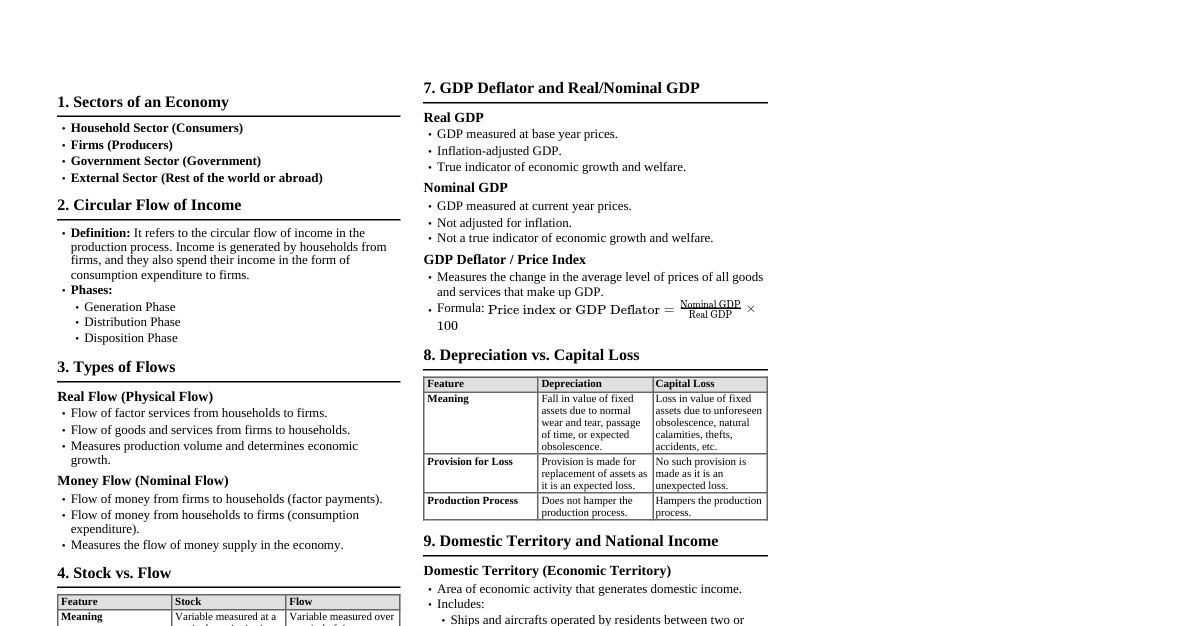

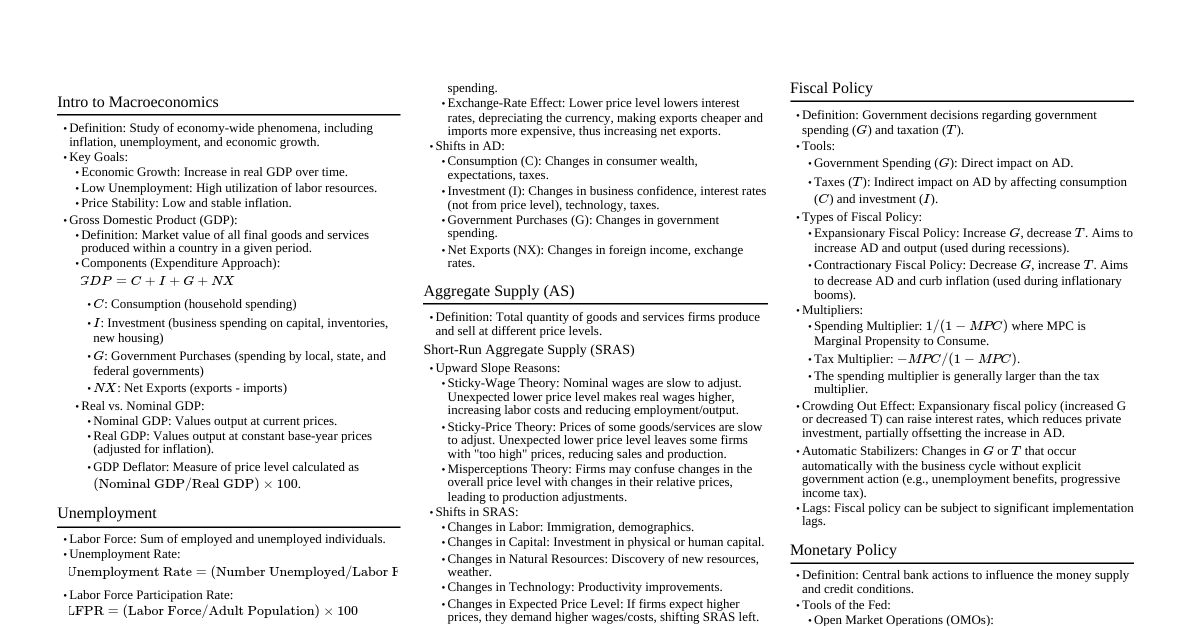

Macroeconomic Concepts Comparative Statics: Analyzes the effect of a change in an exogenous variable on the equilibrium value of an endogenous variable. Assumes the system moves from one static equilibrium to another. Dynamics: Studies the path of economic variables over time, often involving differential or difference equations to model adjustment processes and stability. GDP Deflator: Measures the average level of prices of all new, domestically produced, final goods and services. Formula: $ \text{GDP Deflator} = \frac{\text{Nominal GDP}}{\text{Real GDP}} \times 100 $ Output Gap: The difference between actual output (GDP) and potential output. Positive gap: Actual output > Potential output (inflationary pressures). Negative gap: Actual output NAIRU (Non-Accelerating Inflation Rate of Unemployment): The unemployment rate at which inflation does not tend to increase or decrease. It is the natural rate of unemployment. Sacrifice Ratio: The number of percentage points of annual output lost in the process of reducing inflation by one percentage point. Formula: $ \text{Sacrifice Ratio} = \frac{\text{Cumulative Output Loss}}{\text{Reduction in Inflation Rate}} $ Indices on Output and Inflation: Output: Industrial Production Index (IIP), GDP growth rates, Gross Value Added (GVA). Inflation: Consumer Price Index (CPI), Wholesale Price Index (WPI), Producer Price Index (PPI), GDP Deflator. National Accounts Social Accounting Matrices (SAMs): A comprehensive, economy-wide data framework showing the circular flow of income, disaggregating accounts for institutions (households, firms, government), factors of production, and activities/commodities. Flow of Funds Accounts (FOFA): Tracks financial transactions between different sectors of an economy, showing how saving and investment are financed. Closed Economy: Shows financial flows between domestic sectors (households, non-financial corporations, financial corporations, government). Total savings must equal total investment. Open Economy: Includes a "rest of the world" sector, showing international financial transactions (e.g., current account balance, capital account balance). National savings can differ from domestic investment. Environmental Accounting: Integrates environmental information into national accounts, measuring natural resource contributions to economic well-being and costs of environmental degradation. Indian System of National Accounts (SNA): Follows UN SNA guidelines. Key agencies: National Statistical Office (NSO) under Ministry of Statistics and Programme Implementation (MOSPI). Compiles GDP, GVA, savings, investment, etc. Consumption Theories Consumption Puzzle: Keynesian consumption function suggested average propensity to consume (APC) falls as income rises. Kuznets' data showed constant APC in the long run. Friedman's Permanent Income Hypothesis (PIH): Consumption depends on "permanent income" (long-run average income), not just current income. $ C = k Y_P $ where $C$ is consumption, $Y_P$ is permanent income, $k$ is a constant. Transitory income fluctuations have little effect on current consumption. Ando-Modigliani Life Cycle Hypothesis (LCH): Individuals plan consumption and saving over their entire lifetime to smooth consumption. Consumption depends on lifetime resources (current income, assets, and expected future income). $ C = \alpha W + \beta Y_L $ where $W$ is wealth, $Y_L$ is labor income. People save during working years and dissave during retirement. Representative Household Consumption and Savings Decisions with Inter-temporal Choices: Households maximize lifetime utility subject to an inter-temporal budget constraint. Utility function: $ U = \sum_{t=0}^T \frac{1}{(1+\rho)^t} u(c_t) $ (where $\rho$ is the rate of time preference). Euler equation for optimal consumption: $ u'(c_t) = \frac{1+r}{1+\rho} u'(c_{t+1}) $ Random Walk Hypothesis (Hall, 1978): If PIH/LCH hold and consumers are rational with rational expectations, consumption should follow a random walk (changes in consumption are unpredictable, driven only by new, unexpected information). Investment Theories Neo-Classical Theory of Investment (Jorgenson): Firms choose capital stock to maximize profits. Optimal capital stock ($K^*$) is determined where the marginal product of capital (MPK) equals the user cost of capital. User cost of capital: $ UC = P_K(r + \delta - \dot{P_K}/P_K) $ where $P_K$ is price of capital, $r$ is interest rate, $\delta$ is depreciation, $\dot{P_K}/P_K$ is capital gains. Investment is the adjustment of actual capital stock towards the optimal capital stock. Optimal Capital Stock: The level of capital that maximizes a firm's profit, where the marginal revenue product of capital equals its marginal cost. Tobin's Q Theory: Investment depends on the ratio of the market value of a firm's capital to its replacement cost. $ Q = \frac{\text{Market Value of Installed Capital}}{\text{Replacement Cost of Installed Capital}} $ If $Q > 1$, firms invest more; if $Q Savings and Investment under Uncertainty: Uncertainty about future income, interest rates, or returns on investment can lead to precautionary saving or delayed investment. Real options theory: Investment decisions can be seen as exercising an option, and uncertainty can increase the value of waiting. Volatility in Consumption, Saving and Investment: Investment is generally more volatile than consumption due to factors like varying expected future profits, adjustment costs, and uncertainty. Consumption smoothing behavior tends to dampen consumption volatility. IS-LM Model IS Curve (Investment-Saving): Represents goods market equilibrium ($Y = C(Y-T) + I(r) + G$). Downward sloping relationship between interest rate ($r$) and output ($Y$). LM Curve (Liquidity Preference-Money Supply): Represents money market equilibrium ($M/P = L(Y, r)$). Upward sloping relationship between interest rate ($r$) and output ($Y$). Equilibrium: Intersection of IS and LM curves determines equilibrium $Y$ and $r$. Under Fixed Prices: Standard IS-LM analysis. Fiscal Policy (e.g., $\Delta G$ or $\Delta T$): Shifts IS curve. Multiplier Effect: Initial shift amplified by consumption response. Crowding Out: Rise in $r$ due to increased $Y$ (higher money demand) reduces investment, partially offsetting fiscal stimulus. Monetary Policy (e.g., $\Delta M$): Shifts LM curve. Increases $M \implies$ lowers $r \implies$ stimulates $I \implies$ increases $Y$. Relative Effectiveness: Steeper IS (less interest-sensitive investment) or flatter LM (more interest-sensitive money demand): Fiscal policy more effective. Flatter IS or steeper LM: Monetary policy more effective. Liquidity Trap (flat LM): Monetary policy ineffective. Classical Case (vertical LM): Fiscal policy completely crowded out. Under Flexible Prices (IS-LM-AD): A change in price level ($P$) shifts the LM curve ($M/P$). Lower $P \implies$ higher $M/P \implies$ LM shifts right $\implies$ higher $Y$. This generates the Aggregate Demand (AD) curve. Changes in fiscal/monetary policy shift the AD curve. The impact on $Y$ and $P$ depends on the Aggregate Supply (AS) curve. Monetarist & Natural Rate Hypothesis Monetarism (Friedman): Money supply is the primary determinant of nominal GDP in the short run and price level in the long run. Emphasizes stable money growth rules instead of discretionary policy. Vertical long-run Phillips curve. Natural Rate Hypothesis (Friedman & Phelps): There is a unique "natural rate of unemployment" (NAIRU) determined by labor market institutions. In the long run, monetary policy cannot systematically reduce unemployment below its natural rate; it only affects inflation. Short-run trade-off between inflation and unemployment exists due to adaptive expectations or nominal rigidities. Three Sector Model Adds the government sector to the two-sector (household-firm) model. Components: Consumption ($C$), Investment ($I$), Government Spending ($G$). Equilibrium: $Y = C + I + G$. Introduces fiscal policy tools (taxes, government spending). Adaptive Expectations in AD-AS Model Adaptive Expectations: People form their expectations of future inflation based on past inflation. $ \pi_e = \pi_{t-1} $ or $ \pi_e = \sum \theta_i \pi_{t-i} $. Short-Run AS Curve: Upward sloping, as unexpected inflation can lead firms to produce more (e.g., workers fooled into accepting lower real wages). Shifts with changes in expected inflation. Policy Implications: In the short run, expansionary policy can reduce unemployment, but only if it creates unexpected inflation. As expectations adapt, the AS curve shifts, and the economy returns to the natural rate of unemployment at a higher inflation level. Open Economy Macroeconomics Foreign Trade Multiplier: In an open economy, the multiplier effect of an autonomous spending change is smaller than in a closed economy due to leakages from imports. $ \text{Multiplier} = \frac{1}{1 - MPC(1-t) + MPM} $ where $MPM$ is the marginal propensity to import. Twin Deficits: Refers to the simultaneous occurrence of a government budget deficit and a current account deficit. Identity: $ (S-I) + (T-G) = (X-M) $ (Private Saving - Investment) + (Government Saving) = Current Account. If $T-G Policy Implications: Reducing a budget deficit (e.g., by cutting G or raising T) can help reduce a current account deficit. IS-LM-BP Model (Mundell-Fleming Model): Extends IS-LM to an open economy by adding the Balance of Payments (BP) curve. BP Curve: Represents equilibrium in the balance of payments (current account + capital account). Reflects the interest rate at which capital flows offset any current account imbalance. Perfect Capital Mobility: BP curve is horizontal at the world interest rate ($r^*$). Fixed Exchange Rates: Monetary Policy: Ineffective (money supply changes are offset by balance of payments interventions to maintain the peg). Fiscal Policy: Effective (stimulus leads to BP surplus, central bank buys foreign currency, increasing money supply, reinforcing stimulus). Flexible Exchange Rates: Monetary Policy: Effective (money supply changes $\implies$ interest rate changes $\implies$ capital flows $\implies$ exchange rate changes $\implies$ net exports change). Fiscal Policy: Ineffective (stimulus leads to higher $r$, capital inflow, currency appreciation, reduced net exports, crowding out). Imperfect Capital Mobility: BP curve is upward sloping. Effectiveness of policies is intermediate. Swan Model of Internal and External Imbalances: Uses two policy instruments (e.g., exchange rate and government spending) to achieve two targets (internal balance - full employment without inflation; external balance - current account equilibrium). Divides the policy space into "zones of economic discomfort", showing regions of inflation/unemployment and surplus/deficit. Developments in Open Economy Macroeconomics after Monetarists: Rational Expectations: Agents use all available information to form expectations. Policy effectiveness changes. New Open Economy Macroeconomics (NOEM): Microfoundations, sticky prices, imperfect competition, emphasizing welfare analysis and optimal policy. Role of Financial Markets: Greater emphasis on exchange rate overshooting, financial crises, and capital flow volatility. Six Major Puzzles in International Macroeconomics: (Examples, not exhaustive list) Purchasing Power Parity (PPP) Puzzle: PPP holds poorly in the short run. Consumption-Real Exchange Rate Anomaly (Backus-Smith Puzzle): Consumption and real exchange rate are negatively correlated, contrary to simple models. Home Bias in Trade: Countries trade more with each other than predicted by distance and size. Home Bias in Equity: Investors hold disproportionately less foreign equity than would be optimal for diversification. Exchange Rate Disconnect Puzzle: Exchange rates are very volatile and difficult to link to fundamentals. Forward Premium Puzzle: Currencies with high interest rates tend to appreciate, not depreciate, contrary to uncovered interest parity. Capital Mobility and Capital Controls: Capital Mobility: Ease with which capital can flow across national borders. Small Open Economy: Assumes it takes the world interest rate as given. Perfect capital mobility implies $r = r^*$. Large Open Economy: Can influence the world interest rate. Capital flows affect its domestic interest rate. Capital Controls: Restrictions on the movement of capital across borders (e.g., taxes on foreign investment, limits on foreign borrowing). Reasons: Maintain monetary autonomy, prevent financial crises, manage exchange rates. Costs: Distortions, reduced efficiency, potential for corruption.