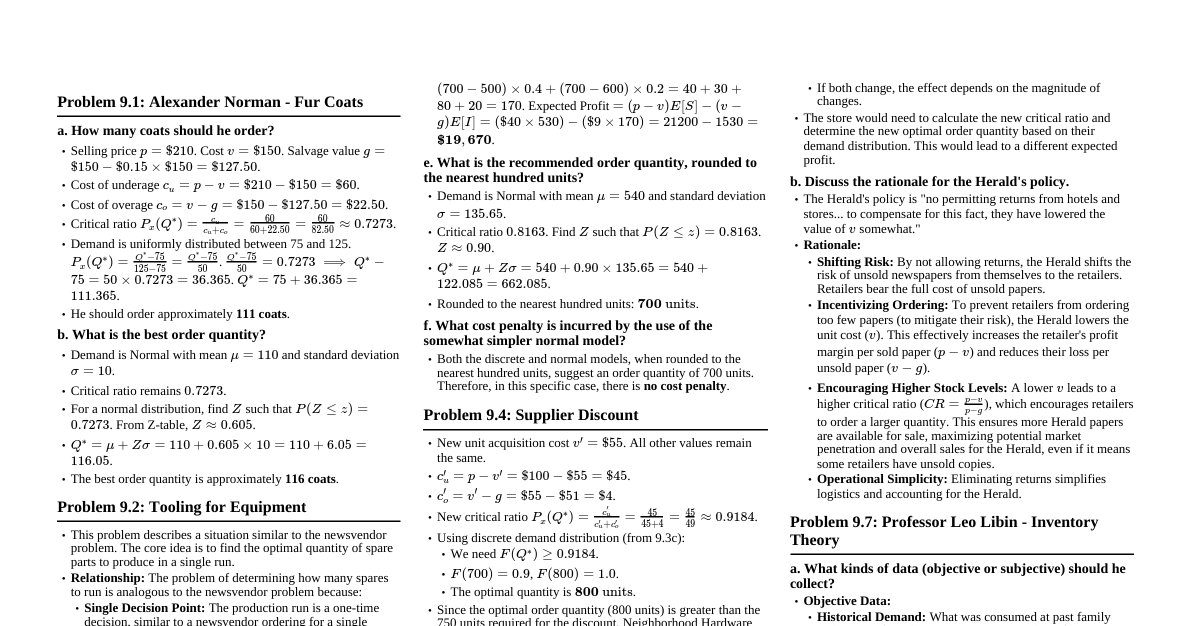

Fashion Goods Problem Relatively short selling season (usually no more than 3 or 4 months) with clear start and end times. Buyers or manufacturers must commit to the quantity of SKUs to order or produce before the selling season. There may be one or more replenishment opportunities after the initial order. Pre-season forecasts have high uncertainty due to a long inactive period between seasons. When total in-season demand exceeds available inventory, there are associated shortage costs. When total in-season demand is less than available inventory, there are excess costs. Fashion products are often substitutable. Sales of fashion goods are often influenced by promotional activities and in-store space allocation. Simplest Case: Unconstrained Newsvendor Problem, Single Item Determining Order Quantity using Marginal Analysis The decision rule is to choose $Q^*$ such that: $P_{x $c_u$: shortage cost associated with each unit of unmet demand. $c_o$: excess cost associated with each unsold unit. Equivalent Result obtained through Profit Maximization Where: $v$: acquisition cost, in $/unit $p$: revenue per sale (i.e., selling price), in $/unit $B$: penalty (beyond lost profit) for unmet demand, in $/unit $g$: salvage value, in $/unit $Q$: quantity to stock, in units $P_{x The decision rule is to choose $Q^*$ such that: $P_{x Here, the shortage cost is $c_u = p - v + B$ and the overage cost is $c_o = v - g$. Normally Distributed Demand Case If demand is normally distributed with mean $\bar{x}$ and standard deviation $\sigma_x$, we define: $k = \frac{Q - \bar{x}}{\sigma_x}$ The decision rule becomes: Choose $k$ such that $P_{u\ge}(k) = \frac{v - g}{p - g + B}$ From which, $Q^* = \bar{x} + k\sigma_x$ Expected profit is: $E[P(Q)] = (p - g)\bar{x} - (v - g)Q - (p - g + B)\sigma_x G_u \left(\frac{Q - \bar{x}}{\sigma_x}\right)$ Discrete Demand Case The best value of $Q$ is the smallest value such that: $P_{x\le}(Q) \ge \frac{c_u}{c_u + c_o} = \frac{p - v + B}{p - g + B}$ Multi-Item, Constrained, Single-Period Situation The objective is to maximize the total expected profit of $n$ items, subject to a budget constraint $W$. Using the method of Lagrange multipliers, choose $Q_i$ to satisfy: $P_{x Where $M$ is the Lagrange multiplier, representing the incremental value of expected profit from adding one dollar to the budget. Product Postponement / Differentiation This is a technique to delay the commitment of final product until more accurate demand information is available, helping to reduce inventory costs and improve service levels. Value of Delayed Financial Commitment Shortage cost: $c_u = p - v_0 - t + B$ Overage cost: $c_o = v_0 - g_0$ Expected profit: $E[P(Q_0)] = (p - v_0 - t)\bar{x} - (v_0 - g_0)EO - (p - v_0 - t + B)ES$ The optimal quantity $Q_0$ satisfies: $P_{x Value of Flexibility When multiple final items are created from the same base product, the ability to prioritize the base product for items with higher shortage costs creates value. If shortage costs differ among items, use a weighted average shortage cost based on demand: $c_u = \frac{\sum_{i=1}^n \bar{x}_i (p_i - v_0 - t_i + B_i)}{\sum_{i=1}^n \bar{x}_i}$ Inventory Control of Perishable Items Fixed-lifetime perishables: Products retain their value for a specific period, after which their value significantly drops (e.g., blood in a blood bank). Random-lifetime perishables: Product value gradually deteriorates over its shelf life (e.g., fresh produce, volatile chemicals). Other Related Issues Forecast Updates Exploiting characteristics of forecasts made by decision-makers. Leveraging the observation that retail sales tend to be proportional to inventory on display. Simple extrapolation methods using a specific mathematical form for cumulative sales over time. Bayesian procedures for updating forecasts as new information becomes available. Using information about past product demand patterns combined with estimates of the current product's total lifetime sales. Replenishment and Markdown Determining the expected time to sell a fraction $F$ of the initial inventory. Optimal "order up to" level if replenishment is possible at a specific point in time. Markdown timing based on the percentage of initial inventory sold, current price, markdown price, and salvage value.