services, or any combination. Made in conjunction with each other by a taxable person for a single price. Does NOT constitute a composite supply (i.e., not naturally bundled). Determining Mixed Supply: Rule out composite supply first. If not naturally bundled but for a single price, it's mixed. Tax Liability: Treated as supply of that particular supply that attracts the highest rate of tax. Example: Gift package with canned foods, sweets, chocolates (highest rate applies to entire package). Example: Refrigerator with water bottles for single price. 12.3 More Than One Supply Taxed at Individual Rates If multiple supplies are involved, but neither composite nor mixed, and separate consideration is indicated for each, then each supply is taxed at its respective rate. Example: Car servicing with separate charges for spare parts and labor. 13. Amendment by Finance (No. 2) Act, 2024 (Effective Nov 1, 2024) New entries added to Schedule III (non-supplies): Para 9: Activity of apportionment of co-insurance premium by lead insurer to co-insurer for insurance services jointly supplied, provided lead insurer pays tax on entire premium. Para 10: Services by insurer to reinsurer for which ceding/reinsurance commission is deducted from reinsurance premium, provided reinsurer pays tax on gross reinsurance premium (inclusive of commission).