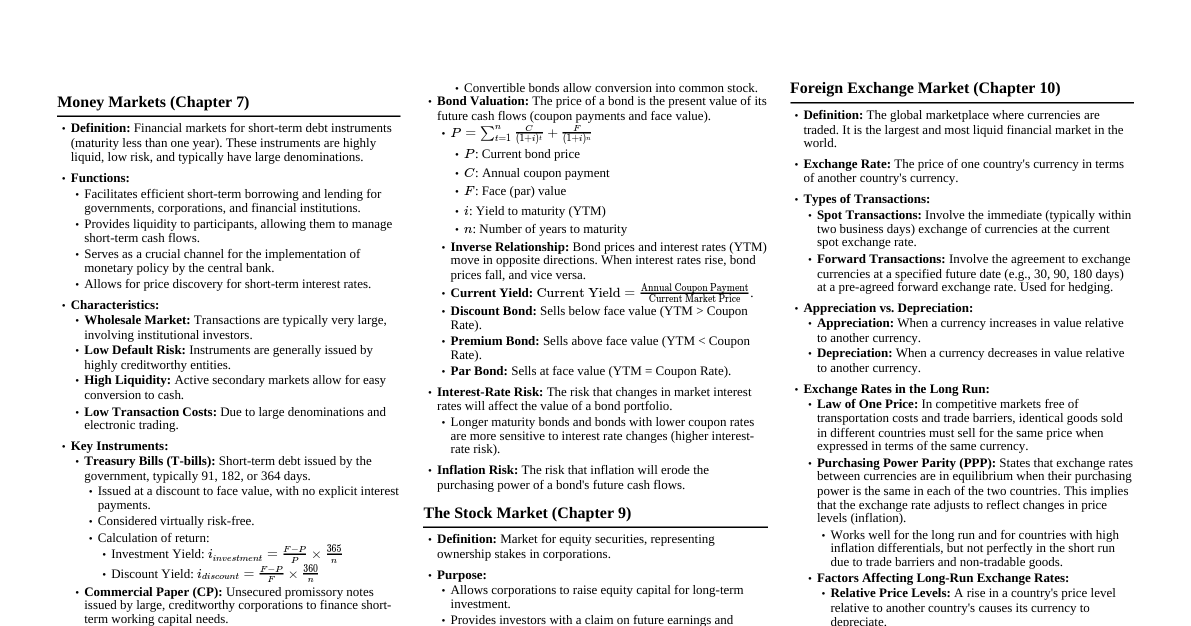

Money Markets (Chapter 7) Definition: Short-term, highly liquid securities (close to money). Money/currency not actually traded. Functions: Equilibrates demand/supply of short-term funds. Supports borrowing/investment at efficient market prices. Transmits monetary policy to the real economy. Characteristics: Active secondary market, wholesale, innovation and flexibility. Why Needed: Cost advantages over banks (less regulation, no reserve requirements, no interest rate caps). Money Market Instruments Treasury Bills (T-bills): Issued by government (91, 182, 364 days tenure). Discounting: Investor pays less than face value, return is the price increase. Formula: $i_{discount} = \frac{F-P}{F} \times \frac{360}{n}$ (discount rate), $i_{investment} = \frac{F-P}{P} \times \frac{365}{n}$ (investment rate). Risk-free, deep market. Call Money: Overnight funds, 2-14 days in notice money market. Uncollateralized in India (banks & PDs only). Collateralized Borrowing and Lending Obligation (CBLO): Fully collateralized, secured instrument (2003). Maturity 1 day to 1 year. Repurchase Agreements (Repos): RBI conducts overnight and term repos (2-14 days). Fully collateralized. Advantages: Instantaneous ownership transfer, integrates money & gov't securities markets, flexible liquidity tool. Commercial Paper (CP): Unsecured promissory note, issued by highly rated corporations (India, 1990). Maturity 7 days to 1 year, min $\text{₹}5$ lakhs. Discounted, redeemed at face value. Eligibility: Tangible net worth $\ge \text{₹}4$ crores, working capital limit, standard asset classification. Minimum credit rating "A3". Certificate of Deposits (CDs): Unsecured promissory notes by corporations, max 270 days maturity. Banker’s Acceptances: Order to pay specified amount to bearer on given date (e.g., for international trade). Eurodollars: Dollar-denominated deposits in foreign banks. Largest short-term security globally. The Bond Market (Chapter 8) Purpose: Long-term investment (maturity $>1$ year). Capital Market Participants: Issuers: Government (T-bills, G-secs, SDLs), Public/Private corporations (bonds & stocks). Purchasers: Households, investment funds, corporations. Trading: Primary Market: Initial sale (IPO). Secondary Market: Sale of previously issued securities. Organized Exchanges (BSE, NSE). Over-the-Counter (OTC). Bond Definition: Debt owed by issuer to investor, specified payments on specific dates. Par/Face/Maturity Value: Amount paid at maturity. Coupon Rate: Fixed interest rate paid periodically. Treasury Bills and Dated Government Securities: G-Sec: Tradable instrument by Central/State gov't. Central Gov't: T-bills ($ State Gov't: State Development Loans (SDLs). Risk-free (gilt-edged), very low interest rates. Types of Dated Securities Fixed Rate Bonds, Floating Rate Bonds, Zero Coupon Bonds, Capital Indexed Bonds, Inflation Indexed Bonds. Bonds with call/put options, Special Securities, STRIPS. Corporate Bonds Issued by large corporations. Often callable. Bond Indenture: Contract stating lender's rights and borrower's obligations. Characteristics: Bearer vs. Registered, Restrictive covenants, Call provisions, Conversion options. Credit Rating: CRISIL, ICRA in India. Financial Guarantees: Purchased to lower debt risk (e.g., Credit Default Swaps). Bond Yield Calculations Current Yield: $i_c = \frac{C}{P}$ (C=yearly coupon payment, P=price). Yield to Maturity (for one-year discount bond): $i = \frac{F-P}{P}$. Semi-Annual Bond Price: $P_{semi} = \sum_{j=1}^{2n} \frac{C/2}{(1+i)^j} + \frac{F}{(1+i)^{2n}}$. Bond Price vs. Interest Rate: Inversely related. Interest-Rate Risk: Risk of loss due to interest rate changes. Longer maturity = higher risk. The Stock Market (Chapter 9) Investing in Stocks: Represents ownership, earns return from price appreciation and dividends. Common Stock: Voting rights, receive dividends. Preferred Stock: Fixed dividend, usually no voting rights. How Stocks are Sold: Organized Exchanges: NYSE, BSE, NSE. Auction markets. Over-the-Counter (OTC): NASDAQ, OTCEI (India). Trading via telecommunication networks, dealers make a market. ECNs (Electronic Communication Networks): Allow direct trading, offer transparency, cost reduction, faster execution, after-hours trading. ETFs (Exchange Traded Funds): Basket of securities, traded on exchanges, indexed to specific portfolios, low management fees. Computing the Price of Common Stock One-Period Valuation Model: $P_0 = \frac{D_1}{(1+k_e)} + \frac{P_1}{(1+k_e)}$ Generalized Dividend Valuation Model: $P_0 = \sum_{t=1}^{\infty} \frac{D_t}{(1+k_e)^t}$ Gordon Growth Model: $P_0 = \frac{D_0(1+g)}{(k_e-g)} = \frac{D_1}{(k_e-g)}$ (Assumes constant dividend growth $g Price Earnings Ratio (PE): $\frac{P}{E} \times E = P$. High PE can mean expected earnings growth or low-risk earnings. Stock Market Dynamics Market Sets Prices: Buyer willing to pay most determines price (often due to superior information). Errors in Valuation: Problems estimating growth ($g$), risk ($k_e$), and forecasting dividends. Impact of Crises: Financial crises (2007-2009) and events (9/11, Enron) lower 'g' and increase 'k_e', driving down prices. Stock Market Indexes Monitor behavior of groups of stocks (DJIA, S&P 500, NASDAQ, S&P BSE SENSEX). S&P BSE SENSEX: Market-Capitalization-Weighted (since 2003, free-float). Buying Foreign Stocks ADRs (American Depository Receipts): Allow foreign firms to trade on U.S. exchanges. Regulation of the Stock Market SEC (U.S.): Protect investors, maintain market integrity. SEBI (India): Protect investor interests, promote & regulate securities market. Foreign Exchange Market (Chapter 10) Exchange Rate: Price of one currency in terms of another. Highly volatile. Transactions: Spot: Near-immediate exchange at spot rate. Forward: Exchange at future date at forward rate. Appreciation/Depreciation: Currency value increases/decreases. E.g., Rupee depreciated 34% against USD (2000-01 to 2014-15). Importance: Appreciation makes domestic goods more expensive abroad, foreign goods cheaper domestically (less competitive). How Traded: OTC market, large transactions ($>1$ million). Exchange Rates in the Long Run Law of One Price: Identical goods have same price worldwide (after exchange rate conversion). Purchasing Power Parity (PPP): Exchange rates adjust to reflect changes in price levels. Domestic price level $\uparrow 10\% \Rightarrow$ domestic currency $\downarrow 10\%$. Works in long run, not short run (due to non-identical goods, non-traded goods/services). Factors Affecting Long-Run Exchange Rates: Relative Price Levels ($\uparrow \Rightarrow$ domestic currency depreciates). Tariffs and Quotas ($\uparrow \Rightarrow$ domestic currency appreciates). Preferences for Goods (Increased demand for domestic goods $\Rightarrow$ appreciates). Productivity (Higher relative productivity $\Rightarrow$ appreciates). Exchange Rates in the Short Run Exchange rate = price of domestic bank deposits in foreign bank deposits. Supply curve (S) is vertical (Rupee assets fixed in short-run). Demand curve (D) traces quantity demanded. Equilibrium: $S=D$ at $E^*$. Explaining Changes: Factors shifting expected returns for domestic/foreign deposits, money supply, overshooting. Impact of Interest Rates: Domestic real interest rate $\uparrow \Rightarrow$ domestic currency appreciates. Domestic expected inflation $\uparrow \Rightarrow$ domestic currency depreciates. Exchange Rate Overshooting: Helps explain volatility. Changes in expectations (price levels, productivity, inflation) cause immediate exchange rate shifts. Why Do Interest Rates Change? (Chapter 12) Determinants of Asset Demand: Wealth: $\uparrow$ Wealth $\Rightarrow \uparrow$ quantity demanded of asset. Expected Return: $\uparrow$ Expected return relative to alternatives $\Rightarrow \uparrow$ quantity demanded. Risk: $\uparrow$ Risk relative to alternatives $\Rightarrow \downarrow$ quantity demanded. Liquidity: More liquid relative to alternatives $\Rightarrow \uparrow$ quantity demanded. Expected Return ($R_e$): $R_e = P_1R_1 + P_2R_2 + \dots + P_nR_n$. Risk (Standard Deviation $\sigma$): $\sigma = \sqrt{P_1(R_1-R_e)^2 + \dots + P_n(R_n-R_e)^2}$. Supply & Demand in the Bond Market Demand Curve ($B_d$): Downward sloping (higher price $\Rightarrow$ lower interest rate $\Rightarrow$ lower expected return $\Rightarrow$ lower quantity demanded). Supply Curve ($B_s$): Upward sloping (higher price $\Rightarrow$ lower interest rate $\Rightarrow$ lower borrowing cost $\Rightarrow$ higher quantity supplied). Equilibrium: $B_d = B_s$. Bond prices and interest rates are inversely related. Factors that Shift the Demand Curve for Bonds Wealth/Saving: $\uparrow$ Economy/Wealth $\Rightarrow \uparrow B_d$. Expected Returns on Bonds: Expected Interest Rate: $\downarrow$ future rates $\Rightarrow \uparrow$ $R_e$ for long-term bonds $\Rightarrow \uparrow B_d$. Expected Inflation ($p^e$): $\uparrow p^e \Rightarrow \downarrow$ real $R_e \Rightarrow \downarrow B_d$. Risk: $\downarrow$ Bond risk (or $\uparrow$ other assets' risk) $\Rightarrow \uparrow B_d$. Liquidity: $\uparrow$ Bond liquidity (or $\downarrow$ other assets' liquidity) $\Rightarrow \uparrow B_d$. Factors that Shift the Supply Curve for Bonds Profitability of Investment Opportunities: $\uparrow$ in business cycle expansion $\Rightarrow \uparrow B_s$. Expected Inflation ($p^e$): $\uparrow p^e \Rightarrow \uparrow B_s$ (real cost of borrowing decreases). Government Activities: $\uparrow$ Deficits $\Rightarrow \uparrow B_s$. Changes in Equilibrium Interest Rates Fisher Effect: $\uparrow p^e \Rightarrow \downarrow B_d$ (shifts left) and $\uparrow B_s$ (shifts right) $\Rightarrow \downarrow P \Rightarrow \uparrow i$. Business Cycle Expansion: $\uparrow$ Wealth $\Rightarrow \uparrow B_d$; $\uparrow$ Investment opportunities $\Rightarrow \uparrow B_s$. Net effect on interest rates depends on relative shifts. Typically, if $B_s$ shifts more than $B_d$, then $P \downarrow, i \uparrow$. Forecasting Interest Rates Methods: Supply & Demand analysis, Econometric Models. Decisions: Forecast $i \downarrow \Rightarrow$ buy long bonds; Forecast $i \uparrow \Rightarrow$ buy short bonds. Forecast $i \downarrow \Rightarrow$ borrow short; Forecast $i \uparrow \Rightarrow$ borrow long. Why Do Risk and Term Structure Affect Interest Rates? (Chapter 13) Risk Structure of Interest Rates: Explains why bonds with same maturity have different interest rates. Factors: Default Risk Liquidity Income Tax Considerations Default Risk: Issuer unable/unwilling to make payments. Default-Free Bonds: Government securities (no default risk). Risk Premium: Spread between interest rates on default-risky bonds and default-free bonds. $\uparrow$ default risk $\Rightarrow \uparrow$ risk premium. Flight-to-Quality: During crises, demand shifts from risky (corporate) bonds to safe (Treasury) bonds, increasing risk premium. Bond Ratings: Moody's, S&P assess default probability. Liquidity: Ease and speed of converting asset to cash. More liquid $\Rightarrow$ more desirable $\Rightarrow$ higher demand. Less liquid (corporate bonds) $\Rightarrow$ lower demand $\Rightarrow$ higher interest rates $\Rightarrow$ contributes to risk premium. Income Tax Considerations: Municipal Bonds (India since 2001): Interest payments exempt from federal income taxes $\Rightarrow$ higher demand $\Rightarrow$ lower interest rates than Treasuries (despite higher risk/lower liquidity). $i_{municipal} Term Structure of Interest Rates Explains why bonds with different maturities have different interest rates. Yield Curve: Plot of yields on bonds with differing terms to maturity but same risk, liquidity, tax. Can be upward-sloping (most common), flat, or downward-sloping (inverted). Upward-sloping: Long-term rates $>$ short-term rates. Facts to Explain: Interest rates on different maturity bonds move together over time. Yield curves tend to have steep upward slope when short rates are low, and downward slope when short rates are high. Yield curve is typically upward sloping. Theories of Term Structure 1. Expectations Theory: Assumption: Bonds of different maturities are perfect substitutes. Implication: Expected returns on bonds of different maturities are equal. Long-term interest rate = average of short rates expected over life of long-term bond. Explains facts 1 & 2, but not 3. 2. Market Segmentation Theory: Assumption: Bonds of different maturities are not substitutes at all. Implication: Markets completely segmented; rates determined separately. Explains fact 3 (people prefer short holding periods $\Rightarrow$ higher demand for short-term bonds $\Rightarrow$ lower rates), but not 1 & 2. 3. Liquidity Premium Theory: Assumption: Bonds of different maturities are substitutes, but not perfect. Implication: Modifies Expectations Theory with a liquidity premium ($ln_t$). Investors prefer short-term bonds, thus demand a positive liquidity premium for long-term bonds. Long-term interest rate = average of future expected short rates + liquidity premium. Explains all 3 facts. Commercial Banking (Chapter 14) Meaning: Bank collects money from savers and lends to borrowers. Features: Accept deposits, advance loans, create credit, commercial institution, manage payment system. Functions of Commercial Bank Basic Functions: Accepting Deposits (Fixed, Current, Saving, Recurring, Home Safe Accounts). Advancing Loans (Money at call, Cash Credit, Overdraft, Discounting Bills, Term Loans). Credit Creation. Promoting Cheque System. Agency Function: Remittance of funds, collection/payment of credit instruments, standing orders, securities trading, dividend collection, tax consultancy, trustee/executor, representative/correspondent. General Utility Services: Locker facility, Traveler's cheques, Letter of credit, Statistics, Underwriting, Gift Cheques, Referee, Foreign exchange business. Role in Developing Economy Capital formation, entrepreneurial innovation, monetization, influencing economic activity, monetary policy implementation, trade/industry promotion, regional development, agriculture/neglected sectors development. Types of Banks Commercial, Industrial, Agricultural, Exchange, Saving, Central. By Ownership: Public Sector, Private Sector, Co-operative. By Domicile: Domestic, Foreign. Scheduled and Non-scheduled. Banking System Branch Banking: Single institution, network of branches. Unit Banking: Single office. Group Banking: Two or more banks controlled by a corporation. Chain Banking: Two or more banks under common control (not holding company). Balance Sheet of a Commercial Bank Liabilities: Share Capital, Reserve Funds, Deposits, Borrowings, Acceptance/Endorsements, Other Liabilities. Assets: Cash, Money at call & short notice, Bills purchased/discounted, Investments, Loans, Acceptance/Endorsements, Building/Fixed Assets. Portfolio Management Liquidity, Solvency, Profitability. Credit Creation Meaning: Banks expand demand deposits as a multiple of cash reserves. Basic Concepts: Bank as business, Deposits (Primary, Secondary), Cash Reserve Ratio (CRR), Excess Reserves. Credit Multiplier ($k$): $k = \frac{\text{Total derivative deposits}}{\text{Initial Excess Reserves}} = \frac{1}{r}$ (where $r$ is CRR). $\Delta D = k \Delta R = \frac{\Delta R}{r}$. Assumptions: Constant CRR, bank asset adjustment, no leakages, developed banking system, no central bank credit control. Limitations: Amount of cash, CRR, leakages (excess reserves, currency drain), availability of borrowers/securities, credit policy of other banks, banking habits, business conditions, monetary policy. Central Banking (Chapter 15) Meaning: Supreme monetary institution at the apex of banking structure. Difference with Commercial Bank: Central bank controls banking system, non-profit motive, state-owned, monopoly of note issue. Commercial banks are units of system, profit motive, private-owned, no note issue rights. Functions of Central Bank Bank of note issue. Banker, agent, advisor to government. Banker's Bank. Lender of Last Resort. Clearing Agent. Custodian of Foreign Exchange Reserve. Controller of Credit. Development Role, Other Functions. Role in Developing Countries Traditional functions, economic growth, internal stability, banking system development, branch expansion, financial institution development, banking habits development, training, proper interest rate structure, other promotional roles. Credit Control Objectives: Price stability, economic stability, employment maximization, economic growth, money market stabilization, exchange rate stability. Methods: Quantitative/General: Bank Rate, Open Market Operations (OMO), CRR. Qualitative/Selective: Marginal Requirements, Regulation of consumer credit, Directives, Credit rationing, Moral suasion, Publicity, Direct action. Quantitative Methods Bank Rate Policy: Rate central bank charges commercial banks for rediscounting bills. Effects: Cost/availability of credit, economic activity, announcement effect, balance of payments. Limitations: Insensitivity of investment, ineffective in deflation, conflicting effects, indiscriminatory, non-dependence of CBs. Open Market Operations (OMO): Direct buying/selling of securities by central bank. Effects: Commercial bank reserves, interest rates, future expectations, inflation/depression policy. Objectives: Influence reserves, interest rates, stabilize securities market, control business situations, supplement bank rate. Limitations: Lack of developed securities market, inadequate stock, excessive cash reserves by CBs. Variable Cash Reserve Ratio (CRR): Changing minimum cash reserves with central bank. Effects: Changes excess reserves and credit multiplier. Limitations: Not effective with excessive reserves or large foreign funds, depends on business mood, not for marginal adjustments, affects only CBs. Comparison: All are objective, indiscriminatory, control total credit volume. Bank Rate: Indirect, slower, for marginal changes. OMO: More direct, depends on securities market, for marginal changes. CRR: Most direct, drastic/immediate effect, for large changes, less flexible. Selective Credit Control Marginal requirements, consumer credit regulation, credit rationing, moral suasion, publicity, direct control. Importance: Divert credit to essential uses, affect particular sectors, discourage consumer spending, useful in UDCs, preferential treatment to backward/priority sectors. Financial Reform (Chapter 16) Nationalization of Banks (India): 14 banks in 1969, 6 more in 1980. Arguments For: Control of wealth, credit to directors, speculative activities, discrimination against small business, agricultural neglect, financing plans, depositor safety. Arguments Against: Reduced efficiency, no control on monopolies, risky lending, compensation burden, not socialism. Achievements of Nationalized Banks: Banking/Industry development (Lead Bank, Branch Expansion, Rural Coverage, Deposit Expansion, Credit Expansion, Financial Inclusion), Priority sector financing (agriculture, small scale, exports, housing, weaker sections). Critical Appraisal: Insufficient help to priority sectors, inadequate rural facilities, regional imbalances, insufficient deposit mobilization, liberal credit problems, low profitability/efficiency, political pressure. Financial Sector Reforms (1991, Narsimham Committee): Objectives: Efficiency, stability, growth. Measures: Reduction in SLR/CRR, interest rate liberalization, prudential norms, income recognition, NPA policy, capital adequacy, new financial reporting, branch licensing, private bank setup. Hedging with Financial Derivatives (Chapter 24) Hedging: Financial transaction to reduce or eliminate risk. Long Position: Asset purchased or owned. Short Position: Asset to be delivered/borrowed and sold for future replacement. Offsets long position with short, or short with long. Forward Markets Agreements between two parties for future financial transaction. Specifies assets, price, date. Long Position: Agree to buy securities at future date (hedges against rate decreases). Short Position: Agree to sell securities at future date (hedges against price risk from interest rate increases if holding bonds). Pros: Flexible. Cons: Lack of liquidity, default risk. Financial Futures Markets Similar to forwards but traded on exchanges. Specifies delivery of security type at future date. Arbitrage ensures contract price = underlying asset price at expiration. If interest rates $\uparrow$, long contract loss, short contract profit. Micro-hedge: Single asset. Macro-hedge: Overall portfolio/firm. Success over Forwards: More liquid (standardized, tradable), delivery of range of securities, mark-to-market daily (avoids default risk), cash netting of positions. Hedging FX Risk: Sell foreign currency futures contracts to lock in exchange rate. Stock Index Futures Contract to buy/sell a particular stock index at a given level. Used to hedge systematic risk (reduce portfolio beta) or lock in stock prices. Value of S&P 500 Futures Contract = $250 \times \text{index}$. Hedging involves taking a short position to offset potential market declines. Options Options Contract: Right (not obligation) to buy (call) or sell (put) an instrument at exercise (strike) price. American (exercisable until expiration), European (only on expiration). Available on stocks, indexes, futures. Hedging with Options: Buy put options to protect against downside risk. Pays a premium. Factors Affecting Premium: Higher strike price $\Rightarrow$ lower call premium, higher put premium. Longer term $\Rightarrow$ higher premiums. Higher volatility $\Rightarrow$ higher premiums. Interest-Rate Swaps Exchange of one set of interest payments for another (same currency). Plain Vanilla Swap: Specifies rates, payment type, notional amount. E.g., Fixed-rate payment for variable-rate payment. Advantages: Reduces interest-rate risk, no balance-sheet change, longer term than futures/options. Disadvantages: Lack of liquidity, default risk. Credit Derivatives Payoffs based on changes in credit conditions. Credit Options: Payoffs tied to credit ratings or credit spreads. Credit Swaps: Exchange payments on loan portfolios. Credit Default Swaps (CDS): Option-like payoffs when loans default. Credit-Linked Notes: Combine bond with credit option (e.g., coupon rate changes based on an index). Concerns: Increased leverage, complexity, systemic risk (e.g., AIG during 2007-2009 crisis).